The world's most audacious realty project

Howard Air Force base was once an imposing military installation alongside the Panama Canal from which the United States fought guerrillas and hunted down drug dealers. Sixteen years after the America

Flying in the back of a black helicopter 700 feet above the Panama Canal, with the side door flung wide open, Colombian billionaire Jaime Gilinski peers down at what was, until 1999, a US military airfield. “From here to the water is all ours,” he says through the chopper’s headset, pointing at a patch of land the size of a small city. “It was a white canvas to develop from the beginning.”

We look out over dozens of stores, office buildings and warehouses with names such as Dell, 3M and Caterpillar emblazoned on their sides. Scanning the 4,450-acre expanse, Gilinski points out a university campus, hundreds of new homes, a basketball court, schools, parks and even an airport. Construction sites are everywhere: Here will be an amphitheatre, there a golf course, here a shopping mall, there a hospital.

It is the world’s most audacious real estate project, which started as nothing more than the harebrained idea of the man in the helicopter. The son of a serial entrepreneur who tried his hand at several businesses before hitting it big manufacturing hand tools, Gilinski, 58, turned around the largest bank in Colombia in 1994, merged it with a rival in 1998 and then began scouring the globe for his next big deal. After US troops pulled out of Howard in 1999, he began dreaming of ways to redevelop the base, which covers an area more than five times the size of Central Park.

There was only one problem: He had zero real estate experience. So Gilinski contacted Ian Livingstone, a neighbour down the street in England (where Gilinski lives today, having fled his native Colombia in 1998 amid an increase in kidnappings by the guerrilla group FARC). Livingstone and his brother Richard became billionaires developing real estate in Europe but had never before invested in Latin America. When Ian was on a vacation in the Bahamas in 2004, Gilinski persuaded him to stop by Panama and take a look. They rented a helicopter and from the sky surveyed the land, framed by the Panama Canal, the Pacific Ocean and the Pan-American Highway, which stretches from Canada to Argentina. Together they concocted a grandiose plan: To buy the wasteland of bunkers and barracks, rename it Panama Pacifico and build an entirely new city from scratch.

“We’ve built a lot of big developments in many parts of the world,” Livingstone says. “I’ve not personally visited or seen anything that was bigger or so full of opportunity.”

The two men made natural partners, with Livingstone’s real estate chops complementing Gilinski’s local fluency and financing expertise. In an early meeting, Ian grabbed a piece of paper and a marker and started drawing up a new city—complete with a logistics hub, plus enough houses for 70,000 people. Gilinski’s job was to secure money, convince government officials of the plan’s worthiness and make the sketch a reality.

“It looked at the time like a pipe dream,” says Augusto Arosemena, Panama’s minister of commerce and industry. “Panama didn’t know what to do with all of the land that was used by the Americans, the Army and the Air Force. We needed someone with [Gilinski’s] vision, his drive and his connections to make a project like this feasible.”

Twelve years after the initial helicopter ride, the new city is coming to life, and that means big money for Gilinski. The entire property is now worth an estimated $3.6 billion, with land selling at more than 25 times its original price. Gilinski has personally made $1.4 billion from the project. And even though he has already constructed close to 1,000 buildings, 85 percent of Panama Pacifico remains undeveloped land. That means there is a lot of work to do—and billions upon billions more to make.

After a day of touring the grounds, Gilinski heads to the airstrip, where his private jet is waiting. We climb aboard the Dassault Falcon 7X, a fantasy plane with padded floors, steamed towels and luxurious leather seats. The jet speeds down the old Air Force runway and takes off for Bogotá. The billionaire kicks off his shoes, unhooks a few buttons on his Oxford and begins recounting his life story.

When he was 11 years old, he stole his parents’ car, taking it out for a ride and totalling it. His father, Isaac, an entrepreneur who owned a midsize tool manufacturing company at the time, didn’t yell or scream. “He only said, ‘Now you have to pay to fix the car’,” Gilinski recalls. “I had to work every Saturday for four years.”

The work ethic stuck. At 16, Gilinski graduated from high school and applied to 11 American colleges, even though he spoke limited English. He received acceptance letters from only two. So he packed his bags for Georgia Tech but soon began dreaming of Harvard. Three years later, at 19, he was accepted into Harvard Business School’s Class of 1980. Upon graduation, he took a job at Morgan Stanley for one year, then returned home with a new goal: To take everything he had learnt in the States and use it to become one of the most prominent businessmen in Latin America.

In 1993, the government of Colombia announced it was privatising Banco de Colombia. Neither Jaime nor his father had anywhere near enough money to buy it, but Gilinski persuaded his dad to become a 50-50 partner in a wild scheme. “There is a moment in life,” he says, “when you have to take all of the risk, just put all of the cards on the table.”

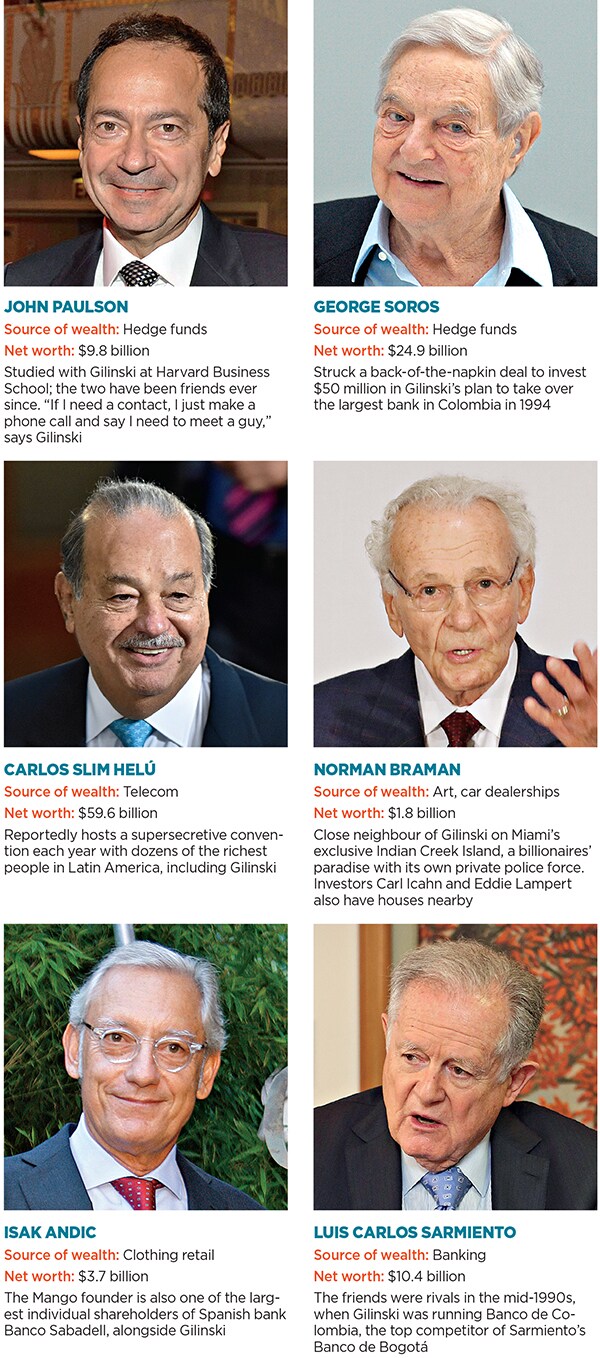

Jaime set out to raise money from 100 international investors, including George Soros, leveraging hundreds of millions in debt without putting down a single dollar of his own. “This is a true story,” Gilinski says. “I was able to raise $376 million, and that was my bid. I didn’t have any more money. I bid what I had, divided by the shares. And then I left $2- or $3 million to pay the legal fees and the bankers, because if I had lost, I would still have to pay those guys.”

He won and turned the bank around, paying down the debt by selling non-core assets like a fertilizer company and a steel business. Annual profits went from $10 million to $50 million in three years, as he got rid of 10,000 of the bank’s 14,000 employees through a combination of divestitures and layoffs. Gilinski merged Banco de Colombia with one of its top rivals in 1998, and after selling off their stakes, he and his father walked away with $400 million apiece. The deal provided Gilinski with not only the seed capital for the Panama project but also the model: Buy a huge government asset, invest as little money out-of-pocket as possible, start churning profits, sell for a fortune and—most critically—do it all alongside world-class partners.

“Soros, he liked me immediately,” Gilinski says. “He saw my eyes, he saw myself and he said, ‘What do you need?’ In life you need those moments. With Livingstone we were on a helicopter. We were not partners. He came here, he saw it and said, ‘I’m in. Whatever you want to do, we’ll go with it’.”

Today Gilinski, who is worth an estimated $3.9 billion, doesn’t have to cobble together groups of 100 investors for his projects anymore, but he hasn’t stopped hustling around the world to forge relationships. He claims London as his home, but he also has houses in New York, Panama, Miami and Colombia. He spends more time travelling than he does living at his UK address, hitting the road 200 days a year with three cellphones at his side to talk with businessmen and government leaders everywhere. He disregards time zones and sleeps six hours a day, eats at odd hours and holds meetings at any time of the day.

We deplane, and two black SUVs are waiting for us. I hop into one and head to the hotel after a long day. Jaime isn’t done working. He climbs into the other car and speeds away, with a fleet of armed bodyguards trailing him, to a dinner with an old friend from Harvard, Juan Manuel Santos, the president of Colombia.

“I have a lot of good friends who are now in important positions,” Gilinski says. “The human part is the key.”

Gilinski’s political connections have been critical in Panama as well. His wife was born into a prominent Panamanian family, and Gilinski has owned a small bank on the isthmus since 1994. His ties with the country have only strengthened over time. Today he serves as a political affairs attaché at the Panamanian embassy in London.

Without such deep roots in Panama, he would have never even found out about the old Air Force base. Back when the Americans still controlled the land, he and his wife would stop at the supermarket near Howard to pick up American goods like bubblegum and potato chips. The base itself was off limits.

In 1977, US President Jimmy Carter signed a deal with dictator Omar Torrijos, abolishing the Canal Zone and promising to hand over the canal itself by the end of the century. Over the ensuing two decades, the United States kept a strong presence at Howard, using it to fight in the war against drugs and to carry out missions in Honduras, El Salvador and even Panama itself.

In 1989, George HW Bush ordered an invasion of Panama to oust Manuel Noriega, the narco-dictator who was in cahoots with Pablo Escobar’s Medellín drug cartel. On the night of January 3, 1990, Noriega turned himself in to US authorities, who brought him to Howard, where Drug Enforcement Administration agents arrested him. Ultimately convicted of racketeering and cocaine trafficking, Noriega sat in a Miami prison until 2010, when he was shipped to France and thrown in a Paris jail for money laundering, before authorities extradited him to his home country to serve more time for murder.

The US invasion that deposed Noriega was painful. Hundreds of civilians died, and the General Assembly of the United Nations condemned the act as a violation of international law. In 1999, the last of the US troops shipped out, nearly 90 years after they had first arrived during the construction of the canal.

The Panamanian government took over the Air Force base and began casting about, searching for ways to sell off small chunks to various developers. For five years, the land remained vacant. Then in 2003, Gilinski and Livingstone approached officials with an idea the government hadn’t yet considered: Selling all of the land at once to a single group, which would develop a master plan for the site. The partners hired designers to pin down the details of Livingstone’s initial sketch—where exactly to put the warehouses, retail shops and homes. Everything was carefully spaced so residents wouldn’t constantly hear planes flying overhead or semitrucks rolling by. Gilinski and Livingstone said they would invest hundreds of millions of dollars and asked for a litany of government concessions in return.

The government came back with a mixed response. The good news: It would turn the old Air Force base into a corporate dreamland, where many companies would pay virtually no taxes, could stay open on Sundays and holidays, would pay a fixed rate for overtime and would get expedited visas for all of their employees. If they needed anything else from the state, they could go straight to a newly created government agency, Agencia Panamá Pacífico, whose job was to cut through red tape elsewhere in government.

The bad news: The officials were going to steal their idea for a master plan, pitch it to competing developers and hold an auction for rights to the base. Seventeen groups submitted proposals for the projects, but only four made it past the pre-qualification process, which required adequate financing and development experience. Ultimately just two groups, the Gilinski-Livingstone partnership and a consortium of the richest families in Panama, made final bids.

The showdown had clear rules. Land prices were initially set at less than $5 per square foot, roughly half of the market value at the time, according to local real estate appraisers. (Each year the price of the land is ratcheted up with inflation.) The property would come with a host of tax breaks and other government concessions. And the winner would be the group that was willing to guarantee the most investment over 40 years.

Gilinski and Livingstone submitted their offer, promising $705 million in investment, which they said would generate 40,000 new jobs. Those sorts of numbers would be significant in any country but especially in Panama, where $705 million represents 5 percent of estimated government spending today (15 percent in 2007) and 40,000 jobs is the equivalent of 2 percent of the nation’s workforce. Their bid only barely defeated a $702 million proposal from the rival group.

Victory in hand, the partners sealed a contract with the administration of President Martín Torrijos (the democratically elected son of the dictator who had signed the 1977 agreement with Jimmy Carter), put down a $20 million payment and took over the property.

It was a steal. One year after the purchase, with barely any new construction on the site, Gilinski hired advisers from the Boston Consulting Group to value the project. Their conclusion: It was worth $1.2 billion to $1.6 billion, roughly twice of what Gilinski and his partners had committed to invest over 40 years and more than 60 times their down payment. Gilinski took the valuation and started searching for buyers, figuring he could sell a huge tract of land in a dream location to foreign investors.

In fall 2008, his plan spiralled downward. Global markets collapsed, and the last thing international investors wanted to buy was real estate. But according to the government contract, Gilinski was required to keep investing in the project. He started putting up empty warehouses and laying out basic infrastructure for vacant lots. At the same time, he was fortunate enough to still be sitting on a pile of cash from the Banco de Colombia deal.

With American and European markets falling apart, Gilinski scanned the global economic landscape and headed to the one part of the world that was still riding high, the Middle East. In 2008, the price of oil peaked at $140 per barrel, nearly four times the price today. Arab rulers had more money than they knew how to invest.

Still, it took Gilinski until 2010 to strike a deal. In the first three years after the partners acquired the property, they invested $80 million to lay out basic infrastructure, building roads, stop signs and streetlights, upgrading water pumps and electrical systems, and even cleaning up bunkers and unexploded bombs left by the US military. Slowly, the government concessions helped draw tenants, like 3M (2009), WR Grace (2010), and VF Corp (2010).

By August 2010, 40 businesses were renting small spaces at the project, and the property was turning a modest profit. It was enough to make managers of sovereign wealth funds in the Middle East take notice. The property was just the sort of flashy bet (a new city next to the Panama Canal!) that appealed to the petro nation of Qatar. In 2010, the nation’s real estate investment arm bought a 50 percent stake in Panama Pacifico for an estimated $1 billion. (Livingstone disputes this price.)

Ask around in Panama and you’ll hear that the Qataris overpaid. “It seems to me like [a] $2 billion [valuation] is way, way off,” says William Herron, the president of Panamericana de Avalúos, a Panama City-based real estate valuation firm. “I don’t see $2 billion there at all. No. I don’t see it. Two billion? That’s a hell of a lot of money, especially by our standards.”

The sale instantly made Gilinski a billionaire. And even though he retained only a 25 percent stake in the project, he remains the chairman, and his brother-in-law is the CEO. Along with Gilinski and Livingstone, two Qataris now sit on the board of four. Gilinski and Livingstone talk every week to go over the details of the project, and the Qataris fly in for board meetings twice a year. (The Qataris didn’t respond to repeated requests to be interviewed for this story.)

At the same time as the Qatari transaction, Gilinski negotiated a side deal to buy a 5.8-million-square-foot lot from the project, a third of which he sold to SABMiller five years later. The beer giant is now clearing dirt for a $400 million brewery on that tract of land, which, if all goes as planned, will make it the most significant investment in the project so far.

“[Gilinski] is certainly a very tough negotiator, on both sides of the table,” says Mark Rosen, the head of Latin-American investment banking at Bank of America Merrill Lynch, who has represented both Gilinski and his opponents in various deals over the last 22 years. “I wouldn’t describe him as fearless but rather as cautious and calculating.”

Since 2010, neither Gilinski nor his partners have invested a single dollar out of their own pockets in the project. Instead, they’ve ploughed massive cash flows, roughly $1 billion so far, back into new construction—already exceeding the $705 million they originally committed over 40 years.

There is more to come. Investments the size of SABMiller’s attract more companies, such as bottlers who want to locate near the factory, which in turn attracts additional residents who want to live near their workplaces, who attract retailers that want to be close to population centres. A lot of companies talk about creating efficiencies of scale, but very few can match the sorts of synergies that come from building an entire city from scratch.All of it plays directly into Gilinski’s hands. Of Panama Pacifico’s 194 million square feet of land, 118 million square feet is slated to be developed, but only 19 million has been so far. According to the 2007 deal with the government, Gilinski and his partners pay for the land as they develop it, and the land remains cheap, around $5 per square foot (or, in Panamanian terms, $50 per square metre). Today, land in downtown Panama City, just across the Panama Canal, sells for as much as $275 per square foot.

Gilinski and his partners don’t sell land directly. Instead they buy a square foot of dirt, spend about $110 to build residential property on it and then turn around and sell houses for $220 per square foot. Even after accounting for a 20 percent margin on the construction of a house, Gilinski and his partners make roughly $90 per square foot. They could never sell all of the land at once for that much money, but their plan is instead to develop it slowly and sell off bits and pieces over time, hauling in piles of cash along the way. One hundred and eighteen million square feet, sold at an average profit of $90, adds up to more than $10 billion.

“We are printing money here,” says Gilinski. “You go to Brooks Brothers, and you buy a shirt for $100. One square metre of fabric. How can you buy land at half the price of a shirt? There is no logic in that. It’s like a stupid joke.”

Part of what is driving the project’s success is a surging real estate market in the rest of Panama City. For evidence of the boom, just look across the Panama Canal. The land-strapped capital has more skyscrapers than any other city in the Western Hemisphere, except New York and Chicago. Of the 25 tallest buildings in Latin America, 16 are in Panama City, and all of them have been built in the last six years. Real estate developers are now so desperate for land that they are erecting skyscrapers on former swamplands and creating artificial islands in the sea.

The government is doing everything it can to keep the boom alive. In July, it is scheduled to complete a more than $5 billion project to widen and deepen the Panama Canal. Workers dug the waterway over 100 years ago, and ships have been getting bigger ever since. About half of the world’s cargo vessels simply can’t fit through the canal anymore, meaning lost revenues for Panama, which charges about $90,000 per container ship. The new project will widen the canal’s locks by 70 feet and deepen its channel by 18 feet, allowing much larger ships to sail through. The expansion will double the amount of cargo that can pass through the canal on any given day. For Gilinski that translates into bigger rent cheques from his warehouses, which already charge 50 percent more than others in the city.

Two other massive infrastructure projects are even more critical for Panama Pacifico. With no traffic, the former Air Force base is just 15 minutes away from downtown Panama City, but there are only two bridges, causing backups that can extend that commute to over an hour. To fix the problem, the government is spending a billion dollars to build an additional six-lane bridge and another $2.5 billion to $3 billion for a 14-stop metro line to connect the west side of the canal with downtown. The first stop on the metro: Panama Pacifico.

In exchange for all of the concessions, the government gets a piece of Gilinski’s profits. After deducting big expenses like infrastructure and construction, Gilinski and his partners have to pay 25 percent of their profits back to the government.

Bigger money will go straight to the developers. Over the next five years, Gilinski estimates, the whole project will bring in $3 billion of revenues from commercial rents and residential sales. Even after ploughing most of the money back into Panama Pacifico, the partners should be able to pay themselves a combined $1.1 billion in dividends by 2020.

With that much cash pouring in, Gilinski is already hunting for new opportunities, in both banking and real estate. Armed with $500 million in cash after the Qatari deal, he took a 7.5 percent stake in Spanish bank Banco Sabadell and snapped up HSBC’s assets in Colombia, Peru and Paraguay. Now, Livingstone and he are considering more real estate investments, making clandestine visits to big tracts of land near large cities in Latin America. Gilinski recognises his first act will be tough to follow. “You could never get this site again,” he says. “But we really see the future in this part of the world.”

First Published: Apr 22, 2016, 07:38

Subscribe Now