Press Metal: Pressing for success

In 1986 Koon Poh Keong and his six brothers decided to start an aluminium company. Today it dominates the Southeast Asian market

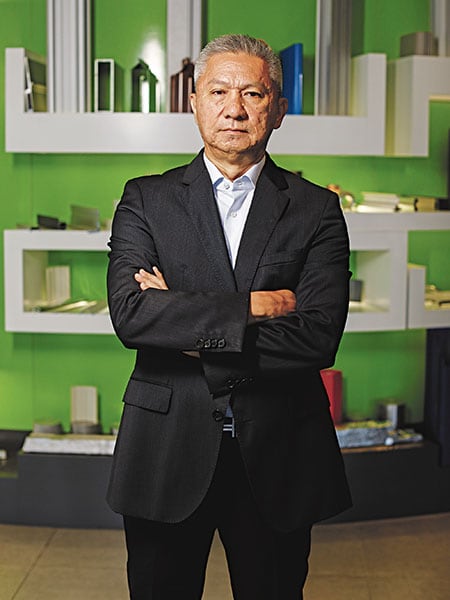

CEO Koon says his company cannot continue to be restrained to just a family-run operation

CEO Koon says his company cannot continue to be restrained to just a family-run operation

Image: Joshua Paul Gilbert for Forbes

Koon Poh Keong knew what he had to do, but the risks were immense. He was betting his entire company on a bold plan to build a factory in China and invade the mainland aluminium market. But Chinese competitors were killing his Malaysian outfit, leaving him little choice. “We couldn’t compete with them,” he says.

So Koon spent $24 million to buy land and build a plant outside Foshan, Guangdong. It was 2005, and that sum equalled the entire value of his listed company, Press Metal. But the bet paid off. From $113 million in annual revenue back then, the company now generates $2 billion, with a net profit of $138 million last year. And the market capitalisation tops $4.7 billion. That track record puts it on the Fab 50 list for the first time. “China is the best thing that ever happened to Press Metal,” says Koon. “China transformed us.”

Koon, 58, may be the face of Press Metal, as well as the chief executive, but the company has always been a family affair. In 1986 he was fresh out of college with a degree in electrical engineering from the University of Oklahoma and was returning home to Malaysia during a recession. Unable to find a job, he started Press Metal with his six brothers (he’s the youngest of seven). He knew hardly anything about aluminium, but he had worked at his family’s small hardware business, which traded aluminium bars. “We thought that since we’re trading these bars, why not make them?” he says. The brothers pooled $50,000 and began an aluminum-extruding company in a rickety rented factory, equipped with secondhand machines.

Today, Koon, who has been at the helm since the beginning, runs the business with four brothers (the other two have died). He calls the shots, but big decisions always go to the board. “Our families are quite united every person plays their [part],” he says. “I get a lot of support from all of them.” Together the Koons own 60 percent of Press Metal, with Koon being the largest shareholder, with a 40 percent stake, giving him an estimated net worth of nearly $2 billion. One brother, Koon Poh Ming, the executive vice chairman, holds a 9 percent stake, worth around $425 million the other brothers hold smaller stakes. “We started from ground zero without much expertise, but we are able to learn quickly,” says the CEO.

Seven years after it started, Press Metal moved into its own factory in the West Malaysia city of Kapar. Then in 1999 it listed on the main board of the Malaysian Stock Exchange. “That gave us good access to the market and publicity to grow further,” says Koon. “We attracted more support from financial institutions—banks are more likely to support you if you’re a public company.” That same year the company began exporting to Europe, Australia and New Zealand, becoming the first Malaysian company to sell aluminium products outside the country. And it opened a subsidiary in the UK and became a major supplier there.  Koon calls the shots at Press Metal, but the big decisions always go to the board

Koon calls the shots at Press Metal, but the big decisions always go to the board

Image: Joshua Paul Gilbert for ForbesSix years later Koon landed in the rural outskirts of Foshan. The area lacked any proper infrastructure so “the big question [people] ask is, ‘Why did you choose a place like this?’” he laughs, recalling the plant’s opening ceremony. “They say you are mad to come to a place like this.” But nearby Guangzhou was the hometown of Koon’s parents, which made it an easy choice when looking for a cheap location. The brothers also speak Cantonese, the local language.

Now Press Metal had to swiftly get the operation up and running. It bought a local aluminum smelter and hundreds of acres of industrial land to put up its first factory overseas. “We needed to get it started to demonstrate to the banks and the government that our outfit [was] successful,” recalls Koon, meaning there was no room for trial and error. That also meant spending a large chunk of his time in China. “Part and parcel of doing business is you have to put in your effort,” he says. “If you put your money there, you better put yourself there.”

China changed Press Metal in many ways. It adopted Chinese technology for its smelters, allowing it to lower its production costs and give it an upper hand against Western rivals. And its unusual status as an international outfit in China made it more attractive to customers. “Many Chinese companies try to export, but there’s a language barrier,” says Koon. “We are Western-educated, so for us to bring the product out to Australia, for example, is a lot easier. Customers are happy to get products from China, but from an international company.”

What’s more, the Chinese market taught Koon a lot about how to build a company quickly and about the aluminium business as he travelled to almost every province in China. “The ‘China speed’ is very exciting,” he says. “If we didn’t choose to go to China, we would have grown as a company but certainly not at this pace. It’s about the pace. If you are slow, the market does not wait for you. The market wants you to be there when they need you.”

Until this point Press Metal was largely in the aluminium extrusion business—making aluminium products for different uses from aluminum alloy. But in 2009 it set up Malaysia’s first aluminium smelting plant, producing billets and ingots in the coastal town of Mukah in Sarawak. The rationale? “The business of extrusion has low barriers to entry, and there are many players,” says Koon. “But upstream requires a lot of capital and players are consolidated. From a business perspective, that’s where you want to be.”

The local government spurred the company’s move when it was seeking industrial companies to buy electricity generated by the Bakun Dam—the largest in Southeast Asia—after plans to send the electricity to peninsular Malaysia through undersea cables were cancelled because of the high cost and the uncertain feasibility. “Sarawak itself does not need all this energy,” says Koon. “So the government decided to make it into a manufacturing hub. That’s how we became a bigger outfit.”

Press Metal got lucky again in 2012, when a rival, mining giant Rio Tinto, scrapped plans to build an aluminum smelter in Samalaju that would have also gotten its electricity from the Bakun Dam. Instead, Press Metal opened its second smelter at that site later that year. Altogether it’s spent $1.2 billion on its smelting plants in Sarawak, and their capacity of 760,000 tonnes a year is the largest in Southeast Asia. Koon says the location in Mukah makes Press Metal one of only two aluminium producers facing the South China Sea, helping it secure a nearly 15 percent market share in Japan, South Korea, Taiwan and Southeast Asia.

But finding the right workers for its smelters is “always a challenge”, says Koon. “We worked with the government, universities and technical schools to develop skilled workers. Sarawak is not known to be a manufacturing place, and we needed to develop a lot of these skills.”

One issue that hasn’t affected Press Metal, however, is US President Donald Trump’s 10 percent tariffs on aluminium imports. “We don’t sell a lot to the US because it’s very far,” he says. “Logistics costs in America are very high so it hasn’t been our major market. So the trade war doesn’t affect us directly.”

The transportation industry is the biggest driver of aluminium demand, along with construction, and Koon expects aluminium to play a major role in the rise of electric vehicles. “It’s all about the size of the battery,” he says. “Aluminium is the key to [lighter batteries].” By 2030 electric vehicles are expected to use nearly 10 million tonnes of aluminium, a tenfold increase from last year, according to a report by UK-based metal consultants CRU. That will help Press Metal: It’s expected to produce $2.3 billion in revenue in 2020, with net profits nearly doubling to $270 million, according to analysts polled by Bloomberg.

Koon has no immediate plans to retire, but he has mulled over the question of whether the company should be led by family members indefinitely, hinting at bringing in outside leadership in the future. “We have been, traditionally, a family-run business, but this business has to be professionally run, so we are hoping that we have this young breed of talent who can bring us new perspectives on how to grow the company,” he says. “It cannot continue to be restrained just to a family-run operation.”

In any event, he’s expecting the demand for aluminium to only grow: “Over the last few years, we see aluminium replacing other materials. To be greener, aluminum is the way.”

First Published: Oct 03, 2018, 09:03

Subscribe Now