Mahindra & Mahindra's American Speed Bump

The Indian auto biggie wanted to launch its trucks in the USA. But now it is embroiled in a legal spat in the country

John Perez was one of the Pedro Pan boys.

He was 12 when he came to the US. From then on he has been trying to pursue the American Dream, trying his hand at various entrepreneurial ventures. In 2006 he started Global vehicles, a car distribution company, to help Indian auto major Mahindra & Mahindra (M&M) launch its pick-up truck in the US. But more recently, he has been giving Anand Mahindra, M&M’s chairman and managing director, sleepless nights.

Since 2010, Perez and M&M have been locked in a legal tussle that has virtually derailed the $15.4 billion (by revenue) company’s plans to launch a pick-up truck in the USA. Perez has fought one arbitration case. He has been a co-accused with M&M in a legal suit. And he himself has been sued twice—both legal suits mention M&M as one of the reasons why Perez has been dragged to the courts.  THE issue

THE issue

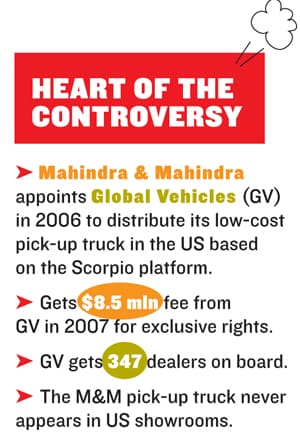

The entire dispute can be summarised thus: M&M wanted to launch a pick-up truck based on the Scorpio platform in the US. It chose Global Vehicles to distribute its trucks John Perez was the head of Global Vehicles at the time (the company ceased operations in 2011). While M&M was getting the necessary certifications, Perez signed on dealers, 347 of them, and collected signing fees. But the trucks never came and when the dealers wanted their money back they found Global Vehicles didn’t have it.

Perez says his entire operation was predicated on the launch of the trucks and the money was spent on getting the network ready for that. Because M&M did not launch, it suckered him and the dealers. M&M says the launch was subject to certification (called homologation) from the US authorities, which did not come. The dealers want someone—either Perez or M&M—to pay.

Anand Mahindra would really like all of this to go away. For years he has wanted to make M&M’s automotive products a success in the US. In an interview to Business Times on January 4, 2010, he said: “We want to build a globally renowned brand in our niche area of sport and utility vehicles. When you have that mission, you have to be global, and you just have to be in the US.”

BATTLE STATIONS

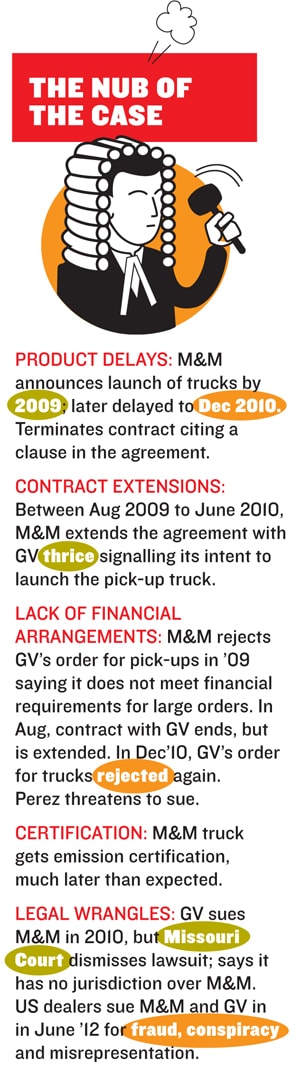

On June 4 this year, the latest round in this battle began. Five automobile dealers in the US filed a suit against M&M in the district court of Georgia. They accuse the company of fraud and conspiracy, and claim damages of $60 million. What makes it significant is that Pawan Goenka, president of M&M’s automotive & farm equipment sector, will be testifying under oath in a US court in the near future.

M&M is clear in its defence and cites an earlier judgement of a Missouri court where it was a co-accused. “While the ruling speaks for itself, the court noted that Mahindra had no contractual relationship with any of Global Vehicles’ dealers. Also, Global Vehicles has been sued by a number of other dealers because those dealers correctly recognised that Global Vehicles was the party responsible for taking the money and making false promises,” says an email response from the company.

M&M says the dealers’ financial relationship was with Global Vehicles and Perez had no business spending their money before he gave them the product. “Under Generally Accepted Accounting Principles, Global Vehicles should have treated these amounts as deposits and been prepared to refund them to the dealers in the event we were unable to certify vehicles for sale in the United States,” says the email.

Perez says he spent the money because M&M led him to believe that it was ready with the product and so he had got the network ready for it. He also says that M&M took away trade secrets. He alleges that they also tried to buy him out. He wants M&M to compensate for this.

M&M rubbishes all this. “Mahindra spent almost $100 million to reengineer the Scorpio for the US markets. Mahindra received $9.5 million from Global Vehicles, primarily consisting of $8.5 million appointment fee to become an exclusive distributor for the US. Yet, Global Vehicles allegedly collected $30 million from the dealers. We do not know what has happened to the rest of the money,” says the email from M&M.

M&M admits it tried to buy out Global Vehicles, but only because it realised that this company was in deep financial trouble. “Global Vehicles lost its credit lines in 2009 and which raised doubts [about] its ability to pay for any vehicles, had they been ready for export. Global Vehicles was pressuring M&M to buy them out in order to save the venture. Mahindra considered doing so but before it could access diligence information Global Vehicles broke off negotiations and sued,” says the M&M email.

M&M DREAMS OF AMERICA

How did it all get to this stage?

Go back to 2003. Just a year after its launch, the Scorpio had become M&M’s best-selling product, adding almost Rs 600 crore to the company’s revenues. Its shares outperformed the Sensex by a huge margin. Anand Mahindra’s American Dream began soon after. According to Perez, Pravin Shah, who was then heading M&M’s international business, called him to discuss a possible partnership. Perez came to India, saw M&M’s operations and went back impressed.

The parameters that M&M used to select Perez aren’t clear. There’s little evidence to suggest that he had expertise in launching emerging market brands in the US nor was it the largest distributor of sports utility vehicles (SUVs) in the US. THAT MAN PEREZ

THAT MAN PEREZ

Perez is an intrepid entrepreneur, but not a very successful one. To make matters interesting, he has a history of promising dealers in the US foreign vehicles which eventually never reach American shores!

In the 1990s Perez floated a Florida-based company to bring Romanian cars into the US. Dealers were solicited, but the cars never came. It was a major bust and several dealers lost their money. Perez blamed the whole thing on the attitude of the Romanian government, but didn’t give up. In September 2003, taking advantage of the privatisation wave in Romania, a former Communist country, Perez, along with a bunch of investors, bought Automobil Romanesc (ARO). This company made a cheap SUV. The new venture was named Cross Lander. In just one year it lined up 144 dealers in the US, who paid about $70,000 each in franchisee rights to sell the vehicle. Perez brought in a few vehicles and worked hard to get the homologation done. But they never made it to the US market. Perez claims the authorities in Romania were very corrupt he was unable to operate the factory.

Late in 2005, Perez abandoned the venture. At the time, several articles were written in Romania and the US calling Perez a ‘crook’, ‘fraudster’ and a ‘dishonest businessman’. He was sued by the Romanian government in 2006.

PLANNING WITH PEREZ

But Perez’s track record did not deter M&M. After a few meetings in 2004 and 2005, the contract between Mahindra and Perez was signed in January 2006. For this venture he formed a new entity, Global Vehicles.

In 2010, M&M cancelled its contract with Global Vehicles. The contract had a clause which said that if the pick-up trucks don’t get launched in the US in four years, the contract would be terminated. Perez now believes that M&M was up to no good because this clause wasn’t in the original contract and was introduced in 2006 at a meeting in Paris.

Despite all the promises by M&M and Global Vehicles, the pick-up truck couldn’t make it in 2008. M&M made another promise that the vehicle would be ready for delivery in 2009 but didn’t live up to it. In 2009, Arun Jaura, then the R&D head, quit M&M to join Eaton, an auto component manufacturer. That surely must have affected the plans but there are more unexplained issues.

THE KNOWN UNKNOWNS

There are two possible reasons for the delay. The first is the deflated market for SUVs in the US. Rebecca Lindland, director of research at IHS Automotive, a consultancy and forecasting firm, describes it as a perfect storm for M&M. If you look at the mid SUV segment in the North American market alone, in 2005 this segment saw volumes of 1.3 million units. In 2009, it had reduced to 2,17,000 units.

“This segment had crashed. And Mahindra is an unknown brand competing in a niche which was under tremendous fire at the time and everybody was buying crossovers. It really was a recipe for disaster,” says Lindland.

According to this logic, it did not make business sense for M&M to sink another $100 million or so in launching a pick-up truck.

But if one believes that M&M is a company that takes the long view and such market volatility does not affect its plans, then could it be something else? “At the time we were wondering what was happening. But my sense is that Mahindra underestimated the difficulties of homologation,” says a former Global Vehicles official who requested anonymity.

Now homologation (where an automobile product of one country is certified to operate in another), takes two-and-a-half to three years in the US. Its two critical aspects are safety clearance and a pollution norm certificate. We know that by 2008, M&M had received a Nitrogen Oxide clearance, which means that the car’s engine has been cleared. But the safety and the final pollution certificates were still to be procured.

Perez believes that M&M had the clearances but did not launch. M&M did not clarify this point but Forbes India has seen the final EPA (pollution norm) certificate which M&M received in February 2011. So, it is entirely possible that it could not get the clearances when Global Vehicles was still its distributor. The vexing issue here is, why did M&M officials, such as Goenka, keep making public statements that the pick-up truck was ready when they did not have the clearances? Was it simply a case of marketing hype?

All these questions will be raised in the latest suit. Whatever the answers, this case is a clear warning to all Indian companies that are trying to globalise. They should choose their partners well and keep to their stated commitments.

First Published: Jun 26, 2012, 06:20

Subscribe Now