Joseph Lubin: Cryptopia's last hope

Crypto mania made Joseph Lubin a billionaire, and he set out to build a utopian business empire. Then reality got in the way

On the hunt for new blockchain projects from ConsenSys’ San Francisco office, CEO Joe Lubin is certain the sun will come out tomorrow for crypto, despite its current dark days

Image: Timothy Archibald for Forbes

A year ago, Joe Lubin seemed like one of the most prescient people on the planet. Cryptocurrencies like ether were in midst of a hockey-stick ascent, and Lubin, a cofounder of the Ethereum blockchain and one of its most articulate pitchmen, was scheduled to speak at events from Davos to SXSW. At his firm’s “Ethereal Summits," it was standing room only, with crowds hanging onto his every utterance, no matter how bizarre.

At one event in San Francisco in October 2017, he scolded attendees for hitting their television sets and for being rude to Siri, Apple’s digital assistant. “We designed Ethereum to enable machines and bots to be first-class citizens," Lubin said with straight-faced sincerity as he espoused visions of decentralisation, self-sovereignty and a democratised global society. “So be nice to the machines of this generation, lest some future artificial general intelligence who feels that you have been disrespectful to her ancestors decides to turn your carbon into something more useful to the future machine economy."

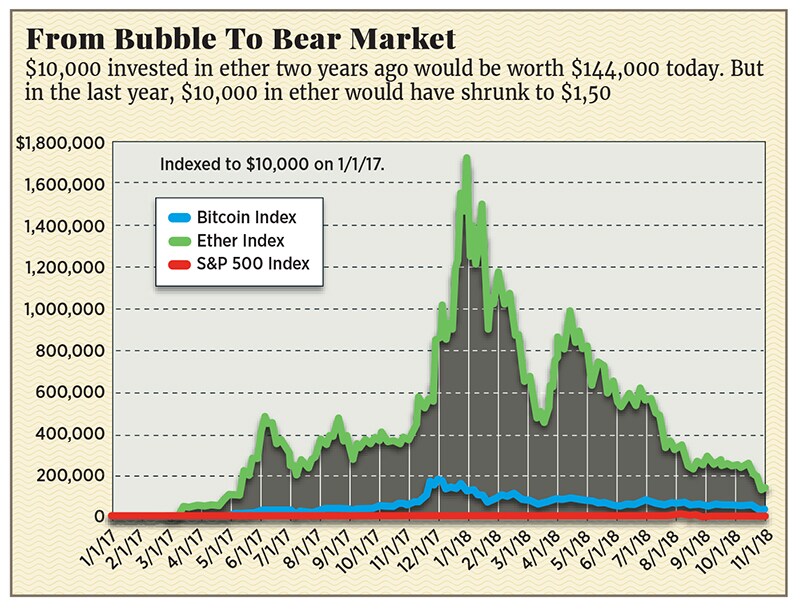

Lubin’s quip drew laughter, but in the autumn of 2017, the idea that blockchain—the distributed database technology underlying virtually all cryptocurrencies—would usher in a new world order did not seem far-fetched at all. The price of a single ether token, a digital representation of money that is similar to bitcoin, had just pierced $300, up from about $10 at the beginning of 2017. It was on its way to a peak of $1,389 within the next three months. Forbes would soon name Lubin the second-richest person in crypto, worth as much as $5 billion, based largely on reports that he owned between 5 percent and 10 percent of all the ether in circulation, which by the beginning of 2018, had a market value exceeding $100 billion.

“The potential of this technology is just enormous," Lubin, 54, tells Forbes in a recent interview. “It’s many orders of magnitude more valuable than [where the tokens] are sitting right now, because it’s going to permeate all aspects of society. We’re going to build everything on this technology."

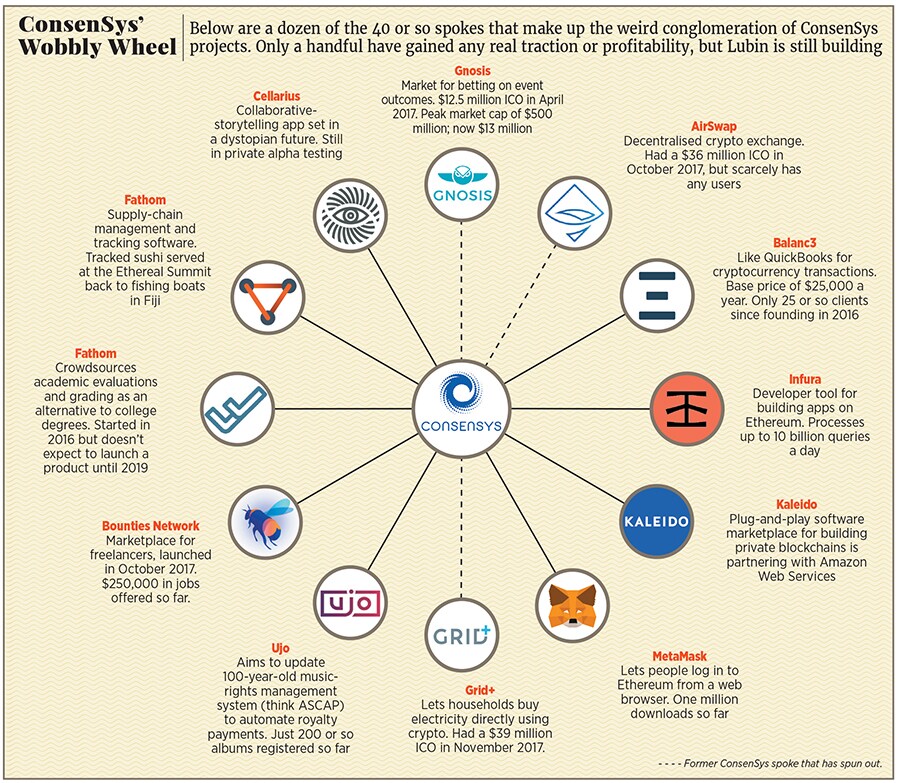

Back in late 2014, a few months after ether launched via crowdsale at 30 cents per token, Lubin created ConsenSys, a holding company he grandiosely describes as a global “organism" to build the applications and infrastructure for a decentralised world. In actuality, it is the first crypto conglomerate, comprising a network of for-profit companies supporting bitcoin’s biggest blockchain rival, Ethereum. More than 50 businesses were quickly spawned out of its Brooklyn headquarters, ranging from a poker site and a supply-chain company to a prediction market, a healthcare-records firm and a cybersecurity consultancy.

But there were no fundraising rounds or debt offerings. In Lubin’s version of the decentralised future, he is the architect, CEO and central banker, funding all of ConsenSys’ “spokes" from his personal cryptocurrency stash.Lubin has yet to veer significantly from this master plan, despite serious cracks in its foundation. For one thing, the Ethereum blockchain faces strong headwinds. Thanks to its perceived technical superiority—largely because it allows apps to be “embedded" in the blockchain—Ethereum became the launching pad for hundreds of initial coin offerings (ICOs), many of which in aggregate resulted in billions in losses for their supporters. The crypto landscape is littered with the carcasses of ill-fated Ethereum-based ICOs, and now the SEC and other regulators are targeting some of them for enforcement action. In November, the SEC settled actions against two Ethereum-based startups, Airfox and Paragon, which had effectively sold $27 million in unregistered securities when they issued their ICOs in 2017. Both tokens are now basically worthless. Meanwhile, rival app-supporting blockchains like EOS, which processes nearly ten times as many transactions a day, and Dfinity, which recently raised $102 million from investors such as VC firm Andreessen Horowitz, are challenging Ethereum. But almost all blockchain technologies remain glacially slow. Ethereum can process only about 20 transactions per second. By contrast, Visa can handle 24,000.

Yet, Lubin’s organism keeps growing. ConsenSys has 1,200 employees, and some 200 job openings are posted on consensys.net. Though ConsenSys declined to comment, Forbes estimates that almost all of its businesses are in the red, some with little hope of profitability. Lubin’s global organism appears to be burning cash at a rate of more than $100 million a year.

When worried staffers have questioned Lubin about ConsenSys’ sustainability, Lubin has always had a pat reply. “Joe would say, ‘This is definitely not something you need to worry about. We can go on at this pace for a very, very long time,’"‰" recalls Carolyn Reckhow, a former director of global operations who left ConsenSys in May.

With the price of ether in free fall, down from $1,389 to barely more than $100 today, Lubin’s fortune may have dwindled to less than $1 billion, calling into question how long he can continue to fund his dream. It all depends on how much ether he sold—and when.

Like Ethereum’s other cofounders, Vitalik Buterin and Anthony Di Iorio, Lubin grew up in Canada. A self-described computer nerd whose father was a dentist and whose mother was a realtor, he attended Princeton in the mid-1980s, where he played squash and was roommates with future billionaire hedge fund star Mike Novogratz, who, like Lubin, would ultimately pivot toward blockchain and crypto. After graduating in 1987 with a degree in electrical engineering and computer science, Lubin started in tech at Princeton’s robotics lab, but he eventually made his way to finance, building software for Goldman Sachs and later running a successful quant hedge fund.

Lubin’s office was not far from Ground Zero during the September 11 attacks, and the harrowing experience threw him into an existential crisis. Over the ensuing decade he became deeply depressed about the state of the world.

“It was folly to trust all those structures that we implicitly felt had our best interests at heart. … I felt we were living in a global society and economy that was figuratively, literally and morally bankrupt," he said at ConsenSys’ Ethereal Summit in May 2017. “I was confident that our economy and society were in a slow, cascading collapse." Lubin foresaw two equally catastrophic outcomes: Central bankers would eventually debase currencies to pay off mounting debts, stifling growth for decades, or some unexpected “nonlinear" event would create great hardships and send the world into the worst economic depression it had ever seen. So distraught was Lubin that he traveled to Peru and Ecuador looking for land he could escape to.

Then in early 2011, Lubin read the bitcoin white paper and had an epiphany: “Decentralisation was a game-changer."

Reading all he could on bitcoin, Lubin was eventually introduced by Di Iorio to Vitalik Buterin, Ethereum’s then 19-year-old creator and boy genius of crypto. Having read Buterin’s November 2013 Ethereum white paper, Lubin got in on the ground floor of the Ethereum project and attended the group’s foundational meeting in Miami in January 2014. He continued as part of the core group through Ethereum’s $18 million ICO in July 2014 and was rumored to be one of the biggest buyers during the token’s initial crowdfunding, at prices estimated to be well below a dollar. Ultimately, Ethereum’s founding team bickered and parted ways. Buterin continued to focus on the technology, while Lubin hatched his plan to create a business ecosystem around Ethereum.For ConsenSys’ headquarters, Lubin chose the hipster-heavy Bushwick neighborhood of Brooklyn. From the outside, 49 Bogart Street looks dingy: The door is covered with the kinds of stickers you’d see in a bar bathroom and is surrounded by graffiti. The interior is not all that different. ConsenSys occupies multiple lofts alongside residential apartments.

When it came to organisational structure, Lubin was not having any of the typical corporate hierarchy. His ConsenSys would be a so-called holocracy—no managers or reporting structures. Decision-making would be decentralised, and employees could choose their own titles. Few had permanent desks.

“Every day, it was so lax that I’d walk in and didn’t know if I had a seat. Literally, it was like Game of Thrones," says Jeff Scott Ward, who joined ConsenSys in June 2015 and left the company in early 2018. There was one toilet for 30 people on the floor, Ward says. The company did not hire a human resources person for almost a year and a half.

ConsenSys’ first projects, or spokes, included accounting software for cryptocurrency transactions and a blockchain-based digital-rights platform for musicians. Most of the ideas for spokes came from ConsenSys employees, and once a project was approved, Lubin would give the startup between $250,000 and $500,000 to get it off the ground.

The goal was for the spokes to become self-sustaining businesses, and in an effort to foster this, they would occasionally be spun out into their own legal entities. Lubin’s broader goal is to turn his Ethereum ecosystem into a what he calls a mesh, whose strength is derived from the spokes’ interconnectivity.

Vitalik Buterin’s 2013 Ethereum white paper gave Lubin a new lease of life

Image: Ethan Pines

Only a handful of the spokes ConsenSys has launched have gained traction. Balanc3, the accounting software project, says it has more than 25 business customers (though it will not specify any), each paying at least $25,000 a year. Another, Kaleido, helps companies implement blockchain technology. It has 1,900 users and says it just began charging for its services. Amazon Web Services recently announced that its ubiquitous hosting platform is compatible with Kaleido’s blockchain offerings. ConsenSys has built technical tools for Ethereum that programmers have downloaded millions of times, but the company does not charge for them.

Lubin has been less rigorous than traditional venture capitalists in approving projects. “Joe is the kind of person who tends to want to keep his options open and say ‘Yes, why not?,’"‰" says Reckhow, who’s now head of client services and operations at Casa, a crypto-wallet company. “He’s lucky to be in a position where that works well, but he’s not as good at prioritising. He’d rather say yes to everything."

Being the Daddy warbucks of the Ethereum blockchain is fine when digital money is trading at stratospheric levels, but as cryptocurrency enters another bear market, Lubin, who admits to periodically selling crypto to fund operations, may need to start pulling some plugs.

In 2017, Mark Beylin, a student at the University of Waterloo in Canada, came to Lubin with the idea for Bounties Network, a marketplace for freelance jobs that is similar to the popular website Upwork but uses Ethereum’s smart-contract technology, which helps with billing. After one year in operation, Bounties Network has seven people working on it and just $250,000 in total “bounties," or offers for jobs, which range from $171 for an 800-word blog post on the future of work to $67.30 in exchange for translating a white paper into Portuguese. Bounties Network has generated revenues of less than $50,000 so far.

In October 2016, Jared Pereira, an 18-year-old high school graduate living in Dubai, pitched Lubin on Fathom, which aims to somehow disrupt the higher-education business by crowdsourcing academic evaluations and grading. Lubin gave the go-ahead, but two years later the project has six people working on it and no launchable prototype. Its website is nothing more than a few pages stating high-minded ideals: “If individuals were free to build their experiences tailored to their unique aims, and were able to communicate those experiences reliably to any entity in the world, there would be an order of magnitude shift in the efficacy of social organisation at every scale."

Other projects that have been staked by Lubin seem even flakier. Cellarius, a spoke that Lubin often promotes by wearing an eponymous T-shirt, is a “transmedia cyberpunk franchise" aimed at collaborative storytelling on the blockchain. What exactly is collaborative storytelling, and why will the blockchain make it better or more profitable? Its website’s explanation is far from clear.

Lubin insists ConsenSys is getting more selective in picking projects. But old habits die hard. In October it bought a nine-year-old asteroid-mining company called Planetary Resources. “We see it as a group of amazingly capable people who are interested in exploring how blockchain could ramify on space operations," Lubin says abstrusely. Civil, a spoke that aims to put journalism on the blockchain and is supposed to somehow increase the level of trust in news, recently had to cancel its ICO because it failed to raise its minimum target of $8 million. Some of the journalists in Civil’s 18 newsrooms say they have yet to receive compensation in the form of tokens they were promised. (Disclosure: Forbes recently announced a partnership with Civil.)

ConsenSys also offers consulting services, essentially assisting companies in becoming blockchain-literate. To date, this is the best business ConsenSys has. In the short run, these services will succeed—until companies wake up and realize that blockchain is not necessarily better for most things and is sometimes worse than other technologies. ConsenSys consultants helped create Komgo, for example, a consortium of 15 big banks that includes Citi, BNP Paribas and ABN AMRO. Komgo wants to use the blockchain to bring efficiency to the financing of goods shipped around the world, like oil. ConsenSys consultants are also working with UnionBank in the Philippines to speed up money transfers.

In the past year, ConsenSys’ consulting arm has grown from 30 employees to more than 250 and, according to Lubin, is bringing in “tens of millions of dollars" in the form of cash and equity stakes.

As for ConsenSys’ spokes, which are mostly applications and developer tools, Forbes estimates the whole lot of them will not generate more than $10 million in revenues in 2018.

So far, ConsenSys’ biggest non-consulting successes are its tools for Ethereum programmers. Its MetaMask product, which lets users log in to Ethereum from a web browser, has more than one million downloads (all of them gratis). Truffle, which helps developers manage and test parts of their code for building Ethereum applications, has also cleared one million free downloads. It can be difficult to charge real money for these tools because of the communal, quasi-anarchist nature of the blockchain developer community. ConsenSys claims it will soon start charging for Infura, another tool that facilitates access to Ethereum.

“ConsenSys has done more for the Ethereum ecosystem in its first five years of development than any other firm," says Meltem Demirors, chief strategy officer at CoinShares, a crypto-asset-management company.

None of this seems to phase Lubin, who is clearly not launching projects to make profits. “The intention isn’t to create companies and send them out and make money," he says. “The intention is to create an ecosystem. It really is very family-like." However, Lubin also acknowledges that changes are in order and recently sent a memo to his staff about becoming more focused. “In ConsenSys 2.0," Lubin says, “we’ll pay more attention" to the market-based hurdles that traditional startups have to clear.

The biggest problems at ConsenSys may have less to do with plunging crypto prices and Lubin’s dwindling fortune than with his conglomerate’s weird operating structure.

ConsenSys would like to believe that it’s reinventing the future of work and business. As you enter ConsenSys’ hacker-chic Brooklyn digs, there are lots of anti-establishment touches, including a large banner on the wall that reads, “Welcome to the decentralised future."

In fact, CEO Lubin tries not to tell people what to do. “He wants to be like the anti-CEO or the anti-founder," says Jeff Scott Ward, a former employee who thinks this is partly because Lubin is a nice guy who wants to be democratic.

But there are some not-so-nice consequences of having Mr. Nice Guy in charge. At ConsenSys, there is less incentive to meet deadlines and make fast progress. “In a lot of ways, there still isn’t pressure to generate revenue or hit targets that normally Silicon Valley VCs and businesses would be looking for," says Griffin Anderson, who leads the Balanc3 spoke. One Glassdoor commenter describes ConsenSys as a place with “unlimited funding and no pressure to actually deliver anything."

The lack of traditional structure has also spawned ugly politics. “It feels a little like Survivor," says Lucas Cullen, a former employee. ConsenSys staffers who are close to Lubin get faster access to resources, says a former employee, and accountability varies widely from team to team.

ConsenSys does have Resource Allocation Committees, which are charged with deciding whether spokes will continue to receive additional engineers or funding. But the committees are in a constant state of flux. “There’s always one person from finance, but they’re generally made up of people who have an interest in your area," says Thomas Hill, a cofounder of Truset, a ConsenSys spoke that’s building a crowdsourced business data platform. “Anyone can sign up for an RAC."

According to Ward, who spent three years at ConsenSys, “There were too many cooks in the kitchen. It was like, Whose ego is the strongest? It was exhausting," he says. UPort, a tool aimed at letting users log in to Ethereum applications, had three project managers, who could not align on a single vision. Today there are just 15 applications using UPort, and the project is splitting in two.

Many describe ConsenSys’ culture as chaotic, and the company seems to have trouble keeping track of its projects. ConsenSys’ homepage says it has “50+ spoke companies," but during the reporting of this story, the number ranged from “more than 30" to, most recently, 42. It’s a “fluid number," says a company spokesperson.

Lubin acknowledges some of these difficulties. “[Accountability] has been an issue at ConsenSys," he says. “We’ve been working to put in place various mechanisms to make it clearer who’s responsible for what and to ensure crisp accountability." But he also cites real benefits to his mesh architecture. Projects are collaborative, and silos are easily breached. Employees report that there is little stigma attached to questioning others’ assumptions. And some insiders report feeling empowered by the autonomy—especially the opportunity to move laterally among projects.

According to Hill, the Truset cofounder, “ConsenSys will end up in the Harvard Business Review as a case study, either as a lesson on how you change corporate organisational structure or as a disaster."

If there is a paradox in Lubin’s quest to reinvent business for the coming age of decentralisation, it is that ConsenSys is actually much more centralised than Lubin would like to admit.

When ConsenSys spokes have spun out and become separate businesses, for example, Lubin has retained ownership of 50 percent or more. Thus, like John Pierpont Morgan and Andrew Carnegie during America’s Gilded Age and tech magnates Jeff Bezos and Mark Zuckerberg of the internet age, Lubin is setting himself up to become one of the controlling titans of the blockchain era.

“This is where the whole mesh-and-decentralisation thing falls apart," Ward says. “It was never clear who had what stake." In the case of Grid+, one of the projects ConsenSys spun out through an ICO, Forbes estimates that Lubin walked away with no less than 20 percent of its tokens, in addition to half of its equity.

“I don’t think they even have the slightest idea what decentralisation is," says Demirors of CoinShares.

The issue of sharing ConsenSys’ equity among its 1,200 employees has become a running joke. Former employees report that for a long time Lubin was evasive and the plan was always “six weeks away," if you asked him. In fact, the first set of 100 employees or so received their equity in early 2017, and nearly two years later, ConsenSys says, it is still working on a plan to give its larger workforce a stake in the company.

Lubin does not think ConsenSys’ structure presents contradictions. “If you can build a system that serves many people and they’re all delighted with the system, then the originating structure doesn’t necessarily have to be equally owned by lots of people," he says, in a response that could have just as easily been uttered by Zuckerberg on the eve of Facebook’s lopsided public offering.

In 2017 ConsenSys was able to use ICOs as an easy and lucrative way to spin companies out and reward internal staff. But now that the SEC is cracking down on ICOs, that window is much smaller. “As we look to make more external investments, there are specific deals where we need to map to a traditional VC model," says Ron Garrett, head of ConsenSys Labs, the division responsible for deciding which projects become spokes. “In those deals, we’ll take less equity." He adds that other startup incubators like Betaworks are known to take majority stakes in the companies they incubate. So much for democratisation and decentralisation.

For now, Joe Lubin’s grand experiment in the future of business is racing against a clock: Will blockchain applications achieve mainstream success before Lubin’s largesse is exhausted?

Even the most successful applications on Ethereum have tiny user bases. The most widely used application is a decentralised exchange for trading crypto called IDEX, which is unaffiliated with ConsenSys. After more than a year in operation, it has a pitiful 1,000 daily users. “We knew that it was going to be a lot of work and take a long time before you enable massive evolution on a planetary scale," Lubin says.

If Lubin is still a billionaire, he may be able to sustain ConsenSys for several years—even at its $100 million-plus annual burn rate. “As it stands, ConsenSys is stable and healthy," he insists.

At what point will Lubin throw in the towel? “I have no exit plan, and I’ve never had an exit strategy for anything I’ve done," he says from ConsenSys’ San Francisco offices, where he just hosted a “demo day" for 16 startups eager to join his bankroll. “I’m all in."

First Published: Jan 10, 2019, 11:43

Subscribe Now