It’s early May, and Patrick Byrne has just gotten off the phone with hip-hop artist Akon and is roaming barefoot in his elegant three-room suite on the top floor of The Jefferson hotel, a stone’s throw from Embassy Row in Washington, DC.

He grabs a Diet Coke, a pack of gummy bears and some M&Ms from a minibar hidden in a tasteful armoire, settles on a plush cream-coloured sofa and begins to boast about the circumstances around which the Senegalese-American celebrity sought him out. “I hear he’s a musician. We share ambitions for Africa,” says Byrne, popping a gummy bear into his mouth.

Byrne, who bought Overstock.com in 1999 and ran it for two decades, has always been a man of many ambitions. High on his list: Transforming the African continent and its 1.3 billion people via blockchain technology. Like an infomercial for the nascent decentralised, distributed ledger technology that underlies cryptocurrencies like bitcoin, he waxes poetic about a future in which corruption is wiped out, people are freed from poverty, and developing nations can leapfrog ahead by putting government functions like voting, property records and central banking on the blockchain.

Characteristically low on his priority list: The economic interests of the thousands of shareholders in his publicly traded former e-tailing giant.

For the last several years, Byrne, 56, spent no fewer than 220 days a year on the road spreading his blockchain gospel, despite the fact that Overstock was hemorrhaging cash. “Over the next five years, we can change the world for 5 billion people,” says Byrne. “At least a billion. Maybe 5 billion.”

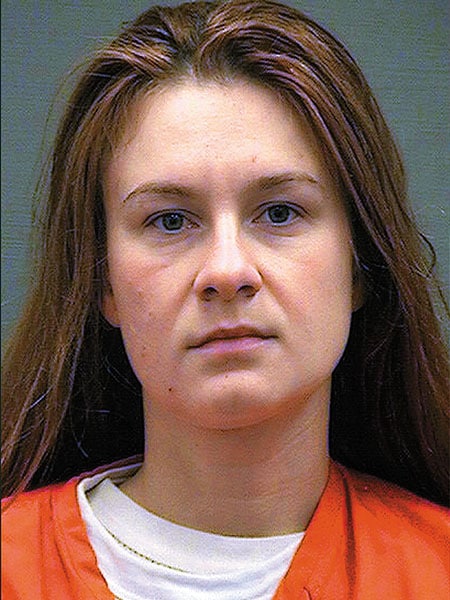

Byrne is vague about why he is in the nation’s capital this week and mentions a meeting with representatives from Africa about his blockchain projects. However, he later reveals that he had been meeting with the Department of Justice. Byrne claims he’s been serving as a government informant, feeding information since 2015 to the “Men In Black”, as he puts it, on Maria Butina, a vivacious Russian grad student with whom he struck up a romantic relationship. She is currently serving an 18-month prison sentence after pleading guilty to conspiring to act as a foreign agent, in connection with her efforts to infiltrate conservative political circles before and after the 2016 presidential election.

In his resignation letter, Byrne cited his involvement in “certain government matters” as complicating “all manner of business relationships, from insurability to strategic discussions regarding our retail business.” Byrne says what he has done (exactly what that was remains unclear) “was necessary for the good of the country, for the good of the firm.”![g_123467_maria_butina_280x210.jpg g_123467_maria_butina_280x210.jpg]() A police booking photograph of Maria Butina, who pleaded guilty to conspiring to act as a foreign agent

A police booking photograph of Maria Butina, who pleaded guilty to conspiring to act as a foreign agent

Image: Reuters[br]Byrne concludes his letter by stating cryptically: “Coming forward publicly about my involvement in other matters was hardly my first choice. But for three years I have watched my country pull itself apart while I knew many answers, and I set my red line at seeing civil violence breaking out. My Rabbi made me see that ‘coming forward’ meant telling the public (not just the government) the truth. I now plan on leaving things to the esteemed Department of Justice (which I have doubtless already angered enough by going public) and disappearing for some time.”

In a call from his car minutes after delivering a farewell speech to his surprised employees, Byrne said he had his bags packed. “I will be sitting on a beach in South America shortly, and that is all I want to think about,” he says. “I want to focus on getting back into good shape, doing yoga and becoming a vegetarian.”

*****

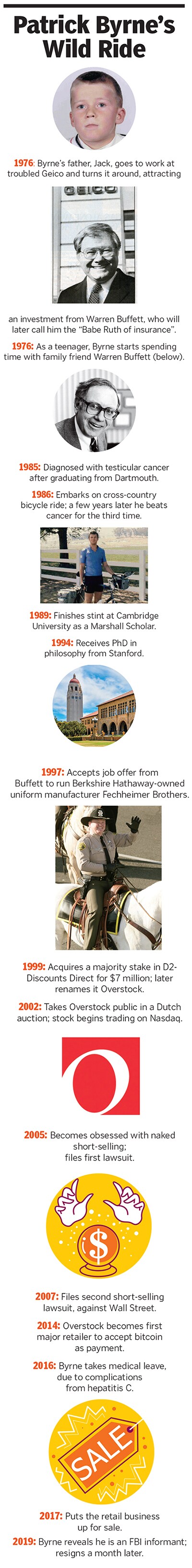

Welcome to Patrick Byrne’s bizarre world. The existential crisis Byrne is putting his Salt Lake City-based company through comes after an impressive career pioneering ecommerce. Nearly two decades ago, Byrne was lauded as “The Renaissance Man of Ecommerce.” The closeout store he took control of in 1999 for a mere $7 million was on its way to becoming an e-tailing phenom and eventually came to command a market capitalisation of $2.2 billion. But in the hypercompetitive digital age, disruptive business models don’t last long, and today Overstock—once an innovator—is a has-been.

This isn’t any secret. By the time of his resignation, Byrne had all but given up trying to compete with the likes of Amazon and Wayfair, and he had spent the last two years unsuccessfully attempting to unload Overstock’s retail business. Just as ecommerce captivated Byrne at the turn of the millennium, blockchain was his shiny new obsession. So Byrne funneled Overstock’s dwindling resources into blockchain ventures—more than $200 million since 2014. About 30 percent of that sum went into 18 early-stage companies that are building a suite of blockchain technology products he wanted to sell to governments. The rest has been seemingly squandered on a personal vendetta: Overstock is creating a blockchain version of Nasdaq, which Byrne believed could right some of the evils of Wall Street—particularly the naked short-selling that he claims plagued his company for much of the last 15 years. Byrne attracted an eclectic mix of allies to his corner doing what he called “God’s work”, ranging from Akon and the World Bank to the infamous short-seller Marc Cohodes and the city of Denver.

But the walls closed in on Byrne’s quixotic adventure. Overstock’s heavily shorted stock plummeted from $87 in the beginning of 2018 to about $17 today as some $1.6 billion in market capitalisation has evaporated. Once reliably profitable, Overstock lost $206 million last year and $110 million in 2017. In recent months, Byrne fired some 400 people.

Even worse were the cracks forming in Overstock’s new strategy. The company’s prized crypto offering, Tzero, is the subject of an SEC investigation, and a highly anticipated private equity investment into the fledgling exchange has withered away. Its blockchain investment arm, Medici Ventures, has yet to generate meaningful revenues and racked up losses of $61 million in 2018. With many big companies now embracing blockchain technology—including a bold new plan from Facebook—Byrne’s strategy shift to blockchain suddenly looks as challenging as Overstock’s online retailing business.

Eventually even Byrne’s most loyal shareholders—blockchain believers among them—were in open revolt. Fumed Byrne in May, after investors bombarded him with calls and emails when he sold 900,000 shares of stock: “Frankly, I had no idea that shareholders would demand explanations of why and how I might want to use my cash derived from my labour and my property to pursue my ends in life.”

*****![g_123481_patrik_byrne_280x210.jpg g_123481_patrik_byrne_280x210.jpg]()

Byrne is the son of the late John “Jack” Byrne, a University of Michigan-trained mathematician and renowned insurance executive credited with turning around Geico in the mid-1970s and persuading Warren Buffett to invest in the auto insurer. Geico would eventually become one of the biggest contributors to Berkshire Hathaway’s bottom line, and Buffett once described Byrne’s father as “the Babe Ruth of insurance”. When Byrne was in middle school, he gravitated toward his father’s friends. Bethesda neighbour Gordon Macklin, the president of Nasdaq from 1975 to 1987 (and later the chairman of San Francisco investment bank Hambrecht & Quist), would drive Patrick to school regularly. Buffett was an occasional house guest, and Byrne’s parents would allow him to skip school to spend time with the investment maven.

Says Byrne, who now refers to the Omaha billionaire as his rabbi, “My mom would get a case of Pepsi, and Buffett, who is a teetotaler, always carried a hip flask of cherry syrup like a drunk. We’d sit there and over an afternoon polish off 18 Pepsis.”

Byrne’s father later went on to turn around American Express’ Fireman’s Fund and eventually created his own insurance holding company, called White Mountains Insurance. His stake, worth hundreds of millions at his retirement in 2007, formed the basis of the family’s wealth.

Patrick was the youngest and most precocious of Jack’s three sons. In 1981, he headed to Dartmouth to study philosophy and Asian studies. Shortly after his graduation, he was diagnosed with testicular cancer. After treatment, he celebrated with a cross-country bicycle ride with his two older brothers. The cancer would come back two more times in quick succession and keep him in the hospital for much of his 20s. To keep his mind occupied while he was bedridden, he began pursuing a graduate degree in mathematical logic from Stanford. In 1988 he headed to Cambridge University as a Marshall Scholar and eventually received his philosophy doctorate from Stanford. Byrne speaks Mandarin and several other languages and once translated Lao Tzu’s Tao Te Ching (The Way Of Virtue) into English. “I was one of those guys who actually studied philosophy because I was trying to figure out man’s place in the universe,” says Byrne, whose dissertation explored the virtues of limited government and drew from libertarian Robert Nozick’s Anarchy, State, and Utopia.

Despite his years in academia, Byrne pivoted hard to the pursuit of wealth in the late 1980s. “I had grown up in a very business-oriented household . . . I never anticipated staying in a university setting,” he says. In 1987 he bought a bankrupt hotel with his older brother called the Inn at Jackson Hole for about a million dollars, which they sold several years later for $4 million. In 1989, they started buying distressed consumer debt at 5 cents on the dollar during the S&L crisis. In the early 1990s, Byrne led a $1 million investment into the development of the Red Dolly Casino in Colorado, which was later sold for $5 million. He also invested in distressed strip malls, office space and apartment buildings across the country. His dad often loaned his sons money and in later years put up mezzanine capital, collecting a preferred, 15 percent return and half as much equity.

Nothing kept Byrne’s attention very long. In 1994, he led an investment into Centricut, a New Hampshire-based industrial torch-part manufacturer, and served briefly as CEO when the current management fell ill. In 1997, he left to run Berkshire Hathaway’s Fechheimer Brothers, which made uniforms for police, firemen and military. In 1999, seeing an opportunity to sell leftover inventory online, his investment holding company, High Plains Investments LLC, acquired a majority stake in D2-Discounts Direct for $7 million. He renamed it Overstock, and when 55 venture capitalists declined to fund the company’s growth, he turned to friends, family and his own chequebook. His timing was perfect. The company began scooping up inventory from bankrupt dot-coms, whether it was consumer electronics, jewellery or sporting goods, then selling it on the cheap. In 2002, Overstock’s revenue hit $92 million and Byrne took the company public via a Dutch auction, which allows investors (not bankers) to set prices for the stock offering themselves. (Google went public the same way.)

By 2005, the company’s stock, which had skyrocketed post-IPO, began to slide as its losses widened. Byrne became convinced it was because of naked short-selling, an illegal practice in which investors sell shares in a company without actually borrowing the shares, typically using leverage. In a now-infamous August 2005 conference call, he ranted about how hedge funds, journalists and regulators were conspiring to push down the company’s stock price under the direction of some faceless menace he called the “Sith Lord”. Overstock sued short-selling hedge fund Rocker Partners and research firm Gradient Analytics, which had been critical of the company. Then, in 2007, he filed a $3.5 billion lawsuit against 11 of the biggest banks on Wall Street (Goldman Sachs, Morgan Stanley and Credit Suisse among them), accusing them of participating in a “massive, illegal stock market manipulation scheme” that distorted the company’s stock price by facilitating naked short-selling.

The crusade cost him two directors, plus the confidence of his father, who threatened to step down from the board because he believed his son was distracted from Overstock’s core business. The litigation dragged on for over a decade and resulted in a handful of settlements, including a $20 million payment from Merrill Lynch in 2016. “I think he won the battle but lost the war when it came to naked short-selling,” says Tom Forte, long the lone analyst covering the stock. In the years Byrne spent chasing short-sellers, Overstock’s stock sagged and revenue drifted slowly upward, hitting $830 million in 2008, $1.3 billion in 2013 and $1.8 billion in 2018. And while the company never racked up massive losses like Amazon or Wayfair, as Byrne likes to point out, its profitability has been modest. Overstock broke into the black in 2009, then eked out small profits for the next seven out of eight years.

In 2017 and 2018, as Byrne shifted his attention to expanding in crypto and blockchain, the company began bleeding red ink—a whopping $316 million over two years, which is more than twice the profits Overstock has ever delivered. Byrne chalked his market share declines up to competitors with seemingly endless piles of cash to blow through. “The thing I never anticipated . . . was that I would be in an industry that tolerated people losing $500 million, $1 billion or $3 billion forever. We started drawing copycats, who came in and seemed to have unlimited capital,” he says, not hiding his disdain for and jealousy of Wayfair.

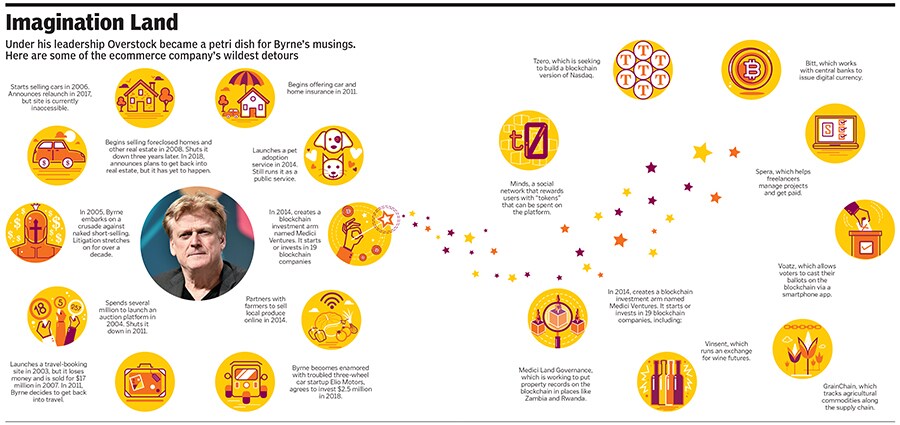

However, former employees say Byrne was distracted by his short-selling crusade and failed to take competitors seriously. Internally Byrne’s ADD management style—enthusiastically starting up new projects, but then losing interest—was jokingly referred to as the Overstock “ovolution”. In 2004, the company spent a couple of million to develop an online auction platform akin to eBay, but it struggled to turn a profit and was shut down in 2011. (Byrne later said he wished he hadn’t abandoned it.) In 2014, Overstock invested $400,000 to facilitate pet adoptions by working with shelters, which it still runs but describes as a “public service”. The company started selling home, auto and small business insurance in 2014, too, which Byrne described as “a long-term play” before trashing it as not doing “particularly well” three months later.

“Patrick gets very focussed on something, and then when he sees the financials didn’t work out, he basically forces layoffs,” says Chad Huff, a former software developer. “Initiatives would get started, then shelved. Or they’d be half done and not in a great state but rolled out anyway.”

*****![g_123469_wayfair_280x210.jpg g_123469_wayfair_280x210.jpg]()

[br]A couple of months before his resignation, as sheets of rain blanket Overstock’s new headquarters at the base of Utah’s Wasatch Mountains—a building designed to resemble a peace sign when viewed from above—Byrne has finished sitting through a scheduled business luncheon and gone missing. Several minutes later, after his assistant tracks him down, he glides into his office, where posters of Bob Marley and Pulp Fiction give it a dorm-room feel. He sits down and begins ruminating on his two decades running Overstock. “It’s kind of imagination land,” says Byrne, dressed in a black long-sleeve T-shirt, jeans and tennis shoes.

Strangely, Byrne’s Overstock was long immune from activist shareholder campaigns and boardroom coups, and what ultimately prompted his sudden departure is still murky. Investors like Marc Cohodes had called for Byrne to step aside as CEO and move into a chairman position. Despite recent stock sales, Byrne remains the company’s largest shareholder, with a 14 percent stake, and says he wasn’t pushed out. “This is not about pressure from shareholders. The only pressure—or actual issue—was that the insurance companies were having conniptions,” he says.

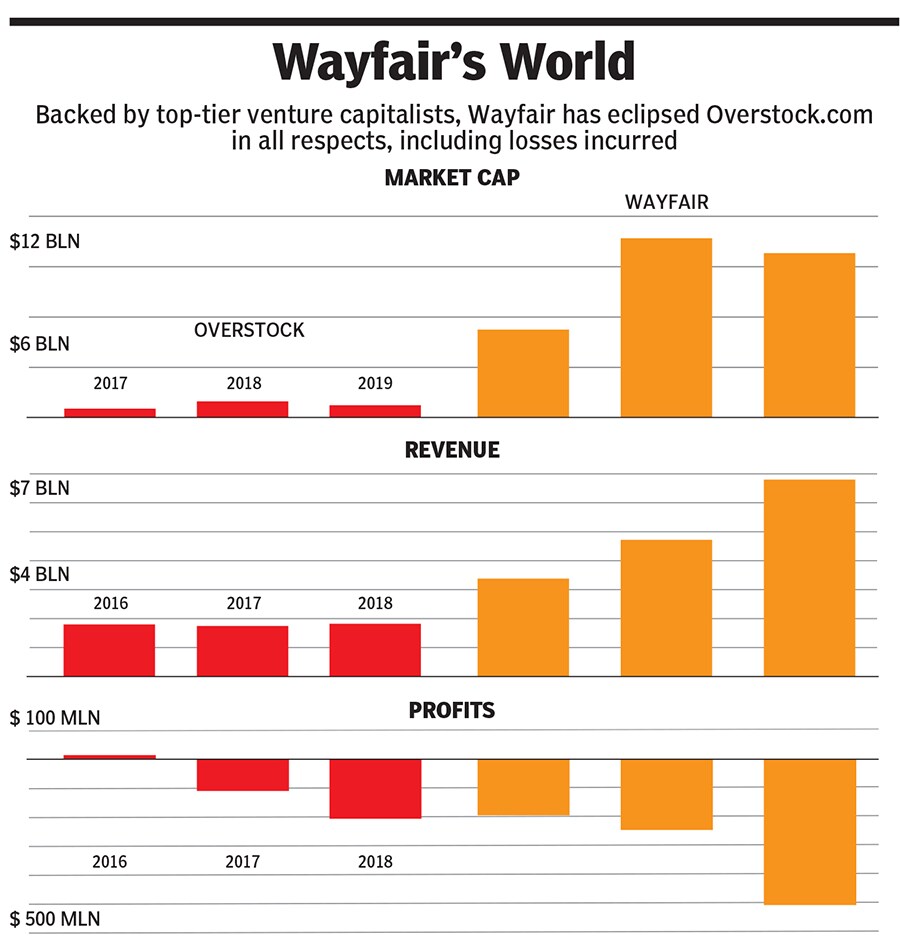

Byrne began chasing crypto in late 2013 when he asked dozens of staffers to work over the holiday break to fast-track a bitcoin payment feature. The price of bitcoin had skyrocketed that year from about $13 to more than $1,000, and in January 2014, Overstock became the first major retailer to accept bitcoin as payment.

Before long, Byrne began tapping Overstock’s balance sheet to fund bigger and bigger blockchain initiatives. The crown jewel: A digital stock exchange called Tzero, which is seeking to allow investors to trade so-called security tokens that represent traditional securities, like stocks, bonds, real estate, private equity and art on the blockchain. Proponents say this will improve access and liquidity for certain investments, plus cut down settlement times for stocks and bonds from up to two days to mere seconds. A bonus: The system would make naked short-selling impossible because there is no longer a lag time between a buy and sell order.

![g_123471_crypto_280x210.jpg g_123471_crypto_280x210.jpg]()

[br]On the plus side, Tzero has satisfied a set of fearsome regulatory requirements, most notably acquiring a company licensed as an alternative trading system. The problem is, with just two tokens—representing Overstock’s and Tzero’s own shares—available to trade on Tzero’s platform, almost no one uses it. The company says it is aiming for five to 10 tokens by the end of the year. In May, it announced partnerships with Saudi real estate giant Emaar Properties, to list $2 billion in real estate, and Securitize, a startup that packages regular assets into digital tokens that can be traded on the blockchain. While it hopes to generate revenues from listing fees, trading commissions, interest on lending assets and more, it first needs to create liquidity by attracting quality issuers and investors to its platform.

Byrne was also developing a securities lending platform as part of Tzero, which would connect asset-rich institutional investors like pension funds (who make money by lending their stock) directly with short-sellers (who borrow stock to make trades). Both parties stand to benefit from lower fees, plus would receive a blockchain-enabled digital locate receipt that proves the shares have actually changed hands. The service takes dead aim at banks like Goldman Sachs and Morgan Stanley, which currently sit in the middle of these transactions. It’s been tried before: A company called Quadriserv created a similar stock-lending platform named AQS in 2006 but alleged in a recent lawsuit that banks conspired to “boycott AQS and starve it of liquidity”. In 2016, AQS was sold in a fire sale for $4 million.

“It’s the last great business on Wall Street,” says Byrne. “Pension funds are going to understand they have been deprived of tens of billions of earnings a year. That money is turning into Maybachs in the Hamptons.”

*****

![g_123473_overstocks_280x210.jpg g_123473_overstocks_280x210.jpg]() [br]At the company’s annual shareholder meeting in May, Byrne fielded tough questions from investors. While the price of bitcoin had climbed some 60 percent in the last five months, Overstock’s shares were sliding. And after months of delays, Overstock just dropped a bombshell: Tzero would receive a measly $5 million in the form of Chinese renminbi, US dollars and other Hong Kong-traded securities from Asian investment firm GSR Capital, after the company originally touted a deal size of as much as $404 million.

[br]At the company’s annual shareholder meeting in May, Byrne fielded tough questions from investors. While the price of bitcoin had climbed some 60 percent in the last five months, Overstock’s shares were sliding. And after months of delays, Overstock just dropped a bombshell: Tzero would receive a measly $5 million in the form of Chinese renminbi, US dollars and other Hong Kong-traded securities from Asian investment firm GSR Capital, after the company originally touted a deal size of as much as $404 million.

Over time Byrne developed a dilettante’s reputation for overpromising and underdelivering. In 2016 Byrne boldly told investors that Overstock would be issuing the world’s first equity security using the blockchain. “The history of capital markets is entering a new era,” he said. Byrne personally ended up buying 50 percent of the $2 million preferred stock offering.

In 2017, Byrne announced a joint venture with Peruvian economist Hernando de Soto Polar that would “challenge global poverty and inequality” by creating a blockchain-based global land registry. But when the two couldn’t agree on terms, Byrne gave $7 million of his personal capital to take a 43 percent stake in the newly formed Medici Land Governance.

Overstock began exploring a sale of its retailing business in 2017, but to date no buyers have materialised. There was also Tzero’s troubled “initial coin offering”, which set out to raise $250 million but, ultimately, as crypto prices were dropping, generated $105 million in August 2018 at an expense of $21.5 million to corporate parent Overstock. The offering is now being investigated by the SEC as part of a broader ICO crackdown.

Many investors grew tired of Byrne’s promises. “Basically, every initiative they put forward, they promised or signaled to the market that this is an incredible layup and they will get it done in three to six months,” says Kevin Mak, a lecturer at Stanford Business School who invested in the company in 2017 and sold his shares last fall. “I ultimately exited when I found that the information I was getting from management was no longer—I want to pick the right words—reliable.”

In the end, Byrne was forced to spend a considerable amount of time hunting for fresh funds to keep his dream alive. In November 2017, Overstock borrowed $40 million from his mother (trusts in her name own 5 percent of the company) and brother at an interest rate of 8 percent. Over the next few months, during the height of crypto-mania, the company received $150 million from two investors, including George Soros, after they exercised warrants in exchange for stock (the investors have since dumped their shares). In August and September 2018, the company raised another $95 million by issuing new shares of common stock in an “at the market” offering.

The problem is, unlike most companies that buy back shares as prices decline, Overstock is selling, diluting the company’s equity. Shares outstanding have climbed to 35 million from 25 million in the last two years. In the first quarter of 2019 Overstock committed to another quick stock sale, raising $31 million to partially offset a $51 million cash burn.

Meanwhile, Overstock’s original business is running on fumes. “It was kind of a fight to run retail, because it was never his priority,” says Stormy Simon, former president of the operation who left in 2016. Since then, there have been several rounds of layoffs in the retail business, leaving a raft of empty desks in Overstock’s new $100 million headquarters. And yet, to his blockchain staffers, Byrne was like Daddy Warbucks. Tzero CEO Saum Noursalehi was paid $4.8 million last year, while his brother and Tzero vice president Nariman earned $1 million. Tzero chief technology officer Amit Goyal made $1.8 million—and his brother Sumit earned an additional $765,000.

In Overstock’s recent quarterly filings, it indicates that it should be able to fund its current obligations for another 12 months, but after that, additional capital may be needed “to be able to fully pursue some or all of our strategies”. The ominous disclosure seems to have had little effect on Overstock’s languishing shares, because by now many investors have given up on the company.

Byrne never showed much respect for Wall Street or small-minded shareholders—and maybe that’s what got him in the end. “We’re like a Russian icebreaker trolling across the Arctic ice field. It’s three or four yards at a time and enormously expensive,” says Byrne. “When you’re talking about the kinds of numbers we’re talking about and freeing up trillions of capital . . . I think there is going to be so much money in it, it’s kind of silly to try and model it.”

Patrick Byrne, founder and CEO of Overstock.com, at a New York City event this May

Patrick Byrne, founder and CEO of Overstock.com, at a New York City event this May A police booking photograph of Maria Butina, who pleaded guilty to conspiring to act as a foreign agent

A police booking photograph of Maria Butina, who pleaded guilty to conspiring to act as a foreign agent

[br]At the company’s annual shareholder meeting in May, Byrne fielded tough questions from investors. While the price of bitcoin had climbed some 60 percent in the last five months, Overstock’s shares were sliding. And after months of delays, Overstock just dropped a bombshell: Tzero would receive a measly $5 million in the form of Chinese renminbi, US dollars and other Hong Kong-traded securities from Asian investment firm GSR Capital, after the company originally touted a deal size of as much as $404 million.

[br]At the company’s annual shareholder meeting in May, Byrne fielded tough questions from investors. While the price of bitcoin had climbed some 60 percent in the last five months, Overstock’s shares were sliding. And after months of delays, Overstock just dropped a bombshell: Tzero would receive a measly $5 million in the form of Chinese renminbi, US dollars and other Hong Kong-traded securities from Asian investment firm GSR Capital, after the company originally touted a deal size of as much as $404 million.