In An Ad-mad World, Google Wants It All

Forget wearable computers and self-driving cars. The search giant will continue its dominance by sticking with its roots—taking $20 billion out of the hides of some very familiar companies

It’s mid-September, and Volkswagen of America has a problem: It won’t have any new models coming out until the spring. Keeping VW front and centre in consumers’ minds has drawn a group of marketing folks from the automaker and two of its ad agencies to Google’s BrandLab at its YouTube headquarters south of San Francisco. Dedicated to “evangelising the art and science of brand-building”, the richly appointed meeting space is basically a man cave for ad creatives, complete with overstuffed couches, booze and the mother of all big screens, an assemblage of 32 flat-panel displays massed into 300 square feet of video overload.

In one corner of the BrandLab, Google’s Jeff Rozic goes to work running VW’s folks through a rapid-fire succession of video ad campaigns the BrandLab feels have worked. His earnest delivery is well-honed, courtesy of 100-plus similar “private workshops” held for potential advertisers from Coca-Cola to Toyota over the past year. VW has some catching up to do, a point Rozic makes intentionally or not by highlighting 13 travel vignettes produced by a rival, Nissan Mexico. His larger point: Don’t clutter a story with too blatant a call to action. “We shouldn’t apologise for trying to sell cars,” one VW exec protests. “Sure,” Rozic shoots back, “but you have to be careful to distinguish when you’re telling a story and when you’re selling.”

Fair point. Rozic is clearly selling—and it’s a product intended to change Google’s path. The king of the click is now lecturing one of the world’s most accomplished advertisers to forget those clicks and amp up the image ads. CEO Larry Page can go on as much as he wants about self-driving cars, wearable computers or any of the company’s other “moon shots”. But Google fundamentally remains the most disruptive advertising company of the past half-century. As its total advertising-revenue growth rate has halved in the past two years, from 29 percent to 15 percent (thanks in part to Facebook and Twitter), it’s now charging full-bore toward the biggest pot of advertising gold it doesn’t own: Brand advertising, the image ads you see in glossy magazines and on television.

Most online ads—the banners that litter nearly every commercial website and, most notably, Google’s search ads—have failed to help marketers move the needle on classic advertising measures like brand awareness and intent to purchase. Instead, they mainly drive people to a product page to click the buy button. Direct marketing is lucrative: Search is still upwards of 60 percent of Google’s ad revenue, helping it earn an estimated 15.8 percent net margin in 2013—but image ads will come to dominate digital advertising in this decade.

Look at the numbers: Digital brand advertising is a $18 billion market this year, according to eMarketer. Its forecast implies that number will double by 2018, at which point it will have passed search and direct marketing, with plenty of room to grow. Television advertising, comprising almost entirely image ads, is currently a $200 billion global market. And it’s a vulnerable one, as younger people scatter to YouTube and Netflix when they aren’t Snapchatting or Instagramming on iPhones or skipping ads entirely on their DVRs. Some 75 percent of respondents to an Interactive Advertising Bureau poll of 5,000 ad execs expect to see some spending move from TV to digital video in the next year.

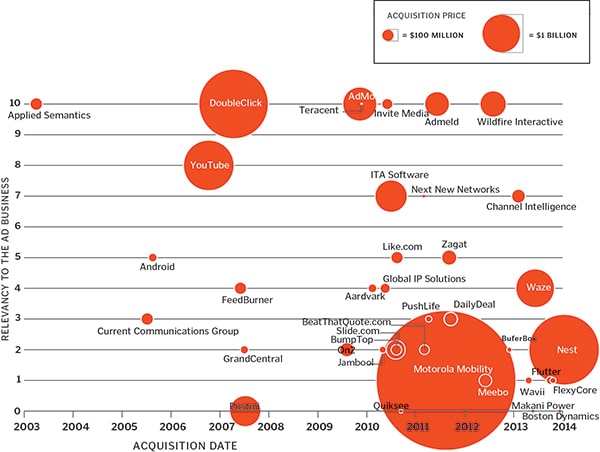

This explains the man cave. YouTube remains one of the greatest acquisitions of the internet era. Larry and Sergey paid $1.65 billion in 2006 for a business that today would conservatively be worth $20 billion as a standalone. So what’s another $400 million or so to build out a brand ad business?

The return has been fairly quick: In October Publicis’s MediaVest, the ad agency for Coca-Cola, Honda and other big advertisers, inked a deal to spend tens of millions of dollars over the next year on Google video, display and mobile ads. It was Google’s first agreement with such an online partner to buy ads in advance, as agencies and marketers do on television. In November Publicis agencies DigitasLBi and Razorfish went bigger, committing to spend $100 million on YouTube and Google’s banner and mobile ad networks this year. “Google is one of the few players with a platform big and wide enough to attract these dollars,” says Razorfish CEO Pete Stein.

And Google sources insist that more of these “upfront” deals will be announced shortly, which has investors—who have driven the stock to a recent alltime high of over $1,150—feeling bullish. Tim Ghriskey, chief investment officer at the asset management firm Solaris Group, a Google investor, figures the company could capture about 6 percent of TV ad spending by 2020, or $20 billion a year. Given that Google’s total revenue this year will come in at around $60 billion, this is the growth the company needs to continue its dominance.

Susan Wojcicki was Google’s 16th hire. Marissa Mayer came a few hires later, yet it was Mayer, now Yahoo’s CEO, who became the flashy female face of Google. No matter. Wojcicki (pronounced wo-JIT-ski), the senior vice president in charge of all Google ad products, plays the anti-Marissa. She favours jeans and hoodies around the office, displaying a self-deprecating plainness. “She never felt she needed to be the smartest person in the room,” says an ex-colleague.

Instead, she’s become the most powerful person—male or female—in advertising. She manages effectively without drama and thus has been Page’s go-to exec for wins such as the introduction of AdSense, which pays other sites to run Google ads (now a $13 billion business), and the acquisitions of DoubleClick, an ad-serving pioneer, and YouTube. “She only works on big problems, not small ones,” says ShareThis CEO Kurt Abrahamson, who worked for her a decade ago.

Her vision of the future of advertising (and hence Google)? Since content is flowing across so many digital devices—a trend Google is trying to accelerate with such initiatives as its Chromecast device for streaming online video to TVs and its flurry of Android smartphones and tablets—she sees nearly all advertising eventually going digital, too, putting it squarely in Google’s wheelhouse.

“Advertisers will have to go where the users go,” says Wojcicki. “A big chunk of dollars will follow.”

Wojcicki envisions an operating system for advertising that can connect search, display, YouTube and branded content, and bundle it all up into campaigns that span computers, smartphones, tablets, connected TVs and—who knows?—maybe Google Glass. Some marketers are moving quickly in that direction. For the recent launch of its D Rose 4 sneakers, Adidas ran ads on YouTube and the Google Display Network, a partnership of some 2 million sites, backed up by mobile ads for a second-screen experience and search ads to catch those who want to buy them right away.

For some time Wojcicki has talked about the “perfect ad”, the one that people see at precisely the time they want to know about a product or are ready to buy it. Search ads now approach that ideal for direct sales, but Wojcicki pictures image ads, supplemented by data on personal preferences and behaviour, that can plant the seed for brand or product preference just as well. It’s an advertising axiom that people are more receptive to messages when they’re leaning back on the couch watching TV than when engaged in online activities. Wojcicki contends the potential is for just the opposite. “If users are engaging with something, they’re choosing to see it,” she says, and Google can use that overt choice to serve even more relevant ads.

So how would a web display ad—largely, the vilified banner—engage?

Upstairs at Google’s display-ad headquarters of the main campus in Mountain View, California, scrawled equations blanket a wall-size whiteboard. The equations are a scrap of the impossibly complex mathematical formulas that power its $12.5 billion display network business. “They turn into beautiful rich-media ads,” says Neal Mohan, Google’s vice president of display advertising.

When Larry Page took over as CEO in 2011, he told Mohan to “revolutionise” display ads so they’re just as useful as Google’s obscenely profitable search ads. Mohan, a veteran of pre-Google DoubleClick, is a true believer. He has bought or built what even rivals concede is the broadest set of software needed by advertisers and publishers to sell and place ads, including a state-of-the-art ad exchange that sells space as fluidly as the Nasdaq sells stock.

Mohan, who likes to decry the 40 percent of “spray and pray” TV advertising he says is wasted on indifferent audiences, offers a vision of the future in which Google can marry its data about individual consumers with the reach of TV and measure the results, too.

Google can generate that reach with its display network, which ranges from tiny outfits to The New York Times and USA Today.

It serves ads on those websites for a cut of revenue. (Tellingly, even NBC partakes, though Google has put a big, fat target on its back.) The network reaches 90 percent of the web’s population and serves impressions to a billion people worldwide a month. It was tough sledding early on, as ads began showing up on dodgy niche sites, but an ongoing cleanup campaign has big brand advertisers increasingly interested. The number of advertisers booking space months ahead—an option chiefly used by big marketers looking to influence brand consideration—has quadrupled from a year ago, but Google isn’t offering specifics.

Still, the banner ads have been losing out to “native” ads, which use content rather than a boring banner to attract people’s attention. “Facebook is a bigger bet for us right now than YouTube,” says Laurent Faracci, the US chief marketing officer for Reckitt Benckiser, owner of brands such as Lysol and Clearasil. Instead, Mohan has bet on rich “engagement ads” for the display network. For instance, one might expand to play videos, games or apps when hovered over for two seconds. Samsung recently ran millions of them to play a live video stream of a new smartphone and smartwatch. In June Burberry ran display and mobile ads through Google that prompted people to snap a photo of their own puckered-up lips and send the digital imprint of the kiss to a loved one.

They’re starting to work. Now used in about 1,000 campaigns daily, engagement ads command around double the price of standard banners, which vary wildly but average around $3 per thousand viewers reached. That’s partly because advertisers can choose not to pay unless someone actually views those ads—like those who pay for clicks rather than views in the banner world—so they’re more valuable. Still, branding remains a challenge for a company whose success so far derives from cold mathematics. Back at the BrandLab, there’s an elegant arrangement of two dozen digital photo frames mounted on a pedestal, all playing videos of flames. “Great stories are told around the campfire,” a Google project manager explains. Cute. Except this campfire gives off no heat. For that, Google needs some of the sizzle of Hollywood.

The warren of studios and soundstages southwest of Hollywood is strewn with cameras, lights, toolboxes and half-empty coffee cups. One stage features stock horror-movie sets, like the hotel hall from The Shining. In another studio, three women, one of them with scissors in hand, are preparing to film a video on how to cut your own bangs. Once a hangar where Hughes Aircraft built the Spruce Goose in the 1940s, this 41,000-square-foot building is now YouTube Space LA, possibly the world’s largest production facility dedicated to online video.

It’s YouTube’s latest bid to shed its dog-on-a-skateboard-video image and make the site a cleaner, more well-lit place for big TV marketers. That bid began a couple of years ago with YouTube’s $300 million drive to create some 200 TV-like channels from the likes of Shaquille O’Neal and Amy Poehler. While they don’t have TV networks quaking just yet, YouTube has been able to command higher ad prices closer to those of TV than web display ads. YouTube gross ad revenue jumped 51 percent in 2013 to $5.6 billion, netting $2 billion after payments to content and ad partners, according to eMarketer.

Here’s the funny thing, though: It turns out that some of the most popular channels are not network wannabes. They’re from producers such as PewDiePie and Jenna Marbles, invisible to those over 30. Likewise, some of the most popular ads on YouTube don’t even look like the TV ads that Google has hoped to capture. It’s dawning on big marketers from American Express to General Electric that to take advantage of the social and interactive nature of online they need to forge a new sensibility, not simply rerun TV commercials.

So now it’s up to Byrne, whose previous job was head of YouTube’s original programming push, to make it easy for big brands to reach You-Tube’s 1 billion monthly viewers. Similar to Rozic’s ad-campaign boot camps in the BrandLab, Byrne brings companies such as PepsiCo and Johnson & Johnson to YouTube LA for a four-day workshop on creating compelling stories, videos and You-Tube channels. He’s aiming to get more than 100 advertisers into the programme this year, both at YouTube LA and in a new combo studio and BrandLab being built in New York.

If Byrne has his way, the new world of brand marketing online will look a lot like a shoot at an unassuming neo-eclectic house in Anaheim Hills, 45 minutes southeast of Los Angeles. In the living room a crew of six is filming the sixth episode of Grace’s Faces, on Bobbi Brown Cosmetics’s I Love Makeup channel on YouTube. It features Grace Helbig, a 28-year-old YouTube star whose own self-produced channel, Daily Grace, draws more than 2 million subscribers to her wacky takes on life. For this new show, Helbig shows up at the doors of fellow YouTube stars to do a makeover.

Her subject this day is Rebecca Black, the 16-year-old who became an instant star in early 2011 for her self-produced monotonous pop hit, “Friday”, that year’s most-watched video on YouTube. Marc Reagan, manager of artistry at Bobbi Brown, is showing Black how to apply various kinds of makeup. Dull barks from a dog banished to the garage only add to the authenticity, apparently. Helbig jumps into the frame, bubbling with a whiff of irony, “You look like an angel!” For a companion show, Touching Your Stuff, Helbig prowls the house rifling through personal effects. “In this medium you can get your Idol moment without paying $20 million,” says Reza Izad, whose Collective Digital Studio produces I Love Makeup and more than 200 other channels, such as the Annoying Orange—a piece of talking citrus that heckles other fruit until they get sliced with a knife.

It’s all pretty nutty, but there’s nothing amateur about Grace’s Faces. Or even overtly commercial. Bobbi Brown isn’t mentioned anywhere in Grace’s Faces despite the use of its cosmetics. Still, the company says it’s happy with the 300,000 views the channel got the first week and the 70,000 channel subscriptions it drew in the next two weeks. “We felt like comedic programming would be in line with our brand personality and would resonate with a younger audience,” says Bobbi Brown President Maureen Case. Marketers don’t pay YouTube to run the shows, but they do pay to run lots of ads to drive people to watch them.

Google will ultimately win this race for a simple reason: Video ads perform better than TV spots, says David Cohen, Universal McCann’s chief investment officer, based on multiple studies his agency has done. “But TV advertising is a frictionless system,” he adds, “a well-oiled machine.” Google can play around with Larry Page’s moon shots, one of which might eventually land, but what will pay for those flights of fancy? Making digital display just as free of friction, something Google knows how to do. It’s just a matter of time.

First Published: Feb 25, 2014, 08:20

Subscribe Now In a new take on its long-running Campaign for Real Beauty, for instance, Dove launched a video on YouTube in April that featured an FBI-trained forensic artist sketching two portraits of women. One was based on their own descriptions and another on a stranger’s, which produced more attractive images. By May the Unilever brand’s touching three-minute video had drawn more than 114 million views worldwide, becoming the most-viewed online video ad ever. “It’s not just 30-second ads,” says Jamie Byrne, YouTube’s director of content strategy. “It’s creating something that people want to engage with and share with friends.”

In a new take on its long-running Campaign for Real Beauty, for instance, Dove launched a video on YouTube in April that featured an FBI-trained forensic artist sketching two portraits of women. One was based on their own descriptions and another on a stranger’s, which produced more attractive images. By May the Unilever brand’s touching three-minute video had drawn more than 114 million views worldwide, becoming the most-viewed online video ad ever. “It’s not just 30-second ads,” says Jamie Byrne, YouTube’s director of content strategy. “It’s creating something that people want to engage with and share with friends.”