To really understand Dan Gilbert, the billionaire owner of Quicken Loans, the nation’s second-largest mortgage lender, it helps to know a little bit about his pumpkin-carving.At least that’s what he tells 1,000 of his newest hires to kick off his latest day-long orientation, which he hosts every six weeks or so.

Gilbert had never given much thought to his Jack-O’-Lantern style, he explains while pacing a balloon-rimmed stage in Downtown Detroit. Then, on his annual pilgrimage to a pumpkin patch with his wife and five children, a stranger offered advice that shook him to the core: “Carve your pumpkin from the bottom.”

The idea had never occurred to Gilbert, who, at 52, has amassed an empire worth $4.2 billion, including the NBA’s Cleveland Cavaliers, casinos in four US cities, 110 other loosely linked small companies—and bankrolling the revival of Detroit, the poster city for all that’s gone wrong in urban America. But once he thought about it, he realised slicing off the bottom of the pumpkin had enormous advantages: It’s easier to get stuff out, you can carry it by the handle, and it’s simpler to light because you just place the carved pumpkin over a candle.

“That really messed me up,” says Gilbert, a short (5’6”), solidly built force in dark slacks and a grey sports coat. “I was always trying to get people to fix things that are wrong. Now it was ‘How do I make things that are going good go better?’” That, in a nutshell, is No 5 on Gilbert’s list of 19 company rules, or “Isms”: “Obsessed with finding a better way.”

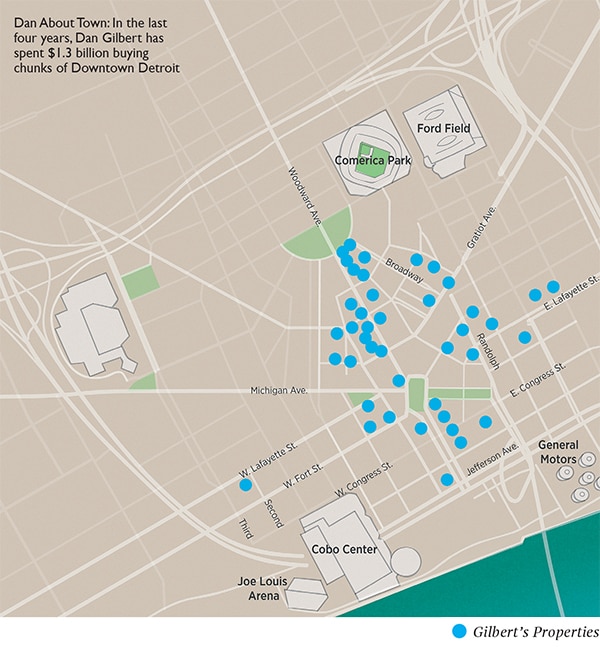

And that, pretty much, explains why he’s turned his not-insubstantial carving skills on an entire city. As you’ve likely heard, over the past four years, Gilbert has become one of Detroit’s single-largest commercial landowners, renovating the city with the energy and impact of a modern-day Robert Moses, albeit bankrolled with his own money. He’s purchased and updated more than 60 properties downtown, at a total cost of $1.3 billion. He moved his own employees into many of them—12,000 in all, including 6,500 new hires— and cajoled other companies such as Chrysler, Microsoft and Twitter to follow. He recruited 140 tenants, though most are tiny startups and other entrepreneurs his venture firm helped finance. Some 40 percent of his tenants are his own companies, including Quicken Loans, Title Source and Rock Gaming, which owns Detroit’s Greektown Casino. “He’s dramatically sped up the redevelopment of downtown,” says Mayor Mike Duggan. Adds Governor Rick Snyder: “Dan has a track record as a successful entrepreneur and innovator, and he’s doing it again in Detroit.”

But while Gilbert has attracted a fair amount of attention for his efforts, the most brilliant—and risky— part of the story is far less known. Yes, he’s saving Detroit because he loves the city, and yes, he sees an unprecedented opportunity to snap up real estate on the cheap (he is in the mortgage business, after all). But more than anything else, Dan Gilbert is saving Detroit to help his business.

If you think luring professional basketball player LeBron James back to Cleveland from Miami, which Gilbert did earlier this year, was an impressive piece of corporate headhunting, it is nothing compared with the HR challenge he faces every day. His empire rests on luring the kind of young, educated, technologically savvy employees that every employer in the nation craves. To get them, he must compete with the golden glow of places like Palo Alto and Manhattan. His genius is to see Detroit—the most dilapidated, forlorn urban environment in North America—not as a hindrance but rather as an opportunity to build the kind of place that Millennial workers crave: Authentic, inspiring, edgy and cheap.

And it’s working. “We turned down 21,000 kids who raised their hands and said, ‘I want to work in Downtown Detroit’,” says Gilbert, who got 22,000 résumés for 1,300 internships this summer. “They were from everywhere. Of all the metrics you’re looking at, that’s the one that makes me the most optimistic.”

Detroit has a long history of staking its future on the grandiose visions of wealthy would-be saviours. In the early 1970s, Henry Ford II aimed to revive the city’s economy with an enormous riverfront office complex billed as a city within a city. Even its name—the Detroit Renaissance Center—promised a new era. Instead, it became a fortress that did little to benefit the rest of downtown. In the late 1980s, Little Caesars co-founders Mike and Marian Ilitch bought and restored the historic Fox Theatre and moved their headquarters downtown from the suburbs, hoping to spur redevelopment. In the late 1990s, they and others built casinos to boost the economy. In the 2000s, both the Ford and Ilitch families built huge new sports stadiums in the centre of town. Compuware founder Peter Karmanos was another hero of the moment, moving his company from the suburbs to a neglected section of downtown, where he built the midrise office building that now houses Quicken Loans’s headquarters.

None of it did much for the economy beyond creating tiny bubbles of prosperity that enticed visitors from the surrounding suburbs to venture into town once in a while—and retreat just as quickly. Already overwhelmed by a broken city government, stalled industry, crime and a population that shrank from 1.8 million in 1950 to fewer than 700,000 today, the city of Detroit was staggered by the Great Recession, mercifully grinding into bankruptcy court in 2013. Outside of a few small pockets, sprawling Detroit, some 143 square miles of it, remains a blighted, dilapidated quilt of abandoned homes and untamed vegetation—literally an urban jungle.

Yet downtown things have changed, unmistakably. Detroit’s reborn Campus Martius Park is a bustling urban Eden where office workers relax by listening to live music, lunching at outdoor cafés or sinking their toes into a sandy beach that didn’t exist two years ago. In November, the beach will be replaced by a skating rink. To the east is the Quicken Loans Sports Zone, where cubicle dwellers from nearby Gilbert-owned office towers break from work to play volleyball and basketball. Most of the traffic is foot traffic, except for a parade of bright white shuttle buses emblazoned with the words “Opportunity Detroit”. Gilbert runs them, too. Locals refer to the city centre as Gilbertville.

He doesn’t own every building in Detroit (the Ilitches, for instance, are planning a $650 million hockey arena and entertainment district), but it feels that way. He keeps a scale model of downtown, 19 feet wide, in a conference room near his office. Every time he buys a building, its miniature replica lights up, like a child’s railroad set. (“There’s a little boy in him,” says pal Warren Buffett who successfully recruited him to take the Giving Pledge.)

In 2009, when General Motors and Chrysler filed for bankruptcy, 48 of the city’s largest office buildings were empty, according to a survey by the The Detroit News. Today, 31 are occupied, undergoing renovation or slated for redevelopment. Employment in the central business district is rising. In 2010, 78,000 people worked downtown, according to the Southeast Michigan Council of Governments. Today’s estimate is 85,000. By 2016, it is expected to grow to 100,000—thanks largely to Gilbert.

The irony is that none of this is part of some master plan. Gilbert never consciously decided on being Detroit’s saviour. But six or seven years ago, he noticed a worrying trend. Quicken Loans, then based in Detroit’s suburbs, was having trouble filling jobs. “For the first time in our history, we started losing job candidates from universities like U-M and Michigan State,” Gilbert says. “People would tell us, I love your company, but I want to go to Chicago or Boston or New York.”

That’s when he decided to move his workforce to Downtown Detroit. Before settling on a location, however, the bottom fell out of the economy: Lehman Brothers failed, the credit crisis hit, and General Motors and Chrysler were collapsing. To be safe, he decided to lease space in the half-vacant Compuware building, moving about 1,700 workers downtown in 2010.

“In the back of our minds, it was an experiment,” he says. “If it didn’t work out, it wouldn’t have been all that big a deal to retrench. We never said that publicly. But just two weeks into it, I knew it was just a matter of time before the entire company moved downtown. We had a huge opportunity in front of us. The mortgage business had blown up. Competitors were reeling. Interest rates were very low. We were taking market share. So we needed to hire quickly. And all these buildings were available.”

Among them were architectural gems designed by Albert Kahn and Minoru Yamasaki, the architect who designed New York’s World Trade Center.

![mg_78465_dan_gilbert_280x210.jpg mg_78465_dan_gilbert_280x210.jpg]()

His decisive, from-the-gut move was hardly out of character, say those who have known Gilbert since childhood. A prankster who once filled a germophobic executive’s office with farm animals as a birthday gag, he was always a little different from the other kids in his 1960s subdivision just outside Detroit (the family fled the city when Gilbert was two). “He started paying attention to business at a very early age, when we were interested in girls, music and sports,” says David Carroll, one of several boyhood buddies now in senior positions at Quicken Loans.

It could have been hereditary: Dan’s father owned a bar in Detroit, and his grandfather owned car washes. An unexceptional student, Gilbert just wanted to get on with life. At Michigan State, he spent a night in jail for taking sports bets (he did 100 hours of community service to get the charges dropped). Later, he got a law degree at Wayne State in Detroit.

He became interested in the mortgage business after he got his real estate licence, and he started Rock Financial, a traditional, branch-based lender, in 1985. It evolved into a nice regional business, with about 30 branch offices in eight states.

On Saturday, March 7, 1998, he blew it all up with an e-mail to his staff (now part of Ism No 11: “You’ll see it when you believe it”). Someone, he said, would transform their industry using the internet. “I’ll tell you all this, whoever it is will WIN BIG!!!!!!!!!!!!!!!! I am willing to spend as much to make this happen as is needed to get this true REVOLUTION going…. LET’S CHANGE THE MORTGAGE WORLD FOREVER.”

Gilbert assigned six or eight of the company’s smartest minds to build a website capable of handling mortgages in all 50 states from one central office. RockLoans.com launched within a year. “Three or four hours later, Dan came in and said, ‘How are we doing?’” Quicken Loans CEO Bill Emerson recalls. “And they told him 50 people had come to the site. And he says, ‘Fifty people? That’s it! We’re shutting down every branch in the country!’”

It was profoundly risky, but Gilbert moved fast and won. He took Rock Financial public that same year, and in late 1999, the company was sold to software giant Intuit, which renamed it Quicken Loans. Gilbert pocketed $320 million and was left in charge, but hated the glare of having public shareholders. Three years later, after the tech crash, he bought it back for just $64 million and licenced Quicken Loans in perpetuity.

At any given time, Quicken Loans has a line of credit of about $3 billion to $4 billion for financing mortgages, selling most of the loans to other investors immediately to avoid long-term debt. During the housing boom, Quicken Loans, like others, did what Gilbert calls “a little alternative lending,” but resisted sub-prime borrowers. “Our mortgage bankers would come in and say, ‘We’re losing business to these other guys!’ But it scared the hell out of me.”

That’s because Quicken Loans was a private company. He worried that if it made sub-prime loans and sold them off, he’d be held personally responsible if borrowers defaulted. “We were absolutely collectible. It was scary.”

The company targeted government-sponsored Federal Housing Administration (FHA) loan programmes. Today, Quicken Loans has the second-lowest default rate on FHA loans in the industry. As competitors fell, Quicken Loans took advantage of government refinancing programmes to keep growing. In 2013, it originated a record $80 billion in mortgage loans and serviced $140 billion, generating about $2 billion in revenues, Forbes estimates.

With the refinancing boom largely passed, the mortgage business has contracted sharply this year. Quicken Loans expects a 25 percent drop in originations for 2014, to about $60 billion. Others have seen a bigger drop, though, which means Quicken Loans continues to gain market share.

Its centralised business model means its costs are substantially lower than those of its rivals. “It’s kind of like the software business,” Gilbert says. “There’s very little cost all we’re doing is moving paper.” Customers seem to like it. JD Power rates Quicken Loans number one in customer satisfaction. “Its consistent updates and information tend to set it apart,” says JD Power’s Craig Martin.

But even as this technological savvy has proved a huge competitive advantage, it is also, ironically, Gilbert’s Achilles’s heel. Systems that make it simple to apply for a loan online are, by their very nature, complex to engineer. Quicken alone employs some 2,000 bankers and 1,100 IT workers from more than 30 countries.

Gilbert has to compete in two of the most cut-throat talent markets in the world: IT and finance. While unemployment in the US is 6.1 percent, it’s 3 percent in IT and 3.5 percent in finance. Even mid-level coders command salaries in excess of $100,000 in many markets—double or triple that in headhunting hot zones like bubble-buoyed Silicon Valley.

That’s where Detroit comes in handy. Earning just $43,000 in the Motor City puts you on the same level for earning power as someone raking in $100,000 in New York and $142,000 in San Francisco, thanks largely to housing costs (the former is some 1,200 percent more expensive, the latter twice that number). Everything—from food to utilities to health care—costs far less in Detroit.

But Gilbert goes beyond outcheaping rival regions. He tries to make his workplaces fun. Inside Quicken Loans’s headquarters, a glass elevator takes you to offices with splashes of reds, blues, yellows and greens. Open spaces and glass-walled offices encourage collaboration, as do well-stocked employee break rooms and the basketball halfcourt smack in the middle of the executive floor.

Just across the park on the chaotic mortgage-banking floor in the former Chase Bank building, now called The Qube, there are no hushed financial conversations across mahogany desks. Just a sea of brightly coloured cubicles and young people dressed in T-shirts and jeans, wearing headsets. Some are standing, some sitting (the desks are adjustable). Every now and then, a group starts bouncing and chanting like a sports team to celebrate a lucky run of mortgage sales. The company routinely ranks in the top tier of best-companies-to-work for lists.

“It’s cool, it’s different, it’s fun. People are walking around while they’re selling loans and throwing a football at each other. You don’t expect it,” said Zachary Hill, a former intern.

“Our business is nowhere near what it would have been if we were still spread around the suburbs,” says Gilbert. “On top of it, the creativity, the connectivity. Our people have never been as creative as they are now. There’s a buzz.”

Even more magnetic for a certain type of sought-after prospect, like Eleanor Meegoda, is Detroit itself. After graduating from Princeton with a degree in public policy and international affairs, Meegoda, 24, took a familiar track for enterprising young do-gooders: New York, the ramen-fuelled grind of being young, smart and poor in one of the nation’s most expensive cities.

Climbing the stairs to her tiny two-bedroom in grungy Washington Heights, which she shared with two roommates, each of whom paid $600 monthly for the privilege of a 25-minute subway commute, “I started thinking critically about where I wanted to spend my 20s,” she says. “It was deeply ironic that I was interested in going abroad, maybe naïvely, to improve the world outside my borders, when there are cities with huge needs right here at home.”

Looking to help America and, yes, find a little financial breathing room, she applied and was accepted into Venture For America, a non-profit that recruits top college graduates to work at startups in depressed cities. She started interviewing with participating companies, including Gilbert’s Detroit Venture Partners (DVP). Launched four years ago, DVP is a $55 million fund that’s made 22 investments so far, mostly in technology-related Detroit companies.

On a tour of the city during her job interview, she fell in love. “It’s a city with this grand American history that’s a little bit down on its luck. There’s massive opportunity to learn from people who are real Americans and to do something unique in this moment.” In 2013, she joined DVP and moved to Motown.

It’s a great story—and exactly what Gilbert is hoping to achieve. Of course, what happens down the road, when Meegoda or her peers have children to raise in a city with a semi-functioning school system, or if Gilbert stumbles amid another big economic downturn, remains an open question.

But for now, she and hundreds of others like her are answering Dan Gilbert’s siren call. In an age of college debt and endless unmet expectations, he’s giving young workers a perk that rival employers can’t equal. He’s made them urban pioneers, part of something exciting and important. They’re not just working at a company. They’re saving a city.

“What a great time to be launching a career,” he tells new employees at the orientation. “You couldn’t have hit it better. If you have parents who are sceptical, they won’t be sceptical in the next few years. I truly believe it.” ‘Yeah, That Was Stupid’ ![mg_78449_dan_gilbert_shoot_280x210.jpg mg_78449_dan_gilbert_shoot_280x210.jpg]() Image: Phil Masturzo/MBO

Image: Phil Masturzo/MBO

Dan Gilbert’s shoot-first style may have helped build a loan empire, but it backfired spectacularly when LeBron James dumped Gilbert’s Cleveland Cavaliers for Miami in 2010. Gilbert called it a “cowardly betrayal” in a searing open letter to Cleveland fans.

Cathartic at the time, Gilbert eventually regretted it. “I was getting so much good feedback, I didn’t really think until later, ‘Yeah, that was stupid’,” he tells Forbes. “I can have a short fuse at times... I can’t believe that I actually went off like that… I might be right in what I felt, but I should have taken half-an-hour to think about it first.” Last July, James and Gilbert got together to see if they could get past the bad blood and bring James back to Cleveland. “The first thing I said to him was, ‘We had five good years and one bad night’,” says Gilbert. “The rest of our three-hour-plus conversation was about the future and what we’re building. James has matured as a person and as a basketball player. And I learnt a lot about my emotional response.” They shook hands after the meeting, but Gilbert wouldn’t find out for five days that, yes, James would play for him again. Forbes estimates the Cavaliers, currently worth $380 million, are worth $100 million more with James back on the roster. Beats a bouquet of flowers

Image: Phil Masturzo/MBO

Image: Phil Masturzo/MBO