Smart Money, Dumb Money of Billionaires

Once we open up more, the billions will be under threat, but new billions will await the intrepid

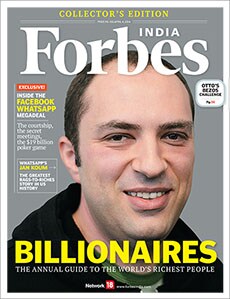

To be a Forbes billionaire and make this list, you have to have at least $1 billion in individual wealth, or $2 billion in case you share it with a sibling and your individual wealth cannot be meaningfully separated. According to Forbes’s calculations, around mid-February this year the world had 1,645 billionaires, which is roughly one billionaire for every 4.3 million people. That shows how much of a rarity billionaires are. Collectively, they represent smart money, dumb money, inherited money.

But tracking billionaires tells you more than just how many Greek islands they can buy on a Sunday afternoon shopping spree. Take the US versus China comparison. You only have to know how many billionaires they have spawned, and the source of their wealth, to understand why they are the new Big Two of Power. The US has 492 billionaires and China 152—which is broadly indicative of their global economic clout and power. But when you look at their composition, you know more. While 70 percent of US billionaires are self-made, China had 99 percent of this species. Most of Chinese wealth is thus new money, wealth created within the last generation after the country put socialism behind. There are more inheritors in democratic America than in authoritarian China.

Bring the comparison to India, and you get a more interesting story. Of our 56 billionaires—55 if you exclude Lakshmi Mittal, who is a non-resident—only 45 percent are self-made. Clearly, Indians love handing over their wealth to progeny—and we are a long way from giving it away. Perhaps, cronyism is helping the rich preserve their wealth for longer in India, but clearly India’s billionaires have been better able to protect their wealth in a protectionist environment. Once we open up more, the billions will be under threat, but new billions will await the intrepid.

You can break the billionaires by gender and learn that while the number of women billionaires is growing, they are still far too few: Just 172 in a pool of 1,645. The vast bulk of them are inheritors and not self-made—which is probably a comment on a tilted playing field than lack of female enterprise. But success is no respecter of patriarchy, and this will surely change in the years to come.

Best,

R Jagannathan

Editor-in-Chief, Forbes India

Email: r.jagannathan@network18online.com

Twitter id: @TheJaggi

First Published: Mar 21, 2014, 06:37

Subscribe Now