The Mostly Happy Returns of Citadel Hedge Fund's Ken Griffin

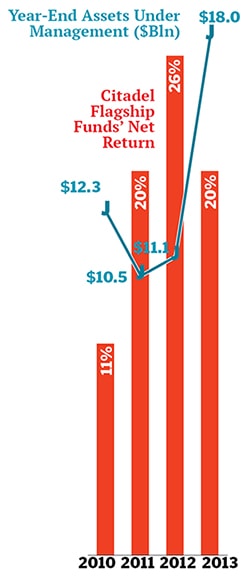

The head of $18 billion hedge fund Citadel began trading from his dorm room as a Harvard undergrad. Now recovered from a brutal credit-crisis thrashing, he just donated $150 million to his alma mater, the biggest gift in its history.

All In the Family

Born in 1968 in Daytona Beach, Florida. His grandfather had died five years prior, leaving behind a small oil company. Bankers descended with bids, but Griffin’s grandmother took over, learned the trade and years later sold out for “several times” those initial offers.

If The Short FITS …

Earns money repairing computers for IBM while a student at Boca Raton Community High At age 18 profitably shorts the Home Shopping Network after reading a Forbes article about the televised-retail operation.

Raising Funds, Trading Bonds

While majoring in economics at Harvard, pulls in $265,000 for his first fund from investors including his grandmother. Trades bonds via a computer program he wrote himself. Rookie Of The Year

Rookie Of The Year

Catches the eye of hedge fundmanager Frank Meyer, who in 1989 persuades him to move to Glenwood Capital Investments in Chicago. Returns 70% in his first year there.

Citadel Arises

Just 22, launches Citadel in 1990 with $4.6 million, one computer and two employees. His aim: To create “a firm that harnesses technology and quantitative methods” to tease out hidden market opportunities. Unorthodox for the era, and effective: Citadel averages a 42% return its first two years.

Greater Assets, Higher Profile

Citadel’s assets under management hit $1 billion in 1998. Five years later Griffin debuts on the Forbes 400 with a fortune of $650 million.

Power Plays

Enron’s implosion sparks an interest in energy trading Griffin picks up distressed energy holdings from struggling Amaranth Advisors in 2006: “Time and again, we have entered into businesses just as others were retreating.”

Crushed By The Crash

Such forward-march tactics backfire in late 2008 amid global financial panic Citadel halts investor redemptions after its flagship funds take a 50% hit—“one of the most difficult decisions I ever made”. The next year he shifts to more straightforward investments and returns 62%. “We were overly confident,” he admits.

Harvard’s Helping Hand

In February 2014, with his net worth at $5.2 billion, Griffin donates $150 million to his college, to be used primarily for financial aid.

First Published: Apr 21, 2014, 07:25

Subscribe Now