More Independent Directors Beneficial for Companies

The composition of several listed Indian companies has undergone a churn in recent months after market regulator Sebi—in a move to strengthen corporate governance—said that an individual can be indepen-dent director in only seven firms simultaneously.

Is it beneficial for a company to have a good board and more independent directors?

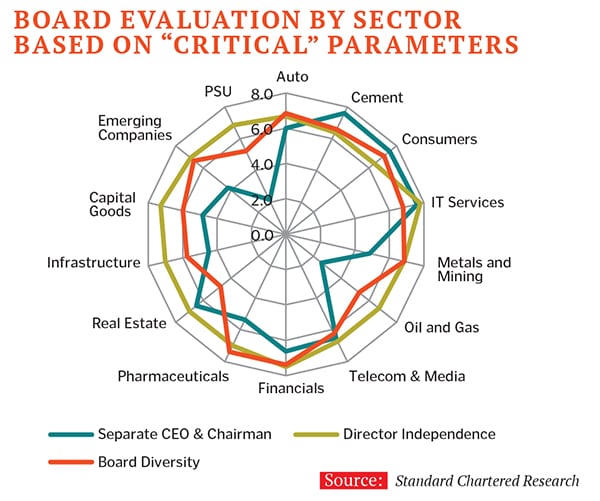

A recent report by Standard Chartered Securities (India) suggests, “There is a reasonable correlation between good board effectiveness scores and superior return on earnings accretion and growth.”

The report, which mapped 80 Indian listed companies across all sectors on various parameters, reveals that only 11 percent of the firms scored high (more than 8 on 10) while over 25 percent scored low (below 6) on board effectiveness. Tata Motors, Biocon, Infosys, HDFC, Axis Bank, ICICI Bank and Marico topped in board effectiveness scores, whereas JP Associates, BPCL, Indian Oil and Steel Authority of India scored the lowest.

The role of indepen-dent directors is critical in India because several companies are promoter-owned and controlled. The median promoter shareholding in Nifty companies is 50 percent. “We also realised that some companies with strong managements— Larsen & Toubro, ITC and Idea—had boards which bagged a low score,” says Rahul Singh, head of equity research, Standard Chartered Securities, and co-author of the report.

First Published: Nov 17, 2014, 07:13

Subscribe Now