“Look at what’s happened at Tata… they removed the chairman himself. So it’s not like these things are only at Infosys. This doesn’t distract us.”

“Our CEO has sent us an email that this is all fake news,” added a third Infosys staffer, agreeing with other colleagues that it’s business as usual when it comes to getting through their day: “See, our work is undisturbed,” another employee added. “This [problem] is at the board level.”

It’s not that they were going to rant and rave about the headline-grabbing friction between the board and the company’s founders, but within the Infosys headquarters in Electronics City, Bengaluru, several employees that Forbes India spoke to appeared unfazed. Of course, most declined to comment.

As they rightly pointed out, the issue is at the top. The work at Infosys, one of India’s largest and most well-known information technology (IT) companies, continues. And well at that. In fact, Infosys shares on NSE were up about 6 percent in the month to February 23, helped by a roughly 2 percent increase on that day alone, as news broke that the founders were backing a $2.5 billion share repurchase programme. The company has told the stock exchanges that it is raising Chief Operating Officer Pravin Rao’s salary as well.

These positives, however, are currently clouded by dissent. The management, which should be singularly focussed on the changing realities of the IT sector, finds itself in a public spat with the company’s founder NR Narayana Murthy. Murthy and his co-founders have given up management control, but remain shareholders to the tune of 12.8 percent.

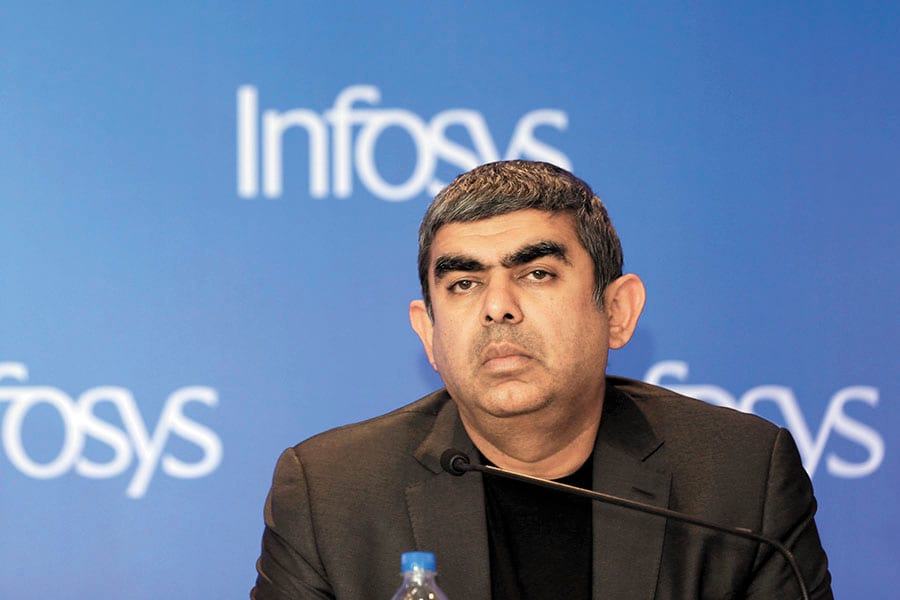

This is a “distraction”, as CEO Vishal Sikka termed it at a press conference in Mumbai on February 13 called specifically to clear the air, that no Indian IT company can afford. Particularly not Infosys, which is finally finding some ground after a slow run.

The industry is, in any case, undergoing a process of recalibration. Indian IT providers have long enjoyed healthy business growth from markets like the US and Europe by catering to the IT needs of clients there and offering them a cost arbitrage. But that’s ceased to be enough. Not only are IT companies expected to reimagine themselves as digital services firms partnering their clients, the Indian IT business model, which has thrived on providing tech support to global clients through offshore centres in the country and by sending employees onsite, is rapidly changing. The reason for this is the combination of cloud computing and automation, and the advent of Artificial Intelligence (AI), even as there is increasing protectionism in the West, particularly in the US—“A perfect storm” of headwinds, as Siddharth Pai, a long-term advisor to buyers of technology services, and formerly a partner and president for Asia-Pacific at consultancy Information Services Group, points out.

Against this backdrop, Sikka, who holds a PhD in computer science and is an enthusiastic AI evangelist, has returned Infosys to growth rates that no longer lag the industry. He can also claim, with some data to back him, that despite hiccups such as a less-than-satisfactory performance on the consulting front, Infosys today is better placed to aggressively chase its next phase of growth than when he took over. His target is ambitious: To double Infosys’s revenues to $20 billion by 2020, raise revenue per employee to $80,000 and increase profit margins to 30 percent.![mg_94161_nr_narayanmurthy_280x210.jpg mg_94161_nr_narayanmurthy_280x210.jpg]() NR Narayana Murthy and his co-founders remain shareholders to the tune of 12.8 percent in Infosys

NR Narayana Murthy and his co-founders remain shareholders to the tune of 12.8 percent in Infosys

Image: Getty Images

During the Mumbai press conference, which was attended by the entire Infosys board, R Seshasayee, the chairman of the board, said that the noise over the disagreements was taking the focus away from the journey of smart recovery that Infosys has been on under Sikka’s leadership. And even the dissenters agree with that. “We have no issues with Sikka’s strategy. He is a new CEO, he has come here and explained the strategy, let him deliver on that. All we are doing is raising governance issues,” former Infosys Chief Financial Officer V Balakrishnan, who has supported Murthy’s earlier public statements, tells Forbes India.

But what looks like governance issues to some are merely board decisions that may be questioned on merit, points out Seshasayee.

Among the concerns raised by Murthy and others is a severance pay of Rs 17.3 crore that Infosys had agreed to pay its former CFO Rajiv Bansal, who quit in October 2015 and served a transition period that ended on December 31, 2015. After the objections were raised, in April 2016, the payment was truncated to Rs 5 crore. It isn’t immediately clear whether the remaining portion of the severance package that the company had agreed to pay Bansal will be credited to him. Murthy has also raised questions over whether the pay to Bansal was “hush money” of some kind—something which an anonymous whistleblower had alleged last year.

“The board has to take a step back, the chairman should step down, because he was part of those decisions [to sanction Bansal’s severance package]. My suggestion will be to get a board member who was not involved in all those transactions, somebody like [DN] Prahlad, because he joined recently and wasn’t there when these transactions happened,” says Balakrishnan. “Make him an interim chairman, and probably get an independent agency to investigate the whole thing.”

Sikka, however, has termed Bansal’s termination a function of lack of chemistry. To that, Balakrishnan points out, “If the chemistry wasn’t working between the CEO [Vishal Sikka] and CFO [Rajiv Bansal], he should have been terminated, but he resigned voluntarily, so there is no need for the company to pay any severance pay.” He also adds that “they have not explained why they agreed to such a large, generous severance pay in the first place”.

Other concerns include the CEO’s target pay doubling from when he joined in 2014, his use of chartered flights, severance pay of a former general counsel of the company, and a new office space taken by the company in Palo Alto in the US.

Another finger that pointed towards the Infosys management—and this one is not by the founders—is that of a purported whistleblower. In an anonymous letter, the whistleblower has linked Bansal’s proposed severance pay to differences between the Sikka-led management and him over the acquisition of Israeli technology company Panaya in 2015. The letter alleges impropriety in the manner in which the deal was transacted and suggests that Infosys may have overpaid. In a statement issued on February 20, Infosys has categorically denied any wrongdoing.

The timing of the emergence of such issues, many believe, is unfortunate. “At the end of the day, the company is going through significant change and the timing as well as the forum on which this issue has surfaced is unfortunate,” says Siddharth Pai. “It’s not an easy time for the industry and they need to have all their energies focussed on dealing with external pressures —not fighting internally. At the end of the day, the company is going through significant change.”

However, the differences of opinion, says Seshasayee, stems from a founder-driven organisation transitioning to one managed by professionals. He also pointed to cultural differences between two generations of leadership which, according to him, is natural. “The company is in the midst of a cultural transformation very different from family-run global companies. We have a professional management and a professional board. There are bound to be issues and challenges,” Seshasayee tells Forbes India. “In general, any challenge we go through, so long as we learn our lessons and re-calibrate our processes, we will emerge stronger.”

And though the differences are unmistakable, so is the overlying tone of respect assumed by the management towards the founders. Both Seshasayee and Sikka have stated that the key messages that emanate from all the “noise” around this issue will be assimilated and action will be calibrated accordingly. “We haven’t been quite successful in addressing the concerns of the founders as the recent developments suggest. We have to change the method and quantum of the communication. We don’t want the stakeholders speaking out in public,” says Seshasayee.

Also, according to Seshasayee, a key learning has been in how Infosys’s contract with Bansal wasn’t as watertight as it should have been. “It contained elements which were subjective,” he says. “We have since done a benchmark study and re-written all contracts to ensure that all aspects of the agreements are certain.” Infosys has appointed law firm Cyril Amarchand Mangaldas as the intermediary agency for shareholder interactions over grievances, to ensure that no one section of shareholders gets preferential treatment, the company said in a February 9 statement. This was done after deliberations over the need for better communication, Seshasayee says.

At the same time, while the tussle has been public, the Infosys—and Sikka—brand continues to be trusted by major institutional investors like OppenheimerFunds, who have expressed their faith in Sikka’s leadership.

In an open letter, Justin Leverenz, portfolio manager of Oppenheimer Developing Markets Fund, asked the board to “restrain divisions in the firm and contain inappropriate interventions by non-executive founders”. Leverenz added: “Let Vishal do what he was hired to do, without distractions.”

undefinedTo be sure, the founders have not expressed doubts over Sikka’s strategy for Infosys[/bq]

Some analysts also read the current tussle at Infosys as a referendum on the best way forward for the company from an operational strategy point of view. To be sure, none of the founders have officially communicated any reservations on Sikka’s future strategy for Infosys, which includes a sharp focus on new digital technologies, AI and machine learning.

“At the heart of what is happening is a deeper debate that Infosys is having with its shareholders to determine the go-forward vision for the company,” says Peter Bendor-Samuel, CEO of Everest Group, a consulting firm that has advised large corporations on tech services purchases. “Infosys must choose between being an ‘arbitrage-first’ company and a ‘digital-first’ company.”

Shriram Subramanian, founder of proxy advisory firm InGovern Research Services, and a former Infosys employee, says that the founders, as shareholders, have every right to ask questions, but these queries need to be communicated through the proper channel. “Rather than air their views through media and give rise to rumours, they should write to the board listing their concerns and offering solutions and suggesting remedial measures. It also isn’t clear whether the founders are united in their views, or if they have different opinions among themselves,” he says.

On the Panaya deal, while some have questioned the rationale for Infosys allegedly paying an excessive amount to acquire the company, as the anonymous whistleblower claimed in the letter, legal experts don’t attach much importance to that theory.

In a post on LinkedIn, Vijay Sambamurthi, a corporate lawyer with close to two decades of experience advising venture capital and private equity funds, cites the example of AppDynamics, a Silicon Valley-based company. The firm was valued at $1.9 billion in its last fund-raising effort. In December 2016, AppDynamics filed for a public listing in the US, which would have valued the firm at around $2 billion. But it then, instead, got acquired by Cisco for $3.7 billion.

Industry observers say that it would be advisable for Infosys to work out a framework of engagement between its management and the founder shareholders, who may have a minority stake at present but will always remain significant owing to their contribution in building the company. Even Seshasayee alluded to this during the Mumbai press conference, saying that Cyril Amarchand Mangaldas was helping Infosys with preparing a framework through which information can be shared with shareholders like the founders in a lawful manner.

That is the way forward, agree experts.

“They have to come to an agreement regarding conflict resolution, confidentiality and willingness to recognise the importance of what has been done before and more importantly what needs to be done by the new board and the new management,” says Prasad Kaipa, a management consultant and researcher who has taught at business schools like INSEAD and Indian School of Business. “Evolution always makes changes to what was core in the past. How much we have to accept and how much we have to fight is a judgement call.”

Two-and-a-half years ago, Murthy sat next to Sikka in a conference room in Infosys’s Bengaluru campus, quipping how ‘Sikka’ meant coin in Hindi and how he hoped the bearer of such a name would make Infosys more prosperous. On February 13, Sikka reiterated that Murthy and he were in constant touch and only earlier that day were chatting about the Apple Watch, which was the first watch that Sikka has owned in 20 years.

This easy camaraderie should translate into swift resolution, or so Infosys shareholders would hope.

(Additional reporting by N Madhavan and Aveek Datta in Mumbai and Anshul Dhamija in Bengaluru)

NR Narayana Murthy and his co-founders remain shareholders to the tune of 12.8 percent in Infosys

NR Narayana Murthy and his co-founders remain shareholders to the tune of 12.8 percent in Infosys