PVR vs Cinepolis: The Show (Down) Is On

Ajay Bijli’s PVR and Mexican chain Cinepolis will be locked in a fascinating duel in the world’s biggest market of moviegoers

Deepak Marda still remembers that fateful day on campus. In early 2007, the 34-year-old IITian was studying at the Stanford Graduate School of Business when Alejanadro Ramirez, the CEO of Cinepolis, Mexico’s biggest movie exhibition company and world’s fourth largest, came to address the class. This was the opportunity that Marda and two of his batchmates, Milan Saini who like Marda was doing a mid-career management course after spending a decade working in the US and Miguel Mier from Mexico, had been waiting for. The three of them had prepared a project report detailing why the Mexican company needed an entry strategy for the Indian market. It seemed a long shot, especially since Cinepolis hadn’t expanded beyond the Americas till then.

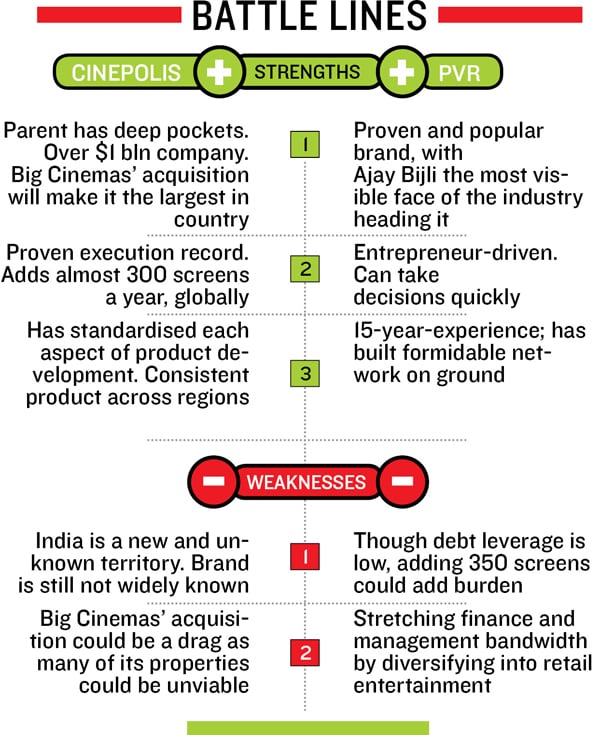

Yet, later that evening, when Marda and his friends got an opportunity to present the report to Ramirez over dinner, the response was immediate. “He instantly saw the opportunity,” recalls Marda. Ramirez had sighted India’s potential: The biggest market of moviegoers in the world, the largest pipeline of content, or movies and most importantly, the lowest penetration of multi-screen exhibition complexes, or multiplexes, in the world. He simply wanted to know the next steps.

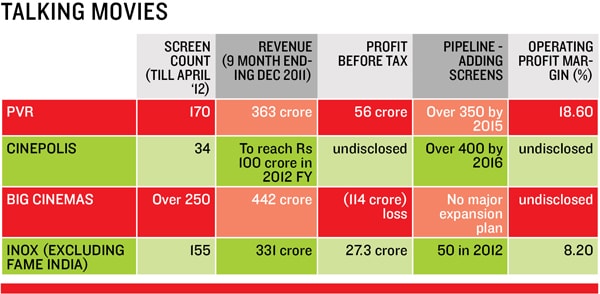

By the very next year, Cinepolis had made its debut in India. And four years later, Marda and Saini are in the midst of ramping up one of Cinepolis’ most ambitious market entries ever. Mier, a senior executive from Cinepolis who was on a sabbatical at Stanford, is now chief operating officer and is supervising the international roll-out from the HQ in Mexico. Now, Cinepolis India has 34 screens across five cities and is likely to clock Rs 100 crore in revenues by the end of 2012. And what’s more, if things go according to plan over the course of this year, the Mexican chain could well emerge from nowhere to become the biggest multiplex operator in the country.

As you read this, a team from Cinepolis is carrying out a due diligence of Anil Ambani’s Big Cinemas, the largest player in the domestic market by screen count. If the two players agree on the valuation, the transaction could lead to a merger of the two companies with the Mexican major taking operational control. Big Cinemas is a unit of the Bombay Stock Exchange-listed Reliance MediaWorks (RMW) and its 500 screens are divided almost equally between India and overseas markets.

There’s one person who has his eyes peeled on every move that Cinepolis makes in India. Ajay Bijli, the chairman and managing director of PVR Cinemas, started the multiplex culture at Saket, New Delhi, 15 years ago. Today, Bijli’s high quality product will be challenged by a global player with a formidable reputation of bringing in cutting-edge innovations.

It isn’t widely known that Cinepolis had approached Ambani after talks with Bijli broke down last year. Bijli even made a trip to Mexico on the invitation of the Cinepolis CEO. But when asked, he chooses to downplay the visit. “Cinepolis was kind enough to invite me to Mexico. The visit was more to gauge the competition,” he says. However, a top official at Cinepolis India confirmed that the two sides had discussed a potential investment by the South American company in PVR. “But every entrepreneur thinks his baby is priceless,” the official says. The two sides couldn’t eventually agree on a valuation.

Interestingly, Bijli had a multinational partner in Australia’s Village Road Show, which later exited in 2002. PVR, or Priya Village Roadshow, draws its name from that alliance.

Mutual Respect

It is not surprising that the two (Cinepolis and PVR) would be interested in each other. “I have respect for them,” says Bijli. “They are the giants from Mexico who have deep pockets and an ambitious BRIC strategy to expand,” he adds. More importantly, the Mexican company, through its half-a-century experience, has mastered the art of movie exhibition and treats each of its screens as a product and not a commodity, as is the norm.

Cinepolis is known to be fussy about every little detail: Leg space between seats, big screen size, a special coating on the 3D screen that makes it easier on the eye, better 3D glasses and sophisticated air conditioning. Cinepolis auditoriums typically have about 10 percent fewer seats compared to its peers so that there is enough space for food to be served at the seat. And they’ve been known to pull out of the mall if the developer doesn’t have enough space for parking. In many ways, that’s what helps them get repeat customers.

In India, Cinepolis has gone digital from its very first screen. This enables even a screen in smaller places like Amritsar to hold the screening of the latest movie at the same time as, say, Mumbai. This was not possible earlier as the prints had to be transported.

Bijli also talks exactly the same language. He has the highest margins in the business. PVR has also undertaken an initiative to go completely digital.

Last year, Bijli increased stakes by launching PVR’s ultra-premium offering Director’s Cut, targeted at the cream of his customers. Tickets are priced over Rs 1,000 and a customer, while watching the movie, can order food from a digital menu in a customised luxury chair. Bijli has also assembled one of the largest design teams in the business, a clear indication that he is looking to upgrade his product offering. But Director’s Cut could face direct competition from Cinepolis’ VIP the company’s equally premium product that will soon debut in India.

However, unlike his peers, Bijli has stayed away from mindless expansion and focussed on profitability and building his PVR brand. Fifteen years after opening the country’s first multiplex, Bijli may have lost his numero uno position in the industry to Big Cinemas and is now ranked third after Inox Leisure acquired Fame India. But the Delhi entrepreneur has remained the most visible face of the domestic movie exhibition industry.

Thanks to higher average ticket price and tight operations, “PVR’s margins are better and its debt-leverage is lower,” says Nikhil Vora, managing director, IDFC Securities. On the other hand, Big Cinemas went on a spree of acquisitions that continues to weigh it down. It reported a loss of Rs 114 crore on revenues of Rs 442 crore in the first nine months of the financial year 2011-12.

While Inox is in a better financial condition, “its tussle with RMW over Fame India has diluted its focus,” says an industry analyst who didn’t want to be named. Inox’s promoter company Gujarat Flurochemicals, owned by the Delhi-based Jain family, is now believed to be at the end of a two-year takeover battle with the Anil Ambani-company over Fame India, which has 102 screens in the country. A recent rights issue in Fame India increased Inox’s share and decreased that of Reliance. But the last word is yet to be heard as Big Cinema’s parent still owns 22.38 percent stake in Fame India.

Upping the Stakes

Meanwhile, Cinepolis is in a hurry to scale up its Indian business. “The Anil Ambani-company has many properties, including single-screen ones, that are unviable and any deal will have to factor this in,” says a top official from Cinepolis. The Mexican company will also prefer to keep Big Cinemas’ international screens out of the deal.

Through its 32 screens though, Cinepolis has already impressed the industry by its “differentiated product.” Customers coming to Cinepolis multiplex have to show their tickets only once while entering the auditorium, instead of at least two rounds of security check. This enables even non-moviegoers to come to Cinepolis’ in-house food and beverage outlet Coffee Tree that is present on each property.

The theatre’s menus offer a wide variety of food and beverages, from traditional movie favourites such as popcorn and soft drinks, to specialty coffee drinks, milkshakes, gourmet finger foods and desserts.Inside, while the auditorium has plush-carpeting, the seats have a ‘PVC-flooring’ that helps the cleaning process. Other initiatives like imported seats and wider leg space, claims Marda, has helped Cinepolis create a niche. And it doesn’t matter that the average cost of developing a Cinepolis screen is about Rs 2.5 to Rs 3.5 crore, much higher than the industry average of about Rs 2 crore, says Saini.

The efforts are paying off. It has already succeeded in Amritsar, a location which others were reluctant to touch. It was the first player to enter Patna and still remains the only one even today. In Ahmedabad, Cinepolis again took over a property that was abandoned by another exhibitor. “Today, our property is easily the best performing in the city. We are doing well even though the tickets are in the Rs 120-Rs 150 range,” says Marda. The earlier exhibitor had brought down the ticket price to Rs 90, but couldn’t salvage his business.

While entering Bangalore, Cinepolis chose to avoid the city centre and headed to the outskirts of the city in the Royal Meenakshi Mall. UB Venkatesh, the mall owner, is duly impressed with the multiplex. “People are willing to travel for more than 20 kms to watch a movie here,” claims Venkatesh.

The Big Fight

In the rush to scale up and sign up new properties, Cinepolis and PVR are increasingly running into each other. While PVR plans to reach 500 screens by 2015, Cinepolis wants to reach the same mark a year later. This year itself, both want to add about 80 screens each, with more than 70 screens in tier two and three cities. “Most of the metro markets have saturated. Margins are better in smaller cities as rental costs are much lower,” says Sumant Bhargava, Managing Director, Stargaze Entertainment, which has kept out of bigger markets as a strategy. (Disclosure: Stargaze is funded by Capital18, a private equity arm of the Network18 group).

It is in these markets that the competition between PVR and Cinepolis might pan out. For instance, the upcoming Celebration Mall in the outskirts of Nagpur fits well into both Bijli and Marda’s scheme of things. The 13 lakh square feet retail hub has the right mix to house a successful multi-screen movie theatre—a good location and a big ‘catchment area’ of multi-lingual moviegoers, who would watch everything from a Bollywood and Hollywood potboiler to regional fares. Sanjay Sachdeva, the mall owner, is interested in setting up a 10-screen multiplex to tap into the demand.

Both PVR and Cinepolis are pushing hard to sign the deal. While PVR can add to its first property that is planned later this year in the Orange City, Cinepolis wants to debut in a fast growing Indian city. Both will fight with incumbents Inox and Big Cinemas. “I’m not in a hurry. I will decide in the next six months,” Sachdeva says, not willing to reveal more. But company officials say that “there is not much to separate between the two.” While PVR is a well established and known brand, Cinepolis, in its four-year journey in India, has already made a mark with its “high quality product.” Says an official, “The decision might boil down to the rent-lease agreement and what the two sides offer.”

Advantage Bijli

While Cinepolis adds almost 300 screens a year internationally and will bring to India that capability, industry insiders hand the advantage to Bijli, at least for the moment. “Ajay has built an enviable reputation in the industry. He has a fantastic relationship with mall developers that will help him move fast,” says Ravi Sinha, a director of PVR. So it is not just the big names like Sunil Mittal, Pawan Munjal and Analjit Singh whom Bijli often approaches for advice, but his network within the industry itself. The 45-year-old has already tied up with high-end real estate players like the Mumbai-based Atul Ruia of Phoenix Mills and Vikas Oberoi of Oberoi Realty and Irfan Razack of Prestige Constructions from Bangalore. Projects of these developers might be crucial because “everything about a mall is location, location and location. Even in a slowdown, the least affected are the better located malls,” says Oberoi.

PVR has over the years also created a reputation of being premium and its ticket prices continue to be at least 10-15 percent higher than its peers. But now flexibility has come in. PVR Cinemas’ CEO Gautam Dutta led a new initiative where the company reduced ticket prices to as low as Rs 50 for early morning shows during week days to attract the young crowd. “Our footfalls in these six cities have increased by 70 percent,” claims Dutta.

Investors on the street seem to have taken notice of the initiatives. While PVR’s market capitalisation is now bigger than its biggest rival RMW, it is the only scrip from the industry that has shown a consistent rise over the past year. Industry trackers like Nikhil Vora of IDFC Securities also like that Bijli is also making sure that there is no ‘distraction’ for his team in PVR.

He has already pared down his loss-making film production business. “We do not have the appetite for the risk profile of the business as it is highly volatile and unpredictable,” says Sanjeev Bijli, joint managing director at PVR. Instead, the brothers will only invest when they come across a ‘good opportunity’. “We just want to do one thing, and do it very well,” adds Ajay.

At the same time, Bijli has also taken the game to another level by planned investment in the “retail entertainment” space that could stretch the management bandwidth. His joint venture with Thailand’s Major Cineplex already operates two bowling alleys in Delhi’s National Capital Region. While this would increase to more than six in the next 18 months, there are also plans to have at least four “retail entertainment centres” that will add ice-skating rinks, F&B outlets, gaming concepts and bowling alleys under one roof. Bijli says that retail entertainment will become “at least a Rs 200 crore” business in the next two years from over Rs 15 crore now.

“Indians mostly prefer ‘passive’ entertainment like movies. Bowling alleys and ice skating require skill sets and investment in gear,” says an industry executive. “While there might be a niche audience for this in metros, scalability could be an issue,” he adds.

Bijli is banking on a plan to leverage his multiplex business. Promod Arora, group president, PVR Cinemas, believes that “bowling alleys will feed off the core exhibition business. And as most of them will be located next to the exhibition properties, the concept will add teeth while bargaining for space with mall developers.”

The main focus for Bijli though remains the exhibition business. It remains to be seen whether the local incumbent is able to fend off the competition from his global foe.

First Published: Apr 30, 2012, 06:50

Subscribe Now