Making the money business work at Birla

A little away from the spotlight, the $40 billion Aditya Birla Group is busy giving shape to Kumar Mangalam Birla's plan of building a financial services powerhouse. The vision has the boss's financia

Aditya Birla Group chairman Kumar Mangalam Birla has just completed a major consolidation exercise to merge the group’s apparel businesses and become the country’s largest pure play fashion lifestyle company a few days ago. But, as is typical at the multi-diversified conglomerate, other things demand Birla’s attention. On the fifth floor of Aditya Birla Centre—the group’s headquarters—in Worli, Mumbai, Birla is locked in back-to-back closed-door meetings, scrutinising the full-year earnings of group flagship firm Hindalco.

It would be difficult to tell that just a few kilometres away, at One Indiabulls Centre in the bustling commercial district of Lower Parel, the vision for the financial services business of the $40 billion group, traditionally known as a manufacturing powerhouse, is being quietly executed by a 12,000-strong army. The conglomerate, the interests of which span from metals to cement and telecom, is currently in the midst of a series of expansions into new financial services ventures which will eventually transform what was a relatively small part of the group into one of its key strategic engines.

Leading the charge in this effort are two former Prudential ICICI Asset Management Company heads, Ajay Srinivasan and Pankaj Razdan. Srinivasan, 52, took charge as chief executive (financial services) of Aditya Birla Group in July 2007, having completed a near-10-year-stint at Prudential Corporation Asia where he managed almost $70 billion worth of assets, based out of Hong Kong. His Prudential stint included a term with Prudential ICICI Asset Management, —a joint venture with ICICI Bank— which he headed for a while.

The 47-year-old Razdan, on the other hand, had the experience of building large mutual fund-, private equity- and offshore businesses and joined in the same year as deputy chief executive (financial services), and as part of the “core think tank” for strategy and operations.

They both came on board with a clear mandate from Birla: To take the financial services business to the next level, given that two of Aditya Birla Financial Services Group’s (ABFSG) core businesses—life insurance and mutual funds—were in the middle of the pile in their respective sectors, despite several years of operations. “We wanted to be leaders but did not have the distribution network. Each of the businesses was at a different level of maturity and needed individual attention,” says Srinivasan. Building the talent pool and scaling up each business in size and reach were the key challenges at the time.

THE TRANSFORMATION

Now, nearly eight years on, the report card is fairly impressive: ABFSG—the umbrella brand created for all financial services businesses of the group—has begun staking its claim as a growth driver in its own right within the conglomerate.

The group’s stakeholding in financial services is articulated through holding company Aditya Birla Financial Services Limited (ABFSL). Aditya Birla Nuvo Limited (ABNL), the group company which holds stakes in multiple businesses like telecom and, till recently, apparels, holds 100 percent of ABFSL.

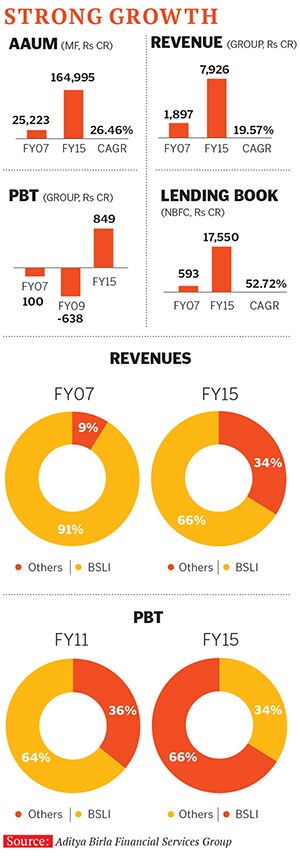

Just prior to the demerger of the retail apparel businesses, ABFSL contributed 30 percent in revenues to ABNL and 35 percent in net profit. In fact, ABFSL’s revenues have jumped four times to Rs 7,926 crore ($1.3 billion) in FY2015, from Rs 1,897 crore in FY2007, before Srinivasan’s entry, a 19.57 percent CAGR.

In FY2007, ABFSG’s portfolio was dominated by life insurance, which then contributed as much as 90 percent to its revenues by FY2015, it was down to 66 percent, with other businesses contributing the rest. And it is in this diversification of portfolio that the Srinivasan-Razdan duo has really made the difference.

During the same period, ABFSL’s average assets under management in the mutual funds (MFs) business have grown over six times to $25.8 billion and the lending book for its NBFC, Aditya Birla Finance (ABFL), soared nearly 30 times.

“[ABFSL] is becoming more and more important for Nuvo, especially after the garments business has been restructured,” Birla, 48, told Forbes India, optimistic about the growth of the financial services business. “Personally, I have always been fascinated by the financial services industry and have believed that there is huge scope for growth in this space.”.

And, as Birla puts it, ABFSG has “come a long way”. Through its 10 lines of business—with health insurance set to be the 11th—ABFSG now connects with over 6.5 million customers and manages assets worth over Rs 1,64,995 crore through its asset management company. It has a presence in more than 500 cities nationwide through 1,750 branches and over 200,000 channel partners.

The transformation from what was once a fairly unremarkable set of businesses into a potential powerhouse has not gone unnoticed by rivals.

“Ajay and Pankaj have done a good job of building a cohesive financial services group. The three engines on which they have grown are the insurance, mutual funds and NBFC businesses. They steadied the insurance and MFs businesses and built up the NBFC. They have imparted a stable management and built a cohesive strategy,” says Rashesh Shah, chairman and CEO of the Edelweiss Group.

In many ways, the Aditya Birla Group’s aggressive focus on financial services is part of Birla’s belief in its potential. He feels the business is in sync with the major trends in the economy, the increasing focus on infrastructure, the changing demography and societal trends where consumerism is being driven by nuclear families with double incomes. It is in keeping with this faith that the group applied to the Reserve Bank of India for a banking licence in 2013 but failed to get one since the banking regulator continues to frown on large industrial houses setting up banks.

Despite that setback, the metamorphosis of ABFSG still makes it a strong adversary which cannot be ignored in a crowded space where it battles rivals like Bajaj Finserv, L&T Finance and Reliance Capital. Also, Srinivasan is backing the theory that financial services would grow 2-2.5 times the country’s GDP, which should help see growth across the board.

But it has been a rough road to success. In the early 1990s, finance formed a very small segment of the Aditya Birla Group. In 1994, the group brought in financial services and insurance veteran SK Mitra to head their finance business. Like several other private players, the Aditya Birla Group ventured into India’s mutual fund industry—which had just opened to private players — through a JV with Canada’s Sun Life Financial, called Birla Sun Life Asset Management Company (BSLAMC). In 2001, the group also forayed into life insurance, through another joint venture with Sun Life, which became a listed firm, Birla Sun Life Insurance Company Limited.

For many years, the MFs, insurance and NBFC (earlier known as Birla Global Finance) were the cornerstones of the group’s financial services play. But despite the strong brand, there was no common umbrella under which these businesses operated. These had also not attained any significant size.

Mitra had played a pivotal role in building the group’s insurance and MFs businesses. “But the early years were tough. He probably did not get more capital [from the promoters] when it was required,” says a financial sector CEO who knows Mitra well. Birla’s early mission was to focus on the core strength of manufacturing, says a Mumbai-based analyst. This may also have impacted investment decisions into the financial services business. By 2007 Mitra had moved on.

And Srinivasan-Razdan entered the fold.

THE McKINSEY, BRAND UNION VISION

Srinivasan returned to India after overseeing a pan-Asia business that spanned ten markets, including Japan, at Prudential. For Razdan, who had worked with Srinivasan earlier at Prudential ICICI AMC, the move to Birla was about finding a bigger role in a diversified conglomerate.

To help Srinivasan and Razdan evaluate new business opportunities and how the group should play the game, global consultancy agencies like McKinsey & Company and Ray+Keshavan | Brand Union were roped in.

One of the most critical elements which Brand Union suggested was the need to stamp the well-regarded Aditya Birla brand onto the financial services businesses. This was after a survey of over 4,000 buyers of financial products in India had shown that there was no transparency across financial services brands customers were confused about the plethora of choices in the market and had a low level of engagement with their financial services provider.

As a differentiator, ABFSG became the brand under which the various businesses fitted in. A group structure was adopted to manage critical functions thus IT, risk and compliance, marketing, human resources and operations are now completely integrated across all financial services verticals, instead of operating in their respective silos.

Today ABFSL holds 100 percent stakes in the NBFC, housing finance, private equity, general insurance broking, stock broking, real estate advisory and personal finance companies. “We needed to be in all businesses as we were competing with other financial services firms in the same space,” says Razdan. “Also, one cannot play a strategy vertically [it must be horizontal].”

Says Motilal Oswal, founder of the eponymous financial services group Motilal Oswal Financial Services: “The segments in which they have done well are insurance and mutual funds. The financial services business has tremendous potential and the group enjoys enormous brand equity.”

Since 2007, ABFSG has spread its net across various verticals. It added private equity, broking, money management, housing finance and health insurance (the most recent addition) into their portfolio. In 2010, it decided to make the NBFC stronger by expanding beyond the capital markets business (which was mainly into promoter funding). ABFSL decided to tap the group’s vast exposure to small and medium enterprises (SMEs). Further, to gather size, the NBFC entered the fast-growing commercial real estate and mortgages business in 2012.

Like rival Bajaj Finserv, ABFSG labels itself as a significant “non-bank”. This explains their diversified range of financial businesses and differentiates them from other large rival firms like Reliance Capital and L&T Finance. It also, in an odd way, signals that they are just one step from becoming a bank. The Aditya Birla Group, like Bajaj and the Anil Ambani-led Reliance Group, failed to get a banking licence in April last year. This was a setback to the plans of the group, which could have been able to build diverse sources of revenue and lower costs further. Birla concedes that not getting the licence was “a huge disappointment”.“If the group does not get a banking licence in the future, they will have to evaluate how to move forward,” says Pankaj Jaju, head of the strategic corporate group at Axis Capital. The Aditya Birla Group has, however, applied for a payment bank licence separately, through a joint venture between ABNL and group company Idea Cellular.

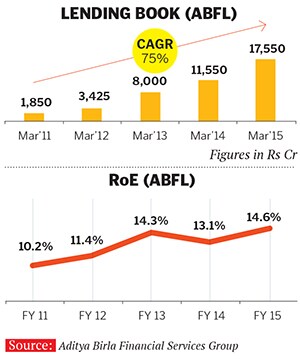

The failure to get a full banking licence, however, has not deterred growth for the NBFC. Incorporated in 1991, this business saw a huge build-up in the lending book since 2007. In 2010, it was rechristened Aditya Birla Finance and the Srinivasan-Razdan combine started focusing on it three years after taking charge.

“We wanted to make sure we got the life insurance and MF businesses—the more customer-facing businesses that people knew—to some level first,” says Srinivasan. After that came the NBFC.

Rakesh Singh, who had previously worked at Standard Chartered Bank in the SME and mortgages businesses, joined in 2011 to head the NBFC. (Not surprisingly, these two sectors—SME and mortgages—subsequently became ABFL’s new businesses too.) ABFL’s total lending book (at Rs 17,588 crore) is larger than some of the country’s smaller banks, as of FY2015. For example, RBL (formerly Ratnakar Bank) has a book size of about Rs 14,450 crore DCB’s (Development Credit Bank) is at Rs 16,132 crore and Dhanalaxmi Bank’s balance sheet size stands at Rs 14,350 crore, according to available data.

Singh spent the first six months building the team, which now includes industry veterans Sekhar Mosur (risk and compliance), Maneesh Yadav (mortgages) and Devang Rawal (corporate finance). Technology was also strengthened, and all the processes were automated, which helped lower the turnaround time for transactions. SME loan transactions are now turned around in 6-7 days, compared to 2-3 weeks earlier, while those for retail loans are completed in 2-7 days from 3-4 weeks earlier.

In 2012, ABFL expanded into mortgages—loans against property, lease rental discounting, project funding and construction finance. Mortgages now contribute the most, 35 percent, to ABFL’s portfolio, while the other businesses (capital markets, corporate finance, project and structured finance) form the balance 20-25 percent each.

“This is a well-stitched strategy. Both the SME and mortgages businesses are sweet spots,” says Rajiv Mehta, research analyst at IIFL. Mehta says that based on India’s economic growth forecast and incremental opportunities, ABFL could grow by around 25 percent CAGR for the next five years.

MULTIPLE ENGINES

One of Srinivasan’s strongest thrusts was on processes. This was most visible in ABFSG’s mutual funds business, which is now the fourth largest in the industry by asset size. In the midst of the 2008 crisis, when global and domestic fund houses were wrecked by huge redemptions, BSLAMC not only survived, but it also grew in market share. In FY2009, BSLAMC grew by 32 percent in size while the Indian mutual fund industry fell by 13 percent, thus increasing market share to 9.5 percent at the time.

“We had a few shocks, but they were tolerable ones. We kept our focus and launched alternative products like short-term funds which invested in bank securities,” says A Balasubramanian, chief executive, BSLAMC. Between 2008 and 2010, in a prolonged and uncertain investment climate, the AMC had gone back to the drawing board to evaluate their performance. It realised that it had picked the right stocks. “But they did not own the stocks sufficiently long secondly they were not willing to cut loss exposures [with the belief that they would bounce back] and were indecisive on underperforming blue chips,” says a source aware of internal developments of that time.

The team also realised that it was too worried about the negatives, its performance and market conditions. “We decided not to worry about what was not working well and only looked at the positive decisions,” says Balasubramanian, a former General Insurance Corporation veteran.

BSLAMC ended FY2015 with an all-time high market share of 10.1 percent against 6.2 percent in March 2007. It has more than doubled the investor base to 24 lakh in that period and nearly quadrupled the number of distributors to 15,000 by FY2015. “The next big step is to grow market share and aim for one crore customers in the next five years,” Balasubramanian says.

There is enough momentum in ABFSG’s second JV, Birla Sun Life Insurance (BSLI), too. Now nearly 15 years old, BSLI is the sixth largest of its kind in India with a 7.6 percent market share and AUM of Rs 30,000 crore. Razdan, who also heads the insurance venture directly as CEO, has been giving finishing touches to a stringent process which would strengthen distribution.

“Insurance was standing on a huge trust deficit,” Razdan says, referring to customer dissatisfaction across the industry over mis-selling of investment-linked products. “We do protection counselling where customers can discover what their needs are. We don’t really sell insurance products.” BSLI has also introduced an innovative programme for external distributors. They now have to pass a three-level certification course before selling products independently, with about 5,000 such distributors expected to pass by June-end.

In another group firm, Aditya Birla Money (ABML), its managing director Sudhakar Ramasubramanian has been giving shape to their wealth management, and broking plans. Alongside, an innovative online personal finance product, MyUniverse, has been rolled out largely aimed at retail investors.

ABFSG did not have a broking platform when Srinivasan and Razdan came on board. “The conscious call we took was that we did not want to remain niche. We wanted to capture all the opportunities,” says Ramasubramanian. ABML, which was then built out of the acquisition of Chennai-based Apollo Sindhoori in April 2008, is a wealth management and broking firm for high income investors.

Yet another company, Aditya Birla Money MyUniverse, runs what ABFSG claims to be India’s leading online personal finance portal, with over 1.5 million registered customers, managing around Rs 15,800 crore, since it started in January 2013.

“It is not enough to tell people where to invest. We need to tell them how much money their money makes,” says Ramasubramanian, who has worked with the Aditya Birla Group in different capacities for two decades.

ICICI Bank, however, does have a similar competing product, ‘My Money’. Nonetheless, IFC has invested in Birla’s MyUniverse, and Ramasubramanian plans to attract 5 million customers by 2019.

Singh at ABFL also has a 2020 vision, to scale up and consolidate the business further. He cites funding ecommerce vendors as an area of interest for the NBFC, which currently constitutes 40 percent of ABFSG’s profits.

With new businesses identified and being rolled out, and teams getting ramped up, ABFSG is working towards a new programme: A unified common customer ID, which could help create a single customer interface across businesses and build a distribution platform for the future, regulations permitting. “People should have a common view of the customer and the customer should have a common view of us,” says Srinivasan.

NEW OPPORTUNITIES

The pace and shape of growth continues to thrill the ABFSG management. At this point, their excitement is over the housing finance and health insurance businesses, identified not just to get a wider customer base and gain size, but also to get a footprint into the long-term growth areas of India’s economy.

Srinivasan and his team took the decision to get into housing finance in early 2014 and started the business in December last year. It has a book size of Rs 142 crore as of FY2015. Aditya Birla Housing Finance Ltd provides home loans, home construction loans and loans against property. This business is a good fit for ABFSG in keeping with its plans to grow its presence in the retail lending business. The strategy is to offer home loans in the top 30 cities to start with. “We are in 15 cities already,” Srinivasan says.

A National Housing Bank trend and progress report on housing in 2013 also shows that mortgage penetration is very low in India, at just 9 percent to GDP, significantly lower than 18 percent in China and 62 percent for the US. Further, the urban housing shortfall—amid slowing economic growth and housing infrastructure—is estimated to be 18.78 million units, based on data from the ministry of housing & urban poverty alleviation.

But the Aditya Birla Group will be up against giants in this segment. An ICRA study points out that the Indian mortgage market is currently dominated by big institutions like the State Bank Group, the HDFC Group, LIC Housing and the ICICI Group.

Alongside new businesses, ABFSG is also keen on expanding its geographical footprint. “There is the overall piece around geography which is linked to where our customer is. That, I think, will take us further outside the large cities. As we get into housing finance and grow our mutual fund business, we need to have a look at the top 100 cities, where most of banking comes from,” Srinivasan says.

Last year, ABFSG announced a move into the health insurance sector, through a 51:49 joint venture with South Africa’s MMI Holdings. With significant under-penetration in health insurance, the opportunity for this business is also considerable. Given ABFSG’s focus on building its retail presence, the JV plans to roll out products which would be a mix of wellness and protection.

“Our products and services will not be determined by anything other than what the customer wants and what we think we can manufacture,” Srinivasan says.

RISK AND THE ROAD AHEAD

He may find confidence in the fact that ABFSG’s biggest competitors, Bajaj Finserv, Reliance Capital and L&T Finance, derive a large part of their profits from their lending business, while ABFSG also has the mutual fund and insurance businesses as key contributors. However, as the group expands into new areas, its leadership and strategy will be tested.

“These three [insurance, MFs and NBFC] were all existing businesses which have grown. The jury is still out on how they can build new businesses like housing finance and health insurance ground up,” says the head of a diversified Mumbai-based financial group. “Even as a group, Birla has largely grown through acquisitions and building on existing businesses,” he adds.

Axis Capital’s Jaju says though Birla’s NBFC business has grown rapidly in recent years, it has yet to catch up with the larger players. Bajaj Finserv’s lending book is nearly double that of ABFL while L&T Finance is even larger at over Rs 45,000 crore. “The scope for growth is there but the challenge will be to grow the book on a sustainable basis and still manage quality. It has also not been ‘seasoned’, which means it has not seen one full cycle,” says IIFL’s Mehta. Doubts also persist over to how ABFSG’s growth plan would play out if the banking licence continues to elude it.“The profitability of the NBFC needs to be examined carefully and its return on equity (RoE) is lower than some competitors which are at about 17-18 percent,” an analyst adds.

In earlier years, ABFSG has worked hard to deal with risk, or what could be called zealousness, particularly while selling financial products. Financial sector veterans also point to some “client debacles” it faced. In 2010, ABML was embroiled in a controversy relating to the alleged mis-selling of derivative products to customers who did not understand the risks involved. That dented its credibility though the group attempted to take remedial action at the time.

Birla admits that risk is what he keeps a close watch on. “The biggest challenge is managing risk and managing growth vis-à-vis risk. I am a little unpopular with them [ABFSG] because my risk appetite is perhaps a bit lower than that of the team’s,” he says. “So I dare say they feel a little constrained because of that. But I think they’ve kind of made peace with it.” He adds that the portfolio has a good balance now. “At the end of the day, there aren’t too many high quality borrowers, so you need to have some flexibility,” he points out. In fact, the only restriction he places on Srinivasan and his team is on the risk front, he says. “At a nitty-gritty level, you’ve got to be in the top two, top three in the businesses... all of that exists. But at a broader level, it’s this issue [risk] that has my attention. When there is a review, that’s something I like to know, always.”

But while Birla does go through the details of the business, and says the group will continue to chase the bank plan, there’s always a niggling doubt about how much management bandwidth and attention this business will get in a manufacturing-driven conglomerate.

Motilal Oswal, for instance, feels the key issue for the Aditya Birla Group will be whether they see financial services as a core business. “It’s a question of focus and allocating resources and the bandwidth. The business has tremendous potential. Management bandwidth is most important,” he says.

Srinivasan and his team can certainly take plaudits for building the business to where it is today, in a challenging economic climate. But the path ahead is bound to come with its share of speed-breakers. They will have to do more of the same if they are to achieve Birla’s vision of becoming market leaders in the financial services businesses and seize the emerging opportunities a growing economy throws up. However, for that, they will need more than just capital from Kumar Mangalam Birla.

First Published: Jun 22, 2015, 06:01

Subscribe Now