Ajay Bijli has been building his Vasant Vihar house for 14 years. It’s a project that is almost as old as his business, PVR Ltd, the largest movie exhibition company in India which he founded in 1995. No one in the family knows when the house will be ready. “Ask Ajay. That is his pet project,” says his brother Sanjeev. At present, the brothers live together in the family’s ancestral mansion on Rohtak Road in Delhi.

Bijli, too, hesitates to give a clear answer. “Probably next year,” he says evasively. Time is hardly relevant. Sixty architects have come and gone and the two-storey structure has been razed four times. “Ajay is a perfectionist. He is particular about each element of the house. If he doesn’t like it, he will redo it,” says a top executive at PVR.

In many ways, 47-year-old Bijli has built PVR along the same exacting lines. Obsessed with creating a brand and not just a chain of multiplexes, the entrepreneur oversees every detail of his expanding empire. Nothing is deemed insignificant: Employees say he accords the same attention to the cleanliness of washrooms that he does to the installation of the latest technology in his multiplexes.

There have been occasions when he has spent Rs 10 crore to set up a single screen, though the average expenditure is Rs 4 crore per screen. (Two years ago, that was 50 percent more than the industry average, though competitors are catching up to PVR’s standards and updating their technology.) But Bijli always had faith in his brand’s growing equity, and was confident enough to compensate the cost with ticket rates that none of his competitors would dare to demand. (They still don’t.) For instance, a ticket at the Vasant Kunj, Delhi, Directors Cut cinema—PVR’s top product which offers plush seats, dine-in facilities and other amenities—can cost Rs 1,400, about four times that of a regular ticket. Bijli has been taking such risks in other ways too: For instance, he opened an 11-screen multiplex in Bangalore in 2003 when even five-screen multiplexes were rare.

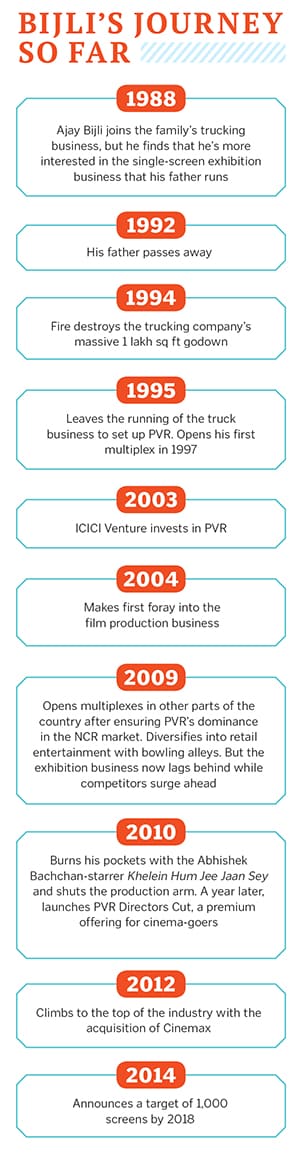

In the process, he has turned the single-screen side business, Priya Cinema, that his father had bought in the 1970s into a Rs 1,500-crore operation.

“His properties are the best in the industry,” says Sumant Bhargava, managing director of Stargaze Entertainment, which runs a 30-screen operation in India’s tier-2 and -3 cities. He points out that there is still a clear difference between PVR’s properties and that of Cinemax that Bijli bought in late 2012. This acquisition of his Mumbai-based peer Rasesh Kanakia’s Cinemax for a total of Rs 600 crore was a deal that catapulted him to the number one position in the industry, overtaking Anil Ambani’s Big Cinemas and DK Jain’s Inox Movies. With this move, PVR’s revenues ballooned to Rs 1,270 crore in 2012 from Rs 669 crore a year earlier.

In the two years since it acquired Cinemax, PVR’s share price increased by 178 percent while the Sensex grew by 39 percent. PVR’s stock price on October 9 stood at Rs 649.

The acquisition may have altered PVR’s DNA and, by extension, even Bijli’s, who has been bitten by the expansion bug ever since. Before the deal, he had built 213 screens over 17 years, an average of less than 15 screens a year. The Cinemax acquisition added 138 screens in one shot. Today, PVR has 454 screens across 102 properties in 43 cities.

Sanjeev, 42, who is joint managing director of PVR Ltd, admits that they were a tad frustrated with the pace of growth—that is, until they acquired Cinemax. “Now, we have become restless for growth,” he says. Bijli adds, “We have tasted blood. We want to reach 1,000 screens by 2018.” That would mean adding 100 screens a year, a pace so far unheard of. So far, Bijli has been selective about the malls and developers PVR associates with. With the 1,000-screen target, however, can he continue to be choosy? For a chairman who is known to delay the opening of a new screen if quality is at stake, this aggressive expansion is a new beast. But he reiterates that the brand’s excellence will not be compromised. “I have to be careful. I need to keep an eye on the company’s Ebitda (earnings before interest, tax, depreciation and amortisation) and I don’t want to get carried away. I have seen too many companies going belly up using the wrong yardstick [for success],” says Bijli, who is revelling in his number one status. “Who doesn’t want to be on top?”

GOING BACK TO HIS ROOTS

One of Bijli’s goals is to maintain PVR’s leading position and, to achieve this, he intends to concentrate solely on the exhibition business. Earlier in his entrepreneurial journey, he had lost focus and burnt his fingers by venturing into the movie production business. There were a few successes like Taare Zameen Par and Jaane Tu... Ya Jaane Na, but they were unable to make up for the loss that he bore when his film Khelein Hum Jee Jaan Se (starring Abhishek Bachchan) bombed at the box-office in 2010.

Around the same time, Bijli also flirted with the idea of creating a retail entertainment behemoth by setting up bowling alleys in Delhi, Gurgaon, Chandigarh, Bangalore and Pune, and investing in the quick services business, Lite Bite Foods, launched by his friend Amit Burman of the Burman family. (Burman is on PVR’s board of directors.) The bowling alleys have now taken a backseat and Bijli has divested out of Lite Bite Foods.

![mg_78119_pvr_280x210.jpg mg_78119_pvr_280x210.jpg]()

Meanwhile, competitors such as Big Cinemas and Inox surged ahead in screen count. With the Cinemax acquisition, Bijli is back on track. But he cannot take PVR’s top spot for granted, not with Jain’s Inox nipping at its heels. After Inox acquired Satyam Cineplexes in August 2014, its screen count stands at 358, less than 100 screens behind PVR. “We are currently present in 50 cities and 17 states across India. For us, this is just the tip of the iceberg,” says Alok Tandon, CEO of Inox Leisure Ltd, in an email interview with Forbes India. “Inox kicked off the consolidation phase in the multiplex industry by acquiring Calcutta Cine Pvt Ltd in 2007. Thereafter, Fame (India) Limited was acquired in 2010 and, in August 2014, we acquired Satyam Cineplexes Ltd. Inox continues to be interested in evaluating opportunities for both organic and inorganic growth in the exhibition sector,” says Tandon.

Bijli is aware of the competition. In company meetings and chats with colleagues, he often compares PVR to Inox. The two companies have squared off in many a deal in the industry, and will continue to do so.

EXPANSION ON THE CARDS

Though he knows that he has to expand to maintain his lead, Bijli is wary of any acquisition that will increase quantity at the cost of profitability. His friends and associates, including long-time mentor Gautam Thapar, chairman of the $4 billion Avantha Group, often remind him of the trade-off. “The question Ajay needs to ask himself is that if he is already the leader, and has considerable organic growth, does he need to look at inorganic opportunity? Because the way the market is today, an acquisition will be expensive,” says Thapar.

The Indian exhibition industry is still very fragmented. Industry veterans like Stargaze’s Bhargava estimate there are at least 30 smaller regional players who operate about 10-15 screens each. According to a 2013 industry report by KPMG and Federation of Indian Chambers of Commerce and Industry (Ficci), multiplexes account for only eight percent of India’s screens. But they rake in a third of the Indian box-office. “More and more of them (regional players) are realising that to grow and maintain the properties, huge capital is needed. Many would be looking to cash out,” says Bhargava. (Stargaze, too, was looking for a buyer until last year when it decided to opt for organic expansion.) If PVR can muster 1,000 screens through expansion and acquisitions, it will have a huge advantage in dictating box-office collections. At present, studios such as Yash Raj Films take more than 50 percent of the collection in a movie’s first weekend, the all-important period that decides the fate of a new release. A 1,000-screen PVR can command a bigger share.

The key will be to keep building on PVR’s financial and organisational strength to absorb another big acquisition. Bijli has been working on that ever since he got his mojo back with the Cinemax takeover.

THE THREE GOLDEN RULES

Before the Cinemax deal took place, Bijli had zoned in on Pacific Mall in Subhash Nagar, West Delhi. The mall is a shopper’s paradise with leading brands and a huge food court. And from Bijli’s point of view, it fulfilled three important criteria: Location, developer and development. “For us it has never been ‘location, location, location’ as it is for some of our peers,” says Gautam Dutta, chief operating officer, PVR Cinemas. There was one problem: Cinemax had already put up screens in Pacific Mall.

Bijli is elated that this crown jewel in the Cinemax basket is now part of PVR. Even at the time of the acquisition, Pacific Mall screens were netting Rs 8 crore a year, the biggest in Cinemax’s operation. This was despite competition from the nearby Satyam and Wave cinemas. But Bijli was not satisfied with the revenue and asked his team to see if the acquired property could be improved upon.

Today, only the roof and floor tiles of the multiplex remain untouched. Everything else has been altered including the box-office, safety arrangements and food counters. There are more plasma TVs, and the Bijli trademark of covering one of the walls with a collage of DVD movie covers has been installed. Ticket prices have been increased by about 10 percent in keeping with PVR’s premium avatar.

![mg_78121_pvr_product_280x210.jpg mg_78121_pvr_product_280x210.jpg]()

The multiplex, however, retains one integral aspect from its Cinemax days. While PVR would provide its own food counters, Cinemax had successfully rented out space to outside vendors. Looking to improve upon its food and beverage revenues that grew by 29 percent to Rs 298 crore in FY14, PVR is now adopting the model across all its properties. “We have been humble [enough] to look at what Cinemax is better at and embrace those practices,” says Dutta.

The initial results at the rechristened PVR in Pacific Mall are positive. In the period between April and July this year, revenue has grown by 5.2 percent. During that time, PVR claims that Satyam and Wave cinemas saw their revenues fall by 0.6 percent and 4.6 percent respectively.

About 40 of the 138 screens from Cinemax have gone through a similar change in operations and look. The rest will be undertaken over the next two years. “The change in brand logo will come last. We want to go inside-out in our approach to the integration,” says Bijli, who has created a separate team to concentrate on merging Cinemax with the parent company.

The three golden rules—location, developer and development—are part of a tried-and-tested formula upon which Bijli has built a profitable business. Before opening a PVR screen, he always researches the developer of a mall and profiles its tenants. It is a long and tedious process, which slows down PVR’s expansion. But Bijli has been successful in forging fruitful partnerships with leading real estate entrepreneurs, including Vikas Oberoi of Oberoi Realty in Mumbai and industry veteran Irfan Razack of the Bangalore-based Prestige Group.

“Starting from (Bangalore’s) Forum Mall in 2003, Ajay has been our favourite exhibitor. He understands the product. As a partner, he meets timelines,” says Razack, who is currently working on a project with Vijay Mallya, which is touted as the most expensive residential property in Bangalore. Bijli and Razack are partnering in new mall projects in Bangalore, Mangalore, Hyderabad and Kochi where PVR will set up screens over the next two years. “Ajay has the first right of refusal for all my mall projects,” says Razack.

THE QUEST FOR EXCELLENCE

Every PVR screen has to be perfect, and Bijli does not compromise on this especially when the brand is at stake. Last year, he got an email complaint from an irate customer at 10 pm. A gentleman had bought an expensive ticket at a PVR multiplex in Bangalore’s Orion Mall only to find popcorn strewn across his seat. Bijli immediately replied, saying that he was rectifying the situation. He alerted his chief operating officer, Dutta, who promptly asked the cinema manager to clean the seat. That was not all. “The next day, I held a video conference with the manager to find out what went wrong,” recalls Dutta. Six screens in the cinema were programmed to start new shows between 9.50 pm and 10.05 pm. With just 12 cleaners on the job, there was not enough time for them to work efficiently. “We changed the timing of the shows so that the auditoriums could be cleaned properly,” says Dutta.

Bijli’s colleagues recount similar stories, including one where a customer’s complaint led the company to install a 3D screen within six days at a PVR property in Bhopal. He credits the people around him for pushing him to achieve perfection. “When I was in school, my teachers would always say that they expected big things from me,” says Bijli, who studied at Delhi’s Modern School, and excelled in basketball, cricket and bowling.

![mg_78123_pvr_brand_280x210.jpg mg_78123_pvr_brand_280x210.jpg]()

At work, investors like Renuka Ramnath of Multiples Alternate Asset Management convinced him to go for the Cinemax acquisition. And in his social life, family and friends are used to seeing him excel on stage. Those who attended fashion designer Suneet Varma’s 2013 Couture Show will also vouch for his singing skills. Bijli had opened the night by singing the Bollywood hit, ‘O Mere Dil Ke Chain’.

But it’s more than just expectation that propels Bijli to set the bar high. He is acutely aware of his responsibility to his company, his employees and his family. His father Kishan Mohan Bijli passed away in 1992, shortly after he had joined the family’s main trucking business, The Amritsar Transport Company (ATC), now run by his uncle and the rest of the Bijli family.

Two years after his father’s death, another tragedy struck when a huge fire brought down ATC’s godown, which was spread over 1 lakh square feet. “At the time, Ajay was confused about what to do. Should he focus on the trucking business or the exhibition business which was his true passion? I advised him to follow his gut,” says Thapar. Bijli founded PVR a year later in 1995.

Ramnath was one of the first investors to recognise Bijli’s potential as an entrepreneur. “PVR is an extension of his personality,” says Ramnath, who invested in the business in 2003 when she was head of ICICI Venture. Her company, Multiples, later invested in PVR in 2012 when Bijli was looking to raise money for the Cinemax acquisition. “PVR has come a long way, but what has remained unchanged is Bijli’s belief that it cannot grow without good professionals. He is an ideal promoter because of his transparency,” she says.

L Capital, the PE arm of luxury group LVMH, also participated in the 2012 fundraising round. “Ajay has created a top team that is entrepreneurial. He has got the best 30-40 people in the industry who can take PVR forward,” says Narayan Ramachandran, chairman of InKlude Labs and co-chairman of Unitus Capital. He is also the alternate director to Ravi Thakran, group president (South Asia, Southeast Asia and Middle East), LVMH Group, on the board of PVR. Ramachandran sits for PVR’s board meetings when Thakran is unable to attend them.

Apart from a diversified portfolio (see box), PVR has a healthy financial position. “It has a net debt of Rs 600 crore. We have a significant ability to leverage,” says Nitin Sood, chief financial officer, PVR Ltd. The company’s Ebitda to debt ratio is 2.25 percent. With a target to add a 100 screens a year for which he needs an investment of about Rs 250 crore annually, that leverage will be tested.

Ajay Bijli has a chosen a challenging path for PVR. He has to retain the number one position. He has to keep his investors and customers happy. And, most importantly, he has to be the best.