How Blackstone made India its largest market in Asia

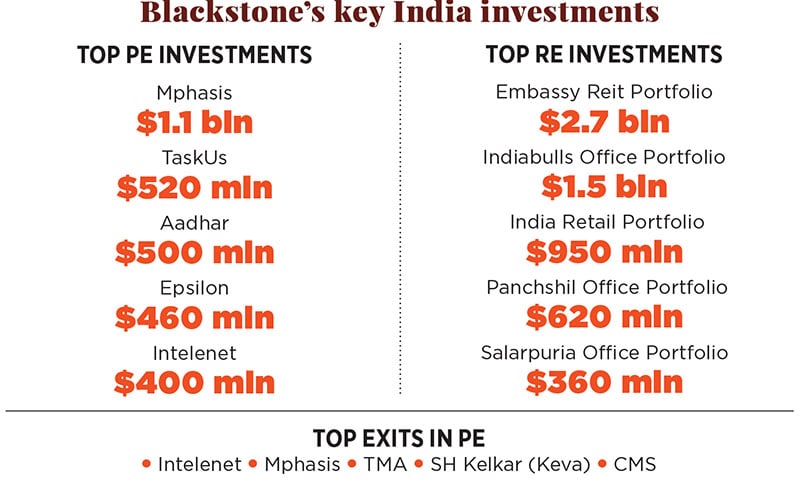

The firm deployed roughly $10.4 billion across private equity, real estate and tactical opportunities. Close to $1 billion of that came in the past six months

(From left)Tuhin Parikh, senior MD & head of Real Estate, Blackstone India and Amit Dixit, senior MD & head of PE, Blackstone India

(From left)Tuhin Parikh, senior MD & head of Real Estate, Blackstone India and Amit Dixit, senior MD & head of PE, Blackstone India

Image: Aditi Tailang[br]It was in December 2016 when Amit Dixit, along with two colleagues, first met Ashok Goel, chairman and managing director of Essel Propack, at the Mumbai headquarters in Kamala Mills in central Mumbai. Goel is the youngest brother of Subhash Chandra, who founded the company in 1982 and which is now the world’s largest speciality packaging firm with 25 factories in 10 countries. Dixit, senior managing director and head of private equity at Blackstone India, was impressed by Essel Propack’s innovation capabilities, how it was changing the way the world looks at tube packaging, and its ability to be ahead of its global peers. Dixit wanted to cut a cheque but Goel wasn’t ready to sell he wanted to continue growing the business.

Essel Propack is Chandra’s first of many ventures that earned him the status of pioneer. After all, he was responsible for introducing Indians to laminated toothpaste tubes at a time when the aluminium ones ruled the roost. Chandra would go on to reinforce his path-breaker reputation by being first off the blocks in satellite television (with Zee TV) and direct-to-home television (Dish TV), among other forays. If Goel wasn’t ready to sell the family’s first jewel—they were rice traders before that—it was with good reason.

By December 2018, exactly two years after Dixit picked up the phone on Goel, the scenario had changed. This time around, Goel made the call to Dixit to propose a sale.

“This was an opportunity we couldn’t let go. We got the full strength of Blackstone behind it,” says Dixit, sitting in Blackstone’s Mumbai office on the fifth floor of Express Towers in Nariman Point that overlooks the Arabian Sea. An unparalleled view from an iconic building was just one of the reasons for Blackstone buying it in June 2014, along with its realty partner Panchshil Developers.

Last December, Dixit and four team members met Goel and the Essel Propack leadership team at the Oberoi Hotel, bang opposite Express Towers. On April 22, Blackstone announced it had entered into an agreement with Ashok Goel Trust to acquire a 51 percent stake in the company at ₹134 a share. The share price had started climbing from December 3, when it was trading at ₹94, and ended up closing at ₹132.65 on the day of the announcement of the deal—a run-up of 41 percent over the four months.

The promoter shareholders owned 57 percent of Essel Propack. The majority acquisition triggered an open offer, with Blackstone offering to acquire another 26 percent as per India’s takeover regulations. Blackstone has offered ₹139.19 a piece to the company’s shareholders as part of the open offer. Based on open offer subscriptions, the deal size is pegged anywhere between ₹2,157 crore and ₹3,211 crore. Harish Manwani, senior operating partner, Blackstone India

Harish Manwani, senior operating partner, Blackstone India

Image: Vikas Khot[br]The deal took five months to close, as it was a mammoth task to undertake due diligence of Essel Propack’s 20 subsidiaries, from China to Poland to Mexico. It was here that Blackstone’s formidable global leadership network came to the fore. Harish Manwani, Unilever’s former chief operating officer who joined Blackstone as senior operating partner in 2015, was at hand to give the process a head start. Manwani was Essel Propack’s first customer when he headed Hindustan Lever’s (now Hindustan Unilever) personal products portfolio in the 1990s.

“I have known the company since its inception. Along with the deals team, the portfolio team met extensively with the region heads across the Americas, Europe, and China. Hence, even before the deal was complete, we were actually able to validate the growth assumptions and ways we can expand the business, both through revenue expansion and productivity,” says Manwani.

Along with such managerial bandwidth, Blackstone’s investee companies in other regions also lent a hand. In late 2017, the private equity (PE) giant had acquired cosmetics packaging firm ShyaHsin Packaging in China. “Our colleagues there offered to help us with the China piece of due diligence,” says Dixit. And Blackstone’s five-member New York investment committee headed by president and chief operating officer Jonathan Gray did late night calls with the India team over the weekends to assess the deal.

Dixit adds the diligence highlighted that the packaging market was undergoing a structural shift towards flexible packaging and, within it, towards laminated tubes. After leading this shift in the oral care segment, Essel Propack was well positioned to drive this shift in beauty, cosmetics and pharmaceutical segments too, reckoned Dixit.The Essel Propack transaction is Blackstone’s second India transaction of 2019. In February, the firm acquired Aadhar Housing Finance, an independent affordable housing finance company, for over ₹3,000 crore ($500 million). What Blackstone will also let on is that it has deployed nearly $1 billion in India across these two deals. Blackstone’s 18-member PE team has invested nearly $4.8 billion across 28 transactions in India since 2006. And don’t forget the launch of India’s first real estate investment trust (Reit) with local partner Embassy Group by the real estate arm headed by Tuhin Parikh. The Reit raised ₹4,750 crore ($680 million) via an initial public offering (IPO), and its shares are up 16.5 percent over the offer price of ₹300 since they began trading on Indian stock markets in April. Blackstone contributed 100 percent of its owned assets to the Reit portfolio and did not sell any of its units during the share sale.

Since establishing its office in India in 2005, Blackstone has deployed nearly $10.4 billion in the country across PE, real estate and tactical opportunities, of which $6.6 billion has been invested in the last four years. This makes India the largest market for Blackstone in Asia. Till date it has done exits worth $4.5 billion.

“We’re very pleased with how Blackstone has performed in India. Our firm’s philosophy is to partner with businesses to help drive value, rather than just providing capital. In India, we see great potential within what looks to be the fastest growth in any major economy, as well as the largest youth population globally,” says Stephen Schwarzman, chairman and CEO, Blackstone. “We’re confident we’ll continue to see tremendous opportunities for growth here.”

Blackstone’s Indian real estate arm was flagged off in January 2007, and Parikh candidly says it was “inactive” for three to four years. “It was only in 2011-12 that the action began, as a shakeout in the sector resulted in the availability of the finished product and the large scale that interested Blackstone.” In 2011, in the largest realty office deal in India till then, Blackstone acquired a substantial stake in the Bengaluru-headquartered Manyata Business Park for an undisclosed amount from Embassy Property Developments it continues to hold on to the asset.“Our partnership with Blackstone has helped us better understand how to manage our properties and strengthen tenant relationships. For example, they brought in established tenant engagement programmes from their overseas investments to our business parks,” says Jitendra Virwani, chairman and managing director, Embassy Group. “We continue to evaluate opportunities that work for both entities. The commercial story in India has a lot of room to run, and we’re working on some exciting opportunities together.”

Blackstone real estate has committed $5.4 billion across 33 investments in India, of which it has committed $4 billion towards acquiring Grade A commercial office buildings across the country it has deployed the rest of the capital to own retail, hotel and residential assets. Apart from investing capital from its funds it also manages $456 million of ML-Asia fund’s assets in India.

After its first investment in Manyata, Blackstone went on to acquire DLF Ackruti Info Park in Pune for nearly ₹800 crore ($165 million) in December 2011. While the real estate industry was trying to pick up the pieces in the beleaguered residential sector, Blackstone went all guns blazing to forge some of the biggest commercial office space deals in India. By 2017, it had surpassed India’s largest commercial space owner and developer, DLF Ltd, to own the largest portfolio of real estate. Till now it has struck 22 deals in office space alone.

“Over the last four to five years, we have found something interesting to do…we started with office space in big scale and then retail a few years ago. We own a few hotels now and over time we have taken a part of our real estate portfolio public and the business has become of scale,” says Parikh.

After building a substantial commercial office real estate portfolio in 2015, it went out to buy two malls from Gurugram-based realtor Alpha G:Corp and acquired the developer’s malls in Amritsar and Ahmedabad for an undisclosed sum. With two malls under its belt, Blackstone was looking for more. That culminated in the creation of its retail assets platform Nexus Malls in 2016, with a portfolio of nearly 6 million sq ft spread across Mumbai, Pune, Ahmedabad, Chandigarh, Indore and Amritsar.

According to realty consulting firm Anarock’s report released in May, total PE inflows in the Indian retail sector between 2015 and 2018 stood at $1.84 billion. Of the five largest deals, Blackstone snared four, leading with a $340 million investment in Chandigarh. Most of Blackstone’s deals in retail are spread across tier 2 and 3 cities.

“Our philosophy is we don’t like to do small, discreet deals. If we like a particular thing then we do it in scale and a concentrated manner so that we can influence the outcome and we spend time and resources to make it work,” explains Parikh.

Backed by a 18-member team, Parikh is now looking to chase down warehousing deals. He believes that with the introduction of the Goods and Services Tax (GST), builders are now focusing on creating large warehouses and, fuelled by the growth in ecommerce, warehousing will see significant amount of activity.

But residential is a play Blackstone hasn’t dabbled in actively as yet. “We have very few residential assets, but we have largely stayed away. In the residential prices have not gone up and the velocity of sale has been very slow. The entire sector is still grappling with a slowdown,” says Parikh.

For Blackstone, as Parikh puts it, the strategy is simple: They would like to own quality office space in the top six to seven cities and majority control in partnerships is not something they agonise over. Besides Embassy Group, partners in India include Salarpuria Sattva Group in Hyderabad, Indiabulls Real Estate, Panchshil Realty, K Raheja Corp. Last December, it acquired a 50 percent stake in Indiabulls in two assets of 0.8 million sq ft in Gurugram. “Even though we [real estate] were slow to start, over the last four to five years the twin engines [real estate and PE] have been firing,” adds Parikh.

Meanwhile, as PE deal-making activity picked up pace, Blackstone began to internally change the way it was doing such transactions in India. Dwelling on the strategy, Dixit says, “...when we started in India in 2006 we had a diversified strategy but we don’t have that anymore. Since 2011, we have focussed on taking large equity stakes in a few select sectors, with a business builder mindset.”

That earlier mindset resulted in investments that didn’t play out, like the 2007 acquisition of Gokaldas Exports, which Blackstone eventually sold at a loss, and the 2011 investment in the deep-in-debt, loss-making Monnet Ispat.

Yet, it’s the business builder mindset that has helped Blackstone India deliver some spectacular returns. Dixit says, “The exit transaction value of the industry over the last two years has been more than $25 billion, which is equal to the exits that have happened in the preceding five years combined. The acceleration in exits is also why LPs [limited partners, or investors in a PE fund] are excited and Blackstone’s internal management is bullish on India. You are finally seeing money coming back from India and transactions of scale.”

The builder mindset also helps pull investee companies back on the growth path. Consider, for instance, the 2016 buyout, for $1.1 billion, of information technology firm Mphasis. For the preceding one and a half years, growth was eluding Mphasis. The deal structuring also included a master services agreement between the seller, Hewlett Packard, and Blackstone, in which the former committed a minimum revenue to Mphasis escalating year over year and totalling $990 million over the following five years since the deal date.

"We continue to be big believers in India. Our goal is to invest in high quality companies and properties, helping accelerate their growth by strengthening governance, deploying strategic capital and leveraging our global scale to drive operational improvements,” says Jonathan Gray, president and chief operating officer, Blackstone.The first thing Blackstone did was to bring in Nitin Rakesh, a former Syntel head honcho, as CEO. The turnaround was quick: Between March 2017 and 2019, the company’s net profit has grown 10.9 percent and stands at ₹769.43 crore, with a reported revenue of ₹3,434 crore in March 2019 as compared to ₹3,018.55 crore in March 2017.

“We established a sales channel focussed on Blackstone-owned portfolio companies. Our guiding force for this partnership is consistency and transformation. We have about 10 Blackstone portfolio companies that we do business with aiding our revenue growth,” says Rakesh. He adds that Blackstone has also initiated and fostered strategic global partnerships (with companies like AWS, Dell and SAP) that are beneficial for all portfolio companies.

Information technology is one of the key sectors Blackstone has identified in India. The others include consumer, financial services, industrial (including auto components) and health care. Dixit explains they are largely sector-agnostic, “but if you look at the country in the last 15 years you will find that whether it is private or public capital, the returns have been from these sectors”. The focus is also sharply on B2B2C deals (business to business to consumer), a segment that feeds consumer businesses.

With the Indian banking system trying to clean up its debt overhang, most global investors are now seeking a pie of the bad loans. Last year, Blackstone acquired a majority stake in RBI-licensed International Asset Reconstruction Co Ltd and it has already bought loans worth nearly $100 million under this platform. The firm is looking to create a $250 million platform and a fund alongside it in the asset reconstruction space.

In December 2013, Blackstone had sold its stake in Pune-based drug maker Emcure Pharmaceuticals Ltd in a secondary deal to Bain Capital. Emcure was Blackstone’s first investment in India, and according to media reports it had clocked nearly three times returns from it. Since then Blackstone has not made deals in health care and pharmaceuticals, although it is vying to invest in that space in coming times.

A recent report from Bain & Co says Indian fund managers have consistently returned capital over the last two years, with 265 exits in 2018. It was one of the strongest years for exits in the last decade, although the 10 biggest exits accounted for 70 percent of the total exit value. The report adds that Blackstone recorded the second highest number of exits for 2018. This included the sale—the second one—of Intelenet Global Services Pvt Ltd for nearly $1 billion, a business it had bought for nearly $385 million in September 2015 from Serco Group Blackstone had first bought Intelenet in 2007 before selling it to Serco in 2011 at a 3 times return. This makes it one of most profitable deals Blackstone has ever done in Asia.

Much of the PE portfolio now comprises companies that deliver dollar revenues. The logic is simple: The firm has to provide dollar returns to its global LPs.

It was in 2011 that Blackstone took the call that India is ready to mature into a market for large, control-oriented transactions. Dixit estimates such deals account for a third of all transactions. Till date, Blackstone has done 13 buyouts, perhaps the largest by any global firm in India.

To benefit from this shift, Blackstone, which till 2011 had just 24 executives in India, hired 35 by 2018. Those were the blocks to build businesses. Blackstone has four to five important interventions to ensure growth in a business, after a deal. The first is to appoint board members, management and senior executives to provide that growth. The second is to install a management information system to ensure all management decisions are based on data. Other areas it focusses on are growth of revenue and productivity, of both capital and labour.

It all begins, though, with the management bandwidth. For example, when Blackstone acquired the Chennai-headquartered DC motor maker Agile Electric Sub Assembly in 2013, it brought in senior advisor Jeff Overly, operating partner of portfolio operations at The Blackstone Group, to increase productivity (he left the firm this May). Overly, who spent 25 years at General Motors and Delphi Corp in operations and engineering positions, observed that the Agile Electric factory was dropping a DC motor every six seconds. The global standard, on the same capital and human resource, is three seconds and Overly succeeded in bringing it down to that in the Indian factory. In 2015, Blackstone sold its stake to Japan’s Igarashi Electric Works Ltd.

Overly, till he resigned, was advising Blackstone India on creating a fresh auto components platform. The firm believes there are huge opportunities in this fragmented space, where companies are unable to scale, which makes attracting capital and top tier management difficult. In April 2018, Blackstone India acquired automotive firm Comstar Automotive Technologies, and followed that up with 66.28 percent of Sona India to create a larger platform. Comstar, says Dixit, has doubled Ebidta since acquisition to roughly ₹500 crore, and is now among the top 10 auto component companies in India.

Once a company comes into Blackstone’s portfolio, it runs a 180-day programme on things that need to be changed. “The saying within the firm is cement hardens. If yesterday was same as today then what is the change?” asks Dixit, who has 18 years in PE, 13 of them at Blackstone. In those 13 years, the Indian arm has executed more than 80 M&A opportunities.

“The way they are organised today, their philosophy is, unless you don’t control the asset you cannot build value. Even in their real estate practice their Reit did well and they are continually buying assets. Under Amit, they have got their act together again in the PE business because there was a time in the middle when it was not as steady as today. And Tuhin, with his contrarian approach from the very beginning, has been able to build significant value for the firm,” says a senior banker.

While PE funds ideally look to flip investments in five years, building businesses calls for a longer holding period. Manwani says, “The thing we do differently is to bring a sense of urgency from the moment we close the deal. Even if the asset is held for a shorter period, all levers of value creation like accelerating revenue growth, operating efficiencies or capital productivity kick in from Day One.”

Globally, Blackstone commands nearly $512 billion in assets under management, a number that its peers are yet to catch up with. In 1987, Stephen Schwarzman and Pete Peterson raised $800 millon to strike deals through leveraged buyouts.

Over the last three decades, the fund has moved away from risky deals to stable investments across asset classes. In India, too, Blackstone has shown a similar maturity in almost 15 years by moving away from diverse smaller deals to bigger ones in select sectors in which it has more skin in the game.

“India is about to embark on a renewed growth journey. I cannot stress enough on the role that financial services has to play here, and Blackstone is very well poised to add value by offering strategic guidance across the ecosystem of companies. Their ability of customising knowledge acquired across the globe to meet local needs has impressed me," says Uday Kotak, managing director and CEO, Kotak Mahindra Bank Ltd.

The connect with New York perhaps ensures that the investment philosophy seeps through to Mumbai. Every Monday at 8.30 am IST, all Blackstone offices across geographies attend an hour-long meeting. It starts with the PE teams, moves on to real estate, then the credit business and finally the fund of funds.

Present from New York on these calls is 72-year-old Chairman Schwarzman, who sits through it all. The meetings are a fertile ground for cross pollination of ideas and to leverage the strength of each outpost. It was at one such meeting that Dixit pitched Essel Propack, and others from different necks of the woods chipped in. As Dixit puts it: “Fundamentally, at the end of the day, investment is an art and not a science, and the art is in pattern recognition.”

First Published: Jun 07, 2019, 07:33

Subscribe Now