Apollo Munich: Healthy profits from Unhealthy people

Apollo Munich has managed to break into the black by shifting focus from group insurance to retail, and from health care financing to health management

It may seem like common sense that health insurers will make more money from healthy people rather than the unhealthy.

Unhealthy people making too many illness claims is the reason why most health insurance companies are themselves under water, ratcheting up losses on mediclaim policies. It may also seem like a no-brainer that selling insurance to companies—a few hundred customers in one sales pitch—should be more profitable than selling to individuals, one policy at a time.

But Apollo Munich has managed to show black on the balance-sheet by standing these ‘self-evident’ truths on their heads.

After an initial trot down the same beaten track, it has decisively shifted course and found that winners are those who take the paths less taken. Recently, it surprised industry observers by announcing that it had broken even in 2012-13 (FY13), earning a profit of Rs 5.1 crore. While it is too early to claim that Apollo has found the Holy Grail, there is quiet satisfaction that it has at least established a ‘proof of concept’ for standalone health insurers—that is, those who don’t cross-subsidise health insurance losses with profits from other forms of general insurance.

This should give hope to the three other standalone health insurers—Star Health, Max-Bupa and Religare—and many more potential ones. Currently, Star Health has a higher market share but is still in losses. As for Max-Bupa (only three years in the business) and Religare (just one year old), Apollo Munich is the arrow pointing in the right direction.

Says Yashish Dahiya, co-founder of policybazaar.com, a site that helps customers compare policies and costs: “Both Star Health and Apollo Munich are innovators, Star Health was the early innovator, and Apollo Munich leads the current round of innovators. Apollo Munich also seems like a really well-run company.” This is a sentiment echoed by a few other insurance brokers, agents and customers of Apollo Munich.

But before we proceed with the Apollo Munich story, here’s the backgrounder. In India, health care and health insurance have seen costs soaring. The public sector health insurers offer mediclaim benefits more like a bounden duty than a real business, and, thanks to the high costs of insurance, especially for older people, 75 percent of India does not have any form of health cover. If you are among the other 25 percent, chances are you depend on your employer to provide you with cover. Only 6 percent of Indians have individual health insurance covers, according to a World Bank study. Indians pay for 60 percent of their health costs from their own pockets.

Given acute poverty and unhealthy living conditions, it stands to reason that money can be made in this business only by insuring the relatively healthy. And this is where Apollo Munich pioneered a strategy to focus on the relatively unhealthy to redefine the insurance market in India. Coming up is a product specifically targeted at so-called unhealthy people—people with known illnesses.

How does Apollo Munich propose to square the circle here? Its product is based on the concept of managing a disease, rather than just paying for its treatment. The new product, slated for an October release, is based on the company’s experience of applying this approach to its group insurance clients over the last three years.

THE DNA OF SUCCESS

A joint venture between Apollo Hospitals and Munich Re, a re-insurance group, Apollo Munich started life in 2007 soon after the government started dismantling the tariff regime in various insurance products. Earlier, health insurance was subsidised from profits earned on other products, but once the fixed tariff regime was ended, cross-subsidisation was no longer an option and pure health insurers entered the fray.

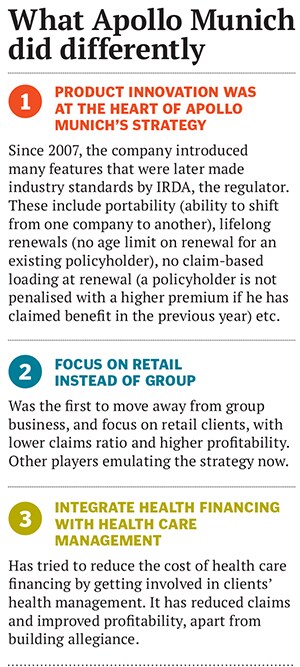

It was in this de-tariffed market that two new standalone health insurers—Star Health and Apollo Munich—made an entry. Both laid stress on innovation and tried to target the group insurance business. The logic: Offer low protection tariffs and obtain hundreds of customers at one go.

However, while this strategy seemed to work for Star Health, which bagged many big government contracts and quickly posted profits in 2008-09, Apollo Munich faltered. “The typical strategy was to undercut your competition by quoting unrealistically low premiums and getting a big group insurance contract,” explains Antony Jacob, CEO, Apollo Munich. This strategy beefed up the topline but hurt the bottomline of all companies.

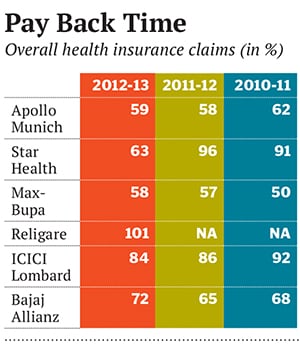

Apollo Munich suffered heavy losses since it was not willing to quote unreasonably low premiums to grab contracts. And since its initial overwhelming exposure was to the group insurance business, the claims ratio was also pretty high (see Pay Back Time). “Our idea was to sell a product that married healthcare financing with healthcare management, but in the price sensitive Indian market, it was an uphill task to find many takers for such products,” recounts Jacob. So, between 2007 and 2009, Apollo Munich failed to take off despite having innovative products that later became industry standards (See What Apollo Munich did differently).

When Jacob joined Apollo Munich in 2009 with a mandate to find a way out of the morass, he had a reputation to live up to. As head of Royal Sundaram General Insurance, he was one of the pioneers in ‘cashless’ health insurance in India, way back in 2001.

THREE BIG BETS

Jacob took three big decisions that put Apollo Munich back on track in the quest for profitable growth.

The first big course correction was to switch focus to retail insurance, which was relatively less popular at that time. “The choice varies from company to company. Risk-averse companies prefer retail because the claims rate is lower, and profitability higher than group business. But, on the flipside, the cost of acquisition of clients is higher in retail,” explains Chinmaya Padhi, Head-Payers, at IMS Health Information and Consulting, a leading global firm providing health care information and services.

Going after individual retail customers is a cumbersome business and involves training agents and staff differently since each customer has to be won over. But it is a long-term play as a happy customer can potentially stay with the company for his or her whole life.

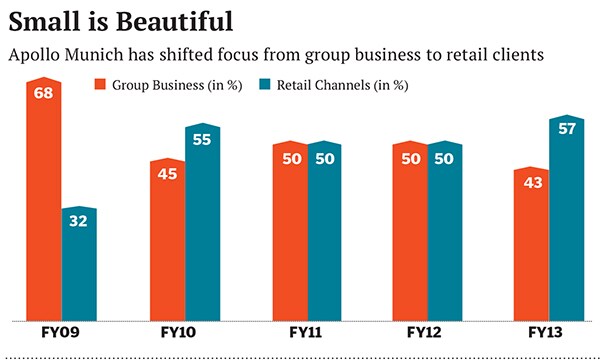

This decisive shift in strategy has yielded results in FY13, with Apollo Munich reporting a huge reduction in its group business from 68 percent of the portfolio in FY09 to 43 percent in FY13.

The second big decision was to convince its existing group insurance clients to try out, and later adopt, Apollo Munich’s model of marrying health care financing with health care management.

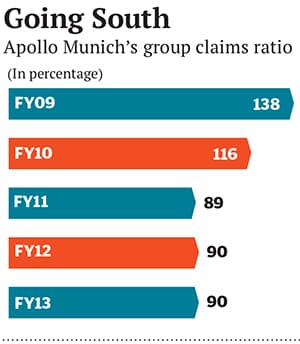

This essentially involved Apollo Munich taking active interest in monitoring the health of its group insurance customers. The costs of such testing and monitoring were built into the premiums, which were higher than what many others were charging. The challenge was to convince big companies to understand the economic benefits of regular checks. “We tried to explain to them that even a 3 to 4 percent fall in absenteeism would more than make up for the extra charges they pay to us,” says Jacob.For Apollo Munich, such an arrangement meant that the claims ratio, which is typically very high in group insurance business, came down drastically from 138 percent in FY09 to 90 percent in FY13. “Moreover, we also understood people and their health patterns, which helped us in more efficiently underwriting risks for our retail clients,” says Jacob.

But convincing companies was not easy. So between 2009 and 2010, Jacob ran pilot projects in some of the biggest client firms free of cost just to prove his point. “And eventually it worked, when our biggest group clients started accepting our model,” he says.

Jacob declined to share details about the companies involved, but claims he was delighted by the efficacy of his agents’ efforts. In their biggest account with an MNC, which comprises 20 percent of the overall business, they found that there was a sharp improvement across all parameters: A 13.1 percent reduction in employees in the high-risk category lower incidence of cardio-vascular attacks in participants (75 percent decrease in incidence for participants when compared to non-participants) lower claims frequency reduced per capita premium despite a benefit increase a rise in average claim costs of 6 percent year-on-year over three years against the industry average of 13 percent and a 4 percent reduction in claims due to accidents.

The result, including the productivity gain, was so well received that the MNC renewed Apollo Munich’s contract for three years instead of one and that too at a higher premium.

Innovation in products continued. The Restore policy, which automatically restored the insured sum even if it was used up during the policy period, was introduced in 2010 and won Apollo Munich the Asia Insurance Award for Innovation in 2012. Its rivals took up the idea too.

Looking back, Jacob is happy to have stuck his neck out. As the experience of the other and the bigger player, Star Health Insurance, showed, it was easy to ramp up revenues by winning big group contracts but they are not quite profitable. After being in profit for a year, Star suddenly slipped into losses. Star is now changing gears to focus more on retail customers, but the transition is costing it market share, which fell from 1.87 percent in FY12 to 1.25 percent in FY13. Apollo Munich’s share has now crept up to 0.9 percent, but Jacob is happier noting that in terms of new premium generated in the market, Apollo Munich has a share of 10 percent.

Looking back, Jacob is happy to have stuck his neck out. As the experience of the other and the bigger player, Star Health Insurance, showed, it was easy to ramp up revenues by winning big group contracts but they are not quite profitable. After being in profit for a year, Star suddenly slipped into losses. Star is now changing gears to focus more on retail customers, but the transition is costing it market share, which fell from 1.87 percent in FY12 to 1.25 percent in FY13. Apollo Munich’s share has now crept up to 0.9 percent, but Jacob is happier noting that in terms of new premium generated in the market, Apollo Munich has a share of 10 percent.

THE WAY FORWARD

Buoyed by his success, Jacob says Apollo Munich is set to launch what he calls the ‘Disease Management Product’ for retail customers. The idea is potentially revolutionary. At present, there is no retail product that specifically caters to people who have existing ailments such as diabetes. The reason is simple: It doesn’t make business sense to provide financial backing to a person who is almost certain to need money for treatment.

But this is where Apollo Munich’s product aims to make a difference. It will offer insurance to such clients, no doubt at a higher premium, but with the proviso that the client also agrees to ‘manage’ the disease. This will entail regular visits to doctors, health tests and exercise regimes that will be monitored by Apollo Munich. If a client is able to follow the regime, the company also promises to give discounts on subsequent premiums.

“Research shows that for every $1 invested in wellness, the company gets a return of anything between $4 and $7,” says Jacob. A 2010 Harvard study states “medical costs fall about $3.27 for every dollar spent on wellness programmes, and absentee day costs fall by about $2.73 for every dollar spent”. It further says, “This average return on investment suggests that the wider adoption of such programmes could prove beneficial for budgets and productivity as well as health outcomes.”Jacob says it is the combined capabilities of Apollo Hospitals and Munich Re that allow him to use the network of 4,000 hospitals better as well as underwrite and process risk. “Thanks to greater use of technology we are able to effectively monitor claims. We are also better at technically underwriting risks. This means savings that I can then use to provide cuts in the premium charged and provide a good product at a competitive price, while still making the returns necessary to have a sustainable business.”

But as Apollo Munich makes its mark, it will find company. Newer players like Max-Bupa and Religare seem to have benefited from a slightly delayed entry. For example, Max-Bupa already has 80 percent of its portfolio in the retail business and Religare has an inbuilt health check-up in its plans.

“We have a health check-up built into our policies. As far as possible, based on customer convenience, we use SRL Diagnotics [in house] so that it is a cashless experience with zero chance of fraud,” says Anuj Gulati, CEO, Religare. The idea again is to monitor the health before it deteriorates and results in a huge claim.

Health insurance is a fairly small market worth Rs 15,000 crore in premiums. General insurance is four to five times as big, and life insurance is a massive Rs 2 lakh crore. This shows that health insurance has nowhere to go but up. Market watchers like Dahiya of policybazaar.com believe the insurance market is poised for a boom over the next two decades, with more competition likely to come up to offer more products.

With global giants like Cigna and Aetna likely to join, the race has only just started. Luckily, Apollo Munich is off to a healthy start by encouraging unhealthy people to change to better lifestyles.

First Published: Aug 08, 2013, 06:33

Subscribe Now