Raymond Bickson's Revival Plan for Taj Hotels

Raymond Bickson is trying to change the Taj hotels' operating model, but first the chain will have to learn to get out of its comfort zone

In 2008, when INSEAD’s Gabriel Szulanski wrote his case study around the Taj hotels’ acquisition of The Pierre, a marquee property in the heart of Manhattan, little did he realise just how prescient he would turn out to be. The case study delved into the group’s dilemma on whether to expand in the US market.

Since 2004, the Taj had been on a roll. In its home market, rooms were in short supply. Its rack rates were at an all-time high. Indian Hotels Company (IHCL), the firm which owns the Taj brand, had chalked out an ambitious plan to buy assets at peak valuations in India and around the world. IHCL had ended the financial year 2008 with an operating profit of around Rs 1,000 crore. In fact, 2008 was the best in 41 years for the global hotel industry. Hubris was high, markets were at their peak.

The Pierre had seemed like a perfect fit. Overlooking Central Park, it had hosted Elizabeth Taylor, Yves Saint-Laurent and Mohamed Al-Fayed as permanent residents in the upper floors that house the suites and grand-suites. It moved from being under the Four Seasons management to IHCL in 2005. Not satisfied with the condition of the property, the Tatas plonked down $100 million (Rs 500 crore) to restore it. But by the time it re-opened in ’09, the world had changed.

About 60 percent of The Pierre’s business came from the Wall Street. As the financial markets tanked, so did its earnings. Despite a modest recovery, the hotel still burns a $20 million (Rs 100 crore) hole in the Taj balance sheet every year. Room rates (measured by RevPAR—revenue per available room) are still about $200 a night less than competition. And things are unlikely to change soon.

IHCL CEO Raymond Bickson has been at the helm through the acquisition and its aftermath. He says the choice is a Catch-22 situation. Getting The Pierre and other US hotels (in Boston and Los Angles) into the Taj fold demonstrated the group’s capability to hotel property owners elsewhere—and opened doors for other management contracts, notably in important markets like China. “It was the only way to go,” says Bickson.

Yet, not everyone inside the Tata group was convinced of the hotel chain’s strategy to pursue costly buyouts abroad, especially at a time when all the major international hotels were pounding at India’s door. Exactly a decade ago, in 2003, the IHCL board, headed by then chairman Ratan Tata, had done a strategic review to decide the way ahead for the Taj. It was clear that market share would decline. So, how to stay relevant over the next 20 years? “The big boys of the hotel industry were here—and here to stay,” says Bickson. “We had to figure out how to draw up a plan so we were able to grow and have at least 10 percent share even in the distant future when India went up to 500,000 rooms,” he says. For perspective, India had 62,000 hotel rooms when the review was on. That has now zoomed to 175,000.

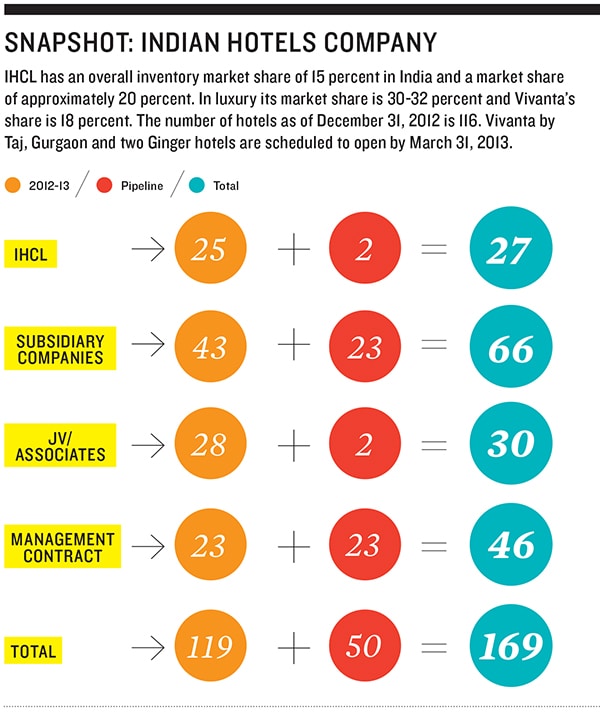

Two key decisions taken there have shaped the group’s path since. The first call was to plant the Taj flag in about 25 key markets internationally. The second move, aimed at the domestic market, was to launch new brands catering to the more value-conscious customers. In 2003, Taj had 62 hotels in its portfolio. It now has 117 and operates with four different brands—Taj Resorts and Palaces (luxury), Vivanta by Taj (upscale), Gateway (midscale) and Ginger (budget).

So here’s the moot point: Was attack really the best form of defense?

Enemy at the Gates

The picture started to change radically after 2009. The financial meltdown, followed by the terror-attack in Mumbai, took the wind out of the Taj sails. Revenues began dropping and debt (taken on in the good times) began rising. In February this year, at his first board meeting as chairman of IHCL, Cyrus Mistry had to deal with a grim set of numbers. Auditors highlighted exposures in long-term investments in and advances to wholly-owned subsidiaries aggregating Rs 1,563.67 crore. The carrying costs of these investments significantly exceeded the book and market value as of December 31. The oldest company in the Tata fold is faced with falling room rates and increased competition.

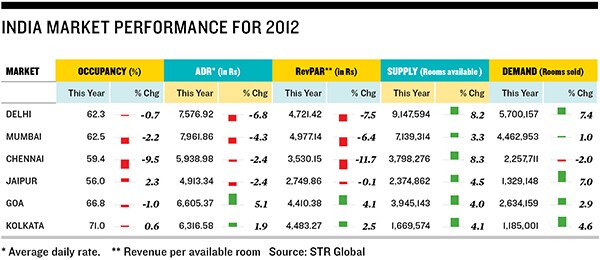

It is no different from other Indian chains like Hotel Leela Venture and East India Hotels (Oberois) that ruled over the domestic market for years. All three are weighed down by debt, taken on during the construction of high-cost luxury properties. The slowdown in the Indian economy and the sudden increase in capacity have not helped matters. The bourses have given the stocks the thumbs down. They have trailed the market, tanking 15 to 30 percent on the Bombay Stock Exchange in the past one year. Growth in revenues have been tepid in 2012, despite a low base in December 2011 (see table on pg 46). All the domestic chains have posted a loss at the net level. The only consolation: Since it’s been fully backed by the Tata group, IHCL has been able to weather the storm better than the others, while Leela and East India Hotels have had to look for white knights to support them through the crisis.

Business is still slow—demand for hotel rooms has tanked in most Indian cities, with the exception of Jaipur and Goa (see table on pg 46). RevPARs have fallen by almost 20 percent every year since the peak. Indian Hotels’ CAGR for the past six years has been a poor 5.36 percent.

In contrast, many global hotel chains had begun heading the other way. Companies like Hyatt and Accor were moving to asset-light models—where the hotel company does not own property, but signs up with owners to manage it in return for a fee and a share of the revenue. And the big chains were all headed into India.

Accor, Carlson Rezidor, Intercontinental Hotels, Hyatt Hotels, Hilton Worldwide are going all out. Well-capitalised and with deeper pockets, they have the edge of global networks with corporates and hugely attractive loyalty programmes. “Business for Indian hotels is much more relationship-based than for the international chains,” says Ashwini Kakkar, executive vice chairman of Mercury Travels. Though Taj and ITC have loyalty programmes, they are not nearly as strong or well-developed. A member with Hyatt moves effortlessly from one level to another. This needs very strong IT—right up to the front office of the hotel, he says. Very often, sales is given much more prominence (and share of management time) than IT, says a Taj insider who did not wish to go on record.

Andrew Harrison, general manager of Four Seasons at Mumbai, has a fair idea of how tough the Indian market is getting. He is battling competition from the entrenched Indian chains as well as a new Shangri-La property that has opened up next door in Lower Parel, with double the number of rooms. He says service quality is a key differentiator. It is tough to make money when land prices are so high, he says. One way to beef up revenues is to focus on higher income from restaurants. “Some Japanese hotels make 65 percent of revenues from F&B [food and beverage] we can only hope to get there,” he says. Four Seasons has also spent millions of dollars revamping its global website to show best available room rates at any minute—just like airlines. “It’s dynamic pricing, no longer standard rack rates,” he says.

By all indications, foreign chains like Four Seasons are still getting their act together in India. But as they learn more about the market, it may not be long before they start scaling up with more vigour. So unless Taj is able to quickly clean up its act financially, it could soon start to cede control of its home market. The next year or so may be crucial.

Recapitalising Taj

That’s exactly why Anil Goel spends much of his time figuring ways to de-leverage the company. The canny executive director, finance, at Indian Hotels is fully aware that with consolidated debt at Rs 3,700 crore, the balance sheet is under pressure. In the past two years, he has been able to reduce some of the pressure through financial re-engineering. This includes changing the currency-mix for the borrowings and tweaking debt tenures, he says. IHCL raised Rs 600 crore through a rights issue in 2008-9 and was followed up with a preferential allotment in 2011-12, that brought in Rs 385 crore from Tata Sons.

Meanwhile, Bickson is busy capping new investments. Construction costs for a five star hotel range between Rs 1 crore to Rs 1.5 crore per room, depending on the city. IHCL has gradually moved out of funding projects itself and the balance sheet now has only two projects (Vivanta hotels at Guwahati and Dwarka). “All the rest are through management contracts or on the books of joint venture companies like the Chennai-based OHL [Oriental Hotels] that is funding a hotel at Begumpet in Hyderabad or Taj-GVK for the airport hotel in Mumbai,” says Bickson.

Changing the operating model is one thing, but learning to get out of its comfort zone is a whole new challenge for the Taj. Especially since the slowdown in the Indian economy began to take its toll on its core luxury segment.

Jaguar or Nano?

For almost five years, almost all its luxury hotels have faced severe headwinds. For instance, Bickson found that in cities like Chandigarh, rates had to be corrected because customers were simply reluctant to pay top dollar to stay at the Taj or any other luxury hotel for that matter. Foreign hotels continue to be bullish about India, but many, including the world’s largest hotel chain the Intercontinental Hotels Group (IHG), have eschewed luxury to focus on the mid-market. “The days of a foreigner being the main customer for hotels in India, are over. The real growth is from domestic travellers,” says Douglas Martell, IHG vice president operations. Thirty-five of IHG’s 48 hotels in the pipeline in India will be Holiday Inn and Holiday Inn Express, both mid-scale brands.

Before the 50-odd foreign hotel brands move in for the kill, the four Taj brands have been trying to quickly seal off the market with its segmentation strategy. Bickson and his team led by brand and marketing head Deepa Misra-Harris have spent considerable time defining the look, feel and even smell of its four new brands. But getting traction is not easy. Many of the existing properties that transformed into Vivanta or Gateway, still felt like they did before. Negotiations with hotel owners were tough and many did not like to change.

Competition is highest in the mid and budget segments. But so is growth. Smaller hotels are faster to build. The returns in the luxury segment come once you hit break-even, after which the returns are much larger. “Guess how many Nanos you’d have to sell to make the same profit as on a Jaguar?” asks Bickson.

“Ideally, we would have to grow in all segments,” he says. “We could have 20 hotels in a city, like a Starwood or Marriott has in the US or Europe. Indian Hotels has eight hotels in Bangalore and 10 in Delhi—all our brands are present. Obviously, not all cities are mature enough to make this viable.”

Bickson admits the group was slow in rolling out properties in the value segment—both Ginger and Gateway. Most of the glitches were in terms of getting the right properties at the right price. “We weren’t the only game in town anymore,” says Bickson. Owners and developers had many more options and wanted quicker returns and shorter term agreements. Revenue share on hotels is typically about 10 percent of gross and 1 to 3 percent of net. “We insist on a tenure of at least 15 years,” he says. “Real estate developers can be very successful at office buildings, but not much at hotels. They often want to build a hotel, so that their friends can stay in it. But they soon find out that hotels are much more expensive, and require longer gestation, for the cash flows to start,” he says.

Manav Thadani, chairman of hotel industry consultancy HVS India, says not too many foreign hotel chains are breaking even today. “If this is positioned as a David versus Goliath story—it is still not clear who David is,” he says. With excellent products and locations, Taj and rival Indian chains like the Oberoi, ITC and The Leela, still rule the super-luxury segment. Competition is much fiercer in the mid-scale and budget segments with brands like Sarovar, Lemon Tree and Ibis doing a very good job. He says IHCL’s multi-brand strategy was very essential but the brands could have been better defined.

Treading Gingerly

Treading Gingerly

When IHCL launched Ginger in 2004, for the Indian consumer, the idea was revolutionary. Based on a plan outlined by CK Prahalad, the idea was to build a low price brand, with room tariffs less than Rs 1,000 a night. The hotels would cater to a huge, under-served domestic market for smart, cheap and clean accommodation. As the first organised player in this segment, Ginger together with Air Deccan and the Nano, captured the imagination of every marketing guru. India could take hundreds of these, they said. Nine years later, there are only 27 of the hotels. Room rates are now upwards of Rs 2,000 for most properties.

Prabhat Pani, CEO of Roots Corporation, the IHCL subsidiary that operates Ginger, says more than half the growth in the Indian market will be from the economy and budget hotel segments. The market is much more crowded than when he started—other domestic and international brands are catching up.

Ginger floundered for two main reasons. Goel says, for most of the bull-run from 2006, land costs became prohibitive. Approvals and permits needed to start a hotel are notoriously tough to get. The industry rues that it takes 125 clearances to open a hotel in India, while it takes 25 in Singapore.

Like its parent, Ginger too was stuck trying to balance growth with high-costs. It found that the only way to scale up was to find less capital-intensive ways. Instead of re-building from scratch, Roots has begun taking over property shells on a four to five year licence from small- and medium-sized real estate developers. The builder gets a fixed return and a share of the profits.

In metros like Mumbai and Delhi, where Pani would like to have several Ginger hotels, even this is too expensive. “Real estate is unaffordable—so we are trying mixed-use development,” he says. Ginger has begun building hotel-rooms on the top floors of malls. The hotels at Faridabad and Andheri in Mumbai are located in malls. The Ginger at IIT Chennai occupies just the last floor of an 11-storey building.

“The Ginger experience showed us that the Indian consumer was very picky compared to other markets,” says Bickson. Even though it was clearly a no-frills hotel, customers were appalled that there was no bellman or room service. “We had to adapt and make changes in some markets,” he says. In some cities, customers needed meeting rooms. At the Haridwar property, we found that Jains, who travelled as a group, did not use our hotel because they needed to cook their own food. So we had to make the changes,” he says.

Revival by Taj

Bickson says the revival plan could substantially improve its financial situation in the next year. Once Ginger reaches a minimum size of about 40 hotels, he plans to take Roots public. The big priority now is to find ways to sweat the existing assets—so cash-generation improves. He has set up a cross-functional task-force to find ways to improve revenues for every hotel. Room rates, income from F&B and retail—the three traditional revenue sources are being examined, he says.

It is clear that the Pierre experience has done little to dim the Tata group’s appetite for growth. The company had bought 11 percent in the Italian hotel chain Orient Express in 2007 for Rs 1,250 crore. It has since, unsuccessfully, made a $1.2 billion takeover offer to buy it fully. Orient, with 45 properties in 22 countries, including hotels, tourist trains, restaurants and cruise ships, says it is better off as a standalone company. IHCL had proposed that a group managed by Ferrari chairman and Ratan Tata’s close friend Luca Cordero di Montezemolo would invest $100 million for a minority stake in the combined company. The offer was unequivocally rejected twice, the last time in November last year.

Bickson says organic growth is painful and there is a great fit of locations between the two hotel groups. He is working towards rebalancing the Taj portfolio to include more international hotels, and Orient Express fits beautifully in the scheme. The current revenue skew is 70 percent from domestic Indian hotels. However, considering that much of the pain is now from foreign hotels, the strategy is certainly a bit of a Catch-22.

The offer to buy into Orient isn’t likely to go through and an eventual sale of the Taj stake in it, will certainly .improve some of the cash flow problems. But Bickson says Indian Hotels is firmly on the path to keep growing. For the past decade, the chain has added one new hotel every eight weeks and plans are to continue doing this.

The big plans include ‘Project Island’, to develop the Landsend property at Bandra, Mumbai, into an iconic 1,000-room hotel with 12 restaurants and two ballrooms seating 2,000 each.

Internationally, too he has signed up with developers for high-end properties in Tangiers and Qatar and much further afield in Cuba and Mexico. “Money will be found, we were never in it for the short-term,” he says.

First Published: Apr 26, 2013, 07:58

Subscribe Now