Lemon Tree Hotels' Audacious Plan

Maverick hotelier Patu Keswani has grand plans for his Lemon Tree Hotels. But a lot hinges on the chain's ability to ramp up operations at a never before seen pace

Patu Keswani likes to talk about Howard Hughes, the late American billionaire businessman, maverick moviemaker and aviator. Hughes was 18 when his father died and left him a fortune of about a million dollars. It took him over 10 years to double that. “But after that, he doubled his wealth almost every year. How did he do that? He built scale,” says Keswani, the founder, and chairman and managing director of Lemon Tree Hotels.

Keswani adds, without blinking an eyelid, “I’m also going to do the same.”

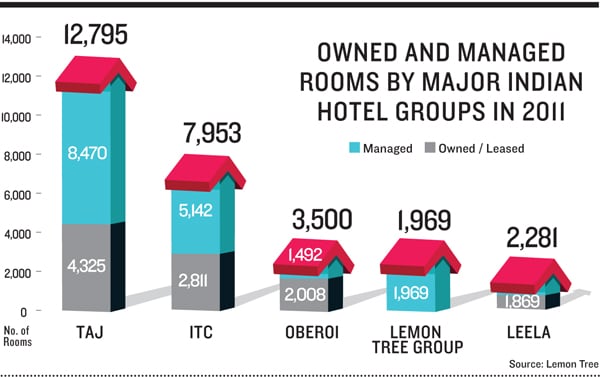

That might sound outlandish. But Keswani’s Lemon Tree is already the fourth largest hospitality company in India in terms of owned rooms. The first three are marquee names of the industry—Taj Hotels, ITC and Oberoi Hotels. Lemon Tree has close to 2,000 rooms at its 18 hotels, built over the last 10 years. Now Keswani wants to add an equal number in the next two years. In a slightly longer timeline, he wants to have an inventory of 8,000 owned rooms by 2015. No one in the domestic industry has built hotels at such a scorching pace.

But being unconventional is the norm for someone who’s been often called a rebel. After all, not everyone leaves a top corporate job with a crore-plus salary for the uncertain life of an entrepreneur. Keswani spent 15 years with Taj Hotels and did a stint at consultancy major AT Kearney before setting up Lemon Tree in 2002.

There is another reason behind Keswani’s optimism. This May, one of the world’s largest pension fund managers, the Netherlands-based APG with assets of nearly $400 billion, chose Lemon Tree for its first Indian investment. In a two-part investment, the fund took a 5.6 percent stake in Lemon Tree and set up a joint venture called Fleur Hotels that will own and manage hotels. The stake-buy values Lemon Tree at Rs 3,300 crore, making Keswani’s firm the third most valuable hotel chain in India after Bikki Oberoi’s EIH and Tata group’s Indian Hotels under which Taj Hotels operate. The joint venture with APG, with a capital outlay of Rs 2,250 crore to set up 35 hotels, gives Keswani enough ammunition to pull off his ambitious plans. Lemon Tree will hold 53 percent stake in the venture.

Remarkably, the “fox”, as Keswani is known since his Taj days, is not done yet. In May itself, Keswani managed to convince hotel industry veteran Rattan Keswani (not related) to leave the Oberoi group after a three-decade innings. The two formed a joint venture, headed by Rattan Keswani, to manage hotels. It is a bold move for Keswani who’s Lemon Tree has only owned hotels. Lemon Tree will be the bigger shareholder in this venture too. The buzz inside Lemon Tree is about having nearly 2,000 “managed rooms” by 2015. This will take Keswani’s overall room count close to 10,000, and within sniffing distance of Indian Hotels.

BILLION DOLLAR DREAMS

Many peers have praised the APG deal, but few are surprised. “Given the challenges in the sector, he has got a great valuation. Patu’s first deal in 2006 with Warburg Pincus was also a great achievement, especially since Lemon Tree at the time had just taken off,” says Sanjay Sethi, another former Taj employee who turned entrepreneur by setting up Keys Hotels. The Warburg investment valued Lemon Tree at Rs 800 crore when the company had fewer than 200 rooms. “The mid-market segment was underserviced. Patu was bringing in both execution capability and also focussed on running a hotel that was high on service,” says Niten Malhan, managing director, Warburg Pincus. In two years, the company’s value soared to Rs 2,200 crore when Shinsei Bank and Kotak Realty Funds invested. In fact, company insiders point out that if not for the current economic environment, Keswani wouldn’t have agreed for anything less than a Rs 4,000-crore valuation from APG.

There is also talk of achieving a billion dollar valuation for Lemon Tree through an initial public offering (IPO) in end 2013 or early 2014. “But that was before the APG deal. Now the talk is to execute the plans with APG and look for $2 billion [Rs 11,150 crore] valuation,” says a senior official, who didn’t want to be named.

“We are looking to be the biggest aggregator of rooms in the mid-segment of India’s hospitality industry,” says Keswani. That, according to Manav Thadani of HVS Hospitality, is the right strategy. “Till now the Indian hospitality industry has been top heavy. We had more luxury hotels than the mid-segment or economy hotels. But for the first time ever, the industry’s pipeline has more rooms from the mid-segment,” he says. And that’s because more and more Indians are travelling across the country. “As compared to six million foreign tourists that come to India in a year, almost 600 million Indians travel within the country. Most of us right now stay in ‘unbranded rooms’—regional hotels, guest houses and lodges,” says Akshay Kulkarni, regional director, hospitality, Cushman & Wakefield.

According to HVS, 38 percent of the proposed branded rooms coming into the market in the next five years will be in the mid-segment market. Keswani wants to make sure that he grabs that opportunity. “Lemon Tree is an India-consumption story… We have a head start over others,” he says.

Industry observers agree. “Not only has he gained experience and created a brand, Patu is also known to run a tight ship. Lemon Tree’s margins are better than industry average,” says a senior official at a consultancy firm who didn’t want to be identified. And peers appreciate his move to get into management of hotels. “I welcome Patu’s move. He does need to build scale,” says Anil Madhok, founder of Sarovar Hotels, which unlike Lemon Tree specialises in managing hotels and has a portfolio of over 50 hotels and over 5,000 rooms.

But not everyone is optimistic about Keswani’s plans. First, the business environment is not the most conducive, what with developers needing up to 130 clearances from government departments to build a hotel. Second, “While Keswani might continue to scale his present model of owned hotels,” says the consultant quoted earlier, “what is the need to get into management of hotels? It is a different ball-game and needs a different mindset.” The biggest difference being ownership and control of the hotel will be in the hands of another person. Can Keswani, known to be finicky about details, let go? More important, Keswani knows that his organisation will have to scale up its capabilities immensely to handle the aggressive expansion. “When I left Taj, I was looking after 2,000 rooms. The clock has turned a full cycle and now again I have control over 2,000 rooms. So, even I, the most experienced hand in Lemon Tree, haven’t handled a bigger scale,” he concedes. Despite his clarifications, there is a constant rumour that he is under pressure from shareholders to scale up fast and use the IPO to exit the company.

THE RATIOS MAN

It is easy to see why the hotel industry didn’t take Keswani seriously when he turned entrepreneur. It took him three years to set up his first hotel in what was then an isolated spot in Gurgaon. The doubts increased when Keswani made his pet dog Sparky the hotel’s mascot and also a shareholder in the company. To make matters worse, his hotel was an experiment no one had dared to try until then—the 49 rooms in seven different themes were just 240 square feet in size against the norm of 320, had built-in beds and no mini bar. Keswani himself was mostly seen in jeans and a T-shirt. Add the pan masala he constantly chews and Keswani was not the picture of a hotelier whom others took seriously.

But those who knew him well thought otherwise. “Among my friends, [I] am most proud of Patu,” says Pallam Raju, minister for state for defence and a close friend of Keswani. Adds Arindam Bhattacharya, managing director of Boston Consulting Group, India: “Patu has a unique combination… [He] has both the qualities of being a hotelier and a good businessman.”

Aradhana Lal, one of the earliest members of Keswani’s startup team at Lemon Tree and a former colleague at Taj, recounts how her boss would be fanatic about customer focus. “I was once with a client in another hotel. The tea was served with two teapots. One of them had a paper tag on top which said hot water. So you could easily serve yourself the tea and add hot water if you needed a lighter version of tea. I brought back a sample and showed it to Patu saying it’s very helpful for a tea drinker. Within three days Patu had implemented it at Taj!”Patu brought that passion to Lemon Tree. But he drew a line between what customers need and what they desire. Taking out the mini bar from rooms is an example. Similarly, having a built-in bed meant that the attendant didn’t have to waste time cleaning under the bed and could do 22 rooms in a shift against the industry norm of under 15. “We have another 180 of practices that we implemented across our hotels,” says Rahul Pandit, president, Lemon Tree.

Keswani had two rules while setting up a hotel. First, the tariff would be half of that of a five-star hotel in the same location. At the same time though, the costs would be one-third of its five-star peers. “We never went to a place where we couldn’t guarantee this,” he says. Consequently, Lemon Tree’s operating margins hover around 50 percent while that of five-star hotels is 12 to 30 percent. Though he refused to share Lemon Tree’s financials, sources put it at near-Rs 300 crore in revenue and Rs 20 crore in EBITDA, or earnings before interest, tax, depreciation and amortisation.

“The experience of running a profitable hotel company will be our biggest USP while looking for partners to manage hotels,” he adds.

INTENSE COMPETITION

While these measures were path-breaking when Lemon Tree came on the scene, competition is fast catching up. While new players like Sethi’s Keys are strictly following the same model and detailing, multinationals like Accor have the advantage of both deep pockets and international experience.

Despite faulty starts in the 1990s, the French multinational is clearly the most aggressive multinational in the market right now. In three years, Accor has gone from one to 17 hotels in India, across six different brands that mostly straddle the mid-segment and economy part of the industry. Only one of their brands, Sofitel, is in the five-star segment. In comparison, Keswani has three brands, Lemon Tree in the mid-segment, Lemon Tree Premier in upscale and Red Fox in the economy segment.

“We have three different investment ventures to expand our presence here,” says Jean-Michel Casse, senior vice-president, operations, India. The company plans to have 90 hotels by 2015.

But from the buzz in Lemon Tree’s office in Delhi, it’s clear that Keswani and his team realise the immensity of the task at hand. The top team is constantly travelling—refurbishing existing properties, talking to potential partners or checking out new locations.

Apart from Rattan Keswani, a few other seniors have been hired. Saurabh Nandi came in from Procter & Gamble to head marketing and Murlidhar Rao was roped in from Leela Hotels to head Lemon Tree Premier.

The performance in the next three years will determine the role Keswani will take in the company later on. A successful IPO might see him kick off a transition in leadership and take on a mentor role. He also plans to take the Lemon Tree brand beyond hotels to vocational education and real estate, including a low-cost housing venture with Warburg Pincus. But first he has to do a Howard Hughes.

First Published: Jul 12, 2012, 06:10

Subscribe Now