Return is king in real estate

In a high-involvement asset like real estate, the 'extra' return on investment should be imperative

Mark Twain is said to have remarked, “Buy land, they’re not making it anymore.” He simply put words to the thoughts of real estate investors. There are several stories of flats/plots from the ’50s which were bought for a few thousand rupees being sold for a few crores today. That is the kind of stuff that keeps the legend of real estate investment alive and kicking.

Is real estate the best investment vehicle compared to gold or equity shares or the perennial favourite, fixed deposits? For starters, it is important to first define “real estate investment”.

Buying an under-construction flat is not real estate investment. You are actually lending money to a developer with the hope that he will deliver a flat to you in the not-so-distant future. You better make a good return when you buy an under-construction flat. Return follows risk, and in the Indian context, the risks of buying an under-construction flat are so high that developers have to provide a price that gives you good returns.

There is nothing wrong in buying an under-construction flat in the quest for higher returns as long as you understand the risks involved. Most people don’t. And those who are otherwise “safety” seeking investors make this investment under the notion that they are investing in “real estate”. Very few investors know that the largest number of pending cases in consumer courts is with respect to developers not delivering on promised flats.

The other mistake people make is the assumption that buying a house to stay in is real estate investment. I would put it more in the category of a consumption item like gold jewellery. You know it has decent resale value but you are unlikely to sell it unless your life is at stake. As an aside, there is a very vocal minority that advocates that it makes no sense to buy a flat for your own residence. They have plenty of charts, tables and rent-versus-buy calculators to prove their point.

I think these rent-versus-buy calculators miss a very significant cost which is that of defying social convention. Buying your own house (even with a fat loan) is considered the sign of having achieved financial stability. The cost of social pressure is enormous and the sense of security you get by conforming to the social norm (of owning your own residence) is way too high to be ignored.  Image: Getty Images

Image: Getty Images

Most people don’t understand the risks involved in buying an under-construction flat in the quest for higher returns

This brings me to why a real estate investment that runs into “thousands” turns into “crores” in just two generations. Real estate investments tend to be lumpy—the thousands invested in the ’50s were pretty big amounts then. Plus, it is not always easy to liquidate a real estate investment unless you are a very active investor. Most investors are not active and this lack of easy liquidity, which is actually a disadvantage, turns into its biggest advantage as the asset continues to accrue and compound returns.

The most crucial bit about these investments are the returns. Let’s assume you have invested Rs 1 crore in a flat in Mumbai in 2015. If you could travel to 2065 and find your grandchild selling it for Rs 117 crore, will you think that you’ve made a great investment? If you are delirious with the result, it typifies the legend of real estate investing.

The actual return on this investment is just 10 percent per annum, and even that is prior to the payment of capital gains tax. The post-tax return will be in single digits. It is a decent return, but not spectacular. This is what I call the ‘law of large numbers’ where the large upfront investment accrues decent compounded returns over very long periods of time (because of illiquidity), resulting in a large value on sale.

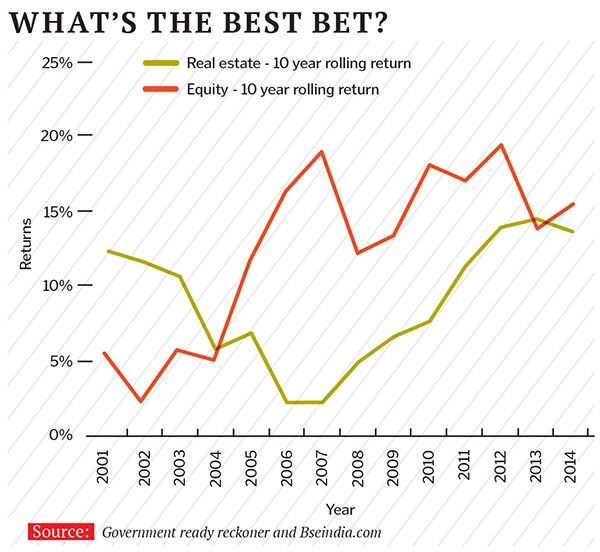

We did a small dip stick survey on the real estate market in Mumbai. Ready reckoner values [market value of properties] are available for 24 years since 1990 and we looked at the 10-year moving returns over these 24 years. While the ready reckoner values trail the real prices in most cases, they keep pace with the increase in prices, and hence, the returns calculated using these rates will tend to be quite close to the actual returns.In the best-performing locality of Colaba, the average 10-year return was 8.07 percent with the lowest being 2.09 percent (1996-2006) and the highest being 14.37 percent (2003-2013). The returns are far more volatile if you take a lower time period of five or eight years.

If you include the returns from investing in under-construction properties, you will notice that over long periods, they are only slightly better than “safe investments” such as fixed deposits. Given the fact that real estate is a high involvement asset, the “extra” return over a bank fixed deposit is a “must have” rather than “nice to have”.

If you look at a comparative return on the Nifty, it is far superior with much lesser volatility. Not a single 10-year return is negative in this case.

But unlike equities, real estate prices are not published on a daily basis and hence, a drop in rates is not publicly visible. Thus, you don’t see panic selling. Because of the illiquidity, the investor also doesn’t book profits prematurely (when prices rise) as in the case of equities. Hence, real estate tends to allow the magic of compounding full play unlike any other asset class even if the rate of compounding is not very high.

We have many clients who have up to 80 percent of their portfolio in real estate. As part of the asset allocation exercise, when we ask them to sell one of their properties, they look at us as if we have asked them to sell one of their kidneys. It is always an uphill battle to convince them.

In conclusion, you should definitely invest in real estate as long as you have a fairly large portfolio and only some portion (up to 30-40 percent) is allocated to this asset class. But don’t delay buying your own home, and understand what you are getting into if you are buying an under-construction flat.

Illustration: Sameer Pawar

First Published: Jan 28, 2015, 06:58

Subscribe Now